In addition to traditional loans, leasing should be considered as a strategic tool to finance micro, small and medium-sized enterprises (MSMEs). Although it is a well-known instrument for financing the acquisition of all types of equipment in countries around the world, in emerging markets, it is generally more accessible to larger companies than to MSMEs. This paper lays out a number of strategies and recommendations that leasing companies and other investors should follow in order to implement policies and procedures conducive to growing access to finance for MSMEs by means of leasing.

Definition

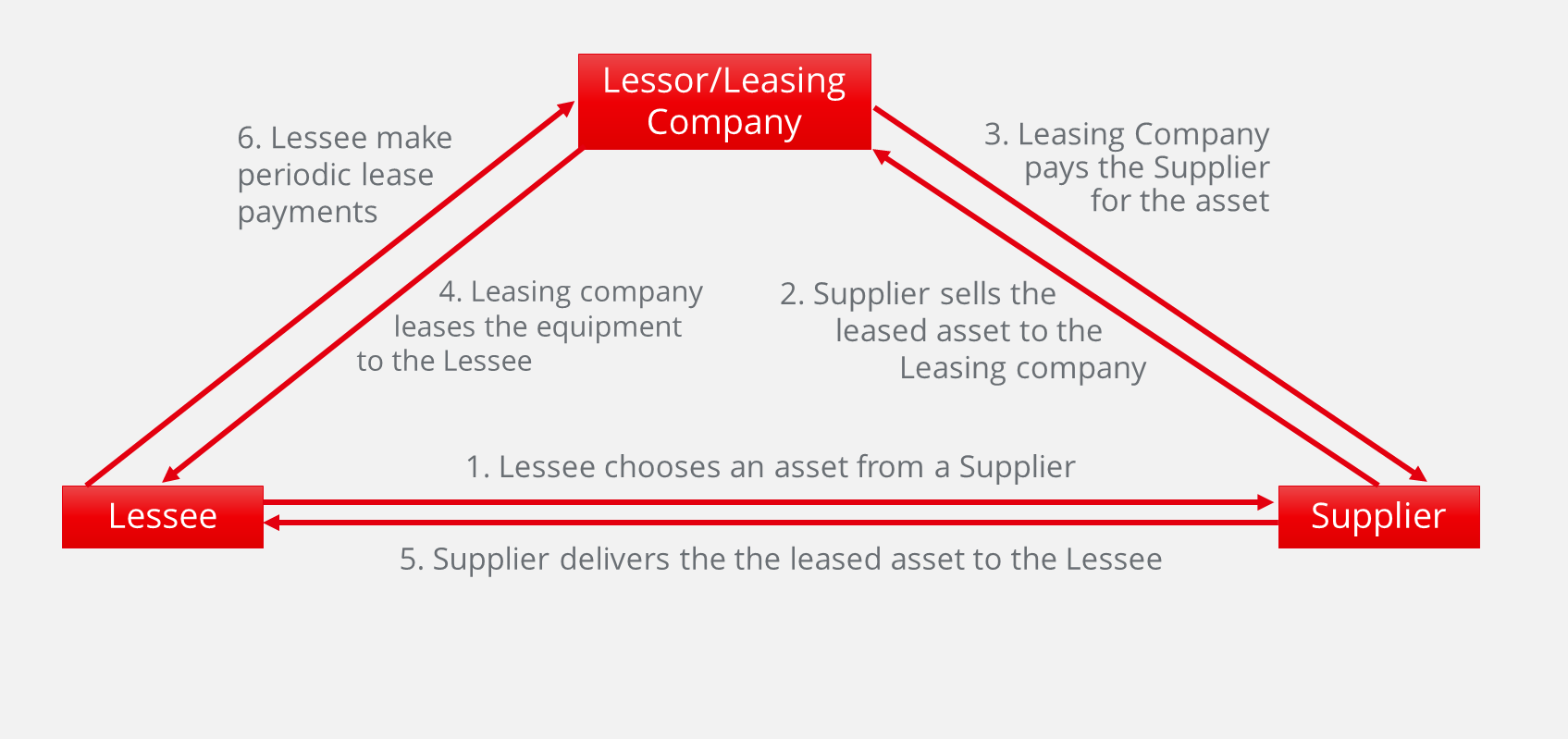

A lease agreement is a transaction whereby one entity, a lessor, leases a defined asset to a lessee. Depending on the country and its specific legislation, a lease agreement may include a third party, the supplier of the leased asset. Please note that the definition of leasing generally varies from country to country, depending on a country’s legal framework, which may include a civil code, leasing laws, and banking regulations.

The approach used to sell leasing services also differs from country to country, depending on the level of development of the financial systems, access to information on potential lessees (through credit bureaus) and the role of the informal economy. Even within one country, the approach may differ depending on the type of leased asset (for example, leasing an aircraft requires a different approach than, for example, leasing a fleet of vehicles).

For the purposes of this paper, we will focus mainly on assets that are suitable for MSMEs (an aircraft is usually not such an asset) and on the general approach to managing all aspects of leasing to this segment.

Typical Structure of a Leasing Transaction

From a macroeconomic perspective, leasing is an important source of additional finance that fills the void for small businesses with limited or no access to bank finance and can be a powerful employment engine.

For financial institutions, due to the relatively strong security provided by the right of ownership, leasing gives them access to a segment of the market that may appear to be riskier, but has the potential to generate higher margins.

Characteristics of Leasing to MSMEs

Here is a quick reminder of the general characteristics of MSME clients:

- Limited access to bank financing.

- Aggressive tax optimisation strategies.

- Dependence on a few key assets to generate income.

- Minimal back-office support for collecting documents and filling out application forms for leasing companies.

Because of the above-mentioned characteristics, MSMEs are much less interested in a strict definition of leasing. They often do not care about the difference between a lease or a loan, and they rarely benefit from any tax advantages. What they really care about is the ease of receiving a new productive asset at an “affordable” price.

As a result, leasing products that are suitable for MSMEs must:

- be simple, and ideally easier to get, or at least no more difficult to apply for than a traditional loan

- take into account the actual revenue and income generating possibilities of MSMEs (including future income)

- be a means of offering entrepreneurs a new productive asset (or a used asset) as quickly and efficiently as possible

Remember that some MSMEs already have some access to financial products based on pure credit risk: these are conventional loans, either to the owner-operators of the businesses or to the businesses themselves. This is why a leasing product should be less focused on credit risk and more focused on asset risk and supplier risk, in order to carve out a more sustainable niche.

As shown in the table below, the general approach to risk management usually depends on the liquidity of the asset and a client's exposure.

Table 1: Risk management focus depends on asset type and total exposure to a client

|

Exposure |

Equipment |

Transportation |

|

> USD 1 million |

Focus: Credit Risk |

Focus: Credit Risk |

|

USD 500,000 to 1 million |

Focus: Credit Risk |

Focus: Mixed approach; the key factor is the liquidity of assets (for instance, 4 Volvo trucks are less risky as compared to one large crane with a value of USD 500,000) |

|

USD 100,000 – 500,000 |

Focus: Mixed approach; the key factor is the liquidity of the leased asset |

Focus: Asset risk |

|

USD 50,000 – 100,000 |

Focus: Mixed approach; the key factor is the liquidity of the leased asset |

Focus: Asset risk |

|

< USD 50,000 |

Focus: Asset risk |

Focus: Asset risk |

For leasing transactions where the focus is on asset risk, a leasing company can minimise customer credit analysis because the credit risk is less important. Remember that the longer and more complex the credit analysis, the less competitive the leasing product.

Small-Ticket Leasing

In general, any lease for less than USD 100,000 can be considered a “small-ticket lease”. Usually these are vehicles, construction equipment, medical equipment and office equipment.

To be as efficient as possible, it is important to apply the following principles:

- Base your analysis on the asset risk.

- Develop internal scoring and segmentation tools to quickly set pricing and approve applications (same day approvals are ideal).

- Always tie financing to the acquisition of a specific asset. Do not provide a client with a funding quote (with an estimate of the interest rate) without an asset. Insist that the prospective client selects a product (ideally from a supplier partner) and then provide a quote that focuses on the monthly payments for that particular asset.

- Banks can expand their potential customer base. Banks that specialise in lending to MSMEs usually do not work with large companies because they do not take micro or small loans. On the other hand, these large companies are often interested in leasing low-value assets. Thus, small-ticket leasing can open up a new sales channel and generate additional income (through commissions and deposits) from large companies.

- It is necessary to constantly work on efficiency to reduce transaction costs and increase the profitability of the product.

Due to the relatively low value of each transaction, the actual risk of a single mistake is quite low. Therefore, it is important to keep in mind the need to have a diversified portfolio when developing risk models. Likewise, due to the relatively small contribution of each transaction to gross profit, one of the keys to profitability is to develop procedures and policies that focus on the efficiency aspects of operations. This starts with marketing and continues through to documentation requirements, processing times, and approval processes.

Sales and Marketing of Leasing to MSMEs

If you are a bank:

- Understand how leasing may be impacted by your existing credit business. If you are a financial institution and have a strong MSME lending business with aggressive growth goals, it will be difficult to motivate loan officers to promote a new product that they are less familiar with. The classic loan products generate commissions and bonuses for managers and loan officers.

- Remember that your lending procedures and processes are already well developed, so mastering the procedures for a new leasing product can take a long time. These new internal procedures will need to be created, tested and revised, if necessary. If combined with the sale and marketing of credit products, it will need time before the leasing operations function as well as the loan operations.

- In most cases, a potential client will be able to apply for both a regular loan and a lease agreement. What will your loan officers suggest? A product they know very well, or a product that they are uncomfortable with and that requires a third party (such as a supplier)? Experience suggests that loan officers, in most cases, will offer a classic loan to a client.

- Ask yourself the following question: is the client really looking for a lease? Or does he just need "financing"?

In the MSME Segment: cross-selling is extremely difficult. While leasing seems to be a logical extension of loan business, numerous nuances make it inefficient to market leasing via the same channels as SME loans.

If you are a leasing company:

When looking at the value proposition from the perspective of a leasing company, one of the key issues to consider is positioning relative to banks offering leasing products. Banks may be viewed as direct or secondary competitors depending on the market. This is important because banks usually have an edge in terms of funding costs and customer relationships.

Therefore, leasing companies are advised to follow, where appropriate, these recommendations when developing and promoting their products:

- Take a more aggressive approach to credit risk as the collateral associated with a lease is generally stronger.

- Specialise in specific assets/industries: better understand resale markets and industry revenue dynamics (including seasonality).

- Forge partnerships with suppliers to share risks and rewards in order to provide more competitive financial offers and/or financing to “higher risk” customers.

Leasing Companies: If you are simply selling a loan that is repackaged and renamed a lease, you better have a good cost of funding, otherwise your margins won’t be any good! The bottom line is that if you are using “banking procedures” without a bank’s cost of funding, it is very difficult to generate and maintain long-term profitability.

Marketing

Mass marketing of leasing is generally a waste of money. If a potential customer is not planning to purchase an asset, he/she does not need leasing. The most effective sales channel is usually via suppliers.

The supplier-partners are the true “clients”. The lessees are the “consumers”!

When it comes to the value proposition, suppliers generally want quick approvals and a high degree of positive decisions. They care less about the price! As stated earlier, most independent leasing companies want to avoid direct price comparisons and competition with banks, as banks tend to have a cost of funding advantage. Therefore, instead of simply selling an interest rate to a potential lessee, it is important to focus on those non-price qualities that are most valuable or important to suppliers.

Another important point to remember about small-ticket leasing:

- For lessees, the lower the cost of the leased asset, the less sensitive they are to higher rates, and the more willing they are to “pay” for fast service!

The most effective marketing tool – a recommendation from a supplier partner!

Risk Components of Leasing Transactions

Leasing has the following three types of risks:

- Credit Risk

- Asset Risk

- Supplier Risk

Credit Risk

As stated earlier, due to the complexity of leasing as compared to traditional lending, leasing companies and professionals need to be more flexible about credit risk, but better understand the risks associated with assets and suppliers.

The general approach depends on the amount at risk (client exposure) and asset liquidity. In principle, the credit risk of a lease agreement is lower than for a loan. In order to further lower the risk of a transaction, especially if the client has a sub-optimal rating, is to put an increased focus on asset risk. One of the main risk management tools used by leasing companies to enhance the strength of asset risk coverage is via advance payment. In principle, the higher the credit risk, the larger the advance payment should be.

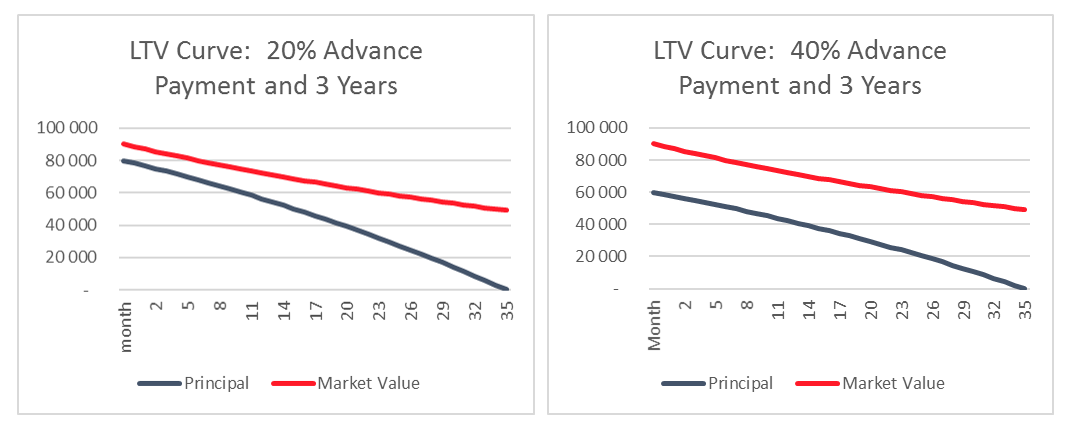

The influence of differing advance payments for risk coverage:

In the graph above, we can compare the curves for two leases with two different advance payments. As we can see, a significant reduction in risk occurs with a larger advance payment.

While the coverage of risks (asset value/lease debt) on the first day of a lease with a 20% prepayment is about 112%, for a transaction with a 40% prepayment, the coverage is 150%. This risk coverage only increases over the lease term, offering the lessor an even higher level of comfort.

|

Key Issues to remember when analysing and structuring lease deals for MSME |

→ Remember: for small-ticket leasing, it must be easier to get a lease than a loan! Otherwise, it will be difficult for the leasing company to compete against more aggressive banks. |

Scoring and Segmentation Models for MSME

In developing markets, there are a number of reasons why the utilisation of complex scoring models is difficult, these include:

- MSME legal entities tend to open and close at a high rate, therefore, these legal entities often lack long-term financial track records.

- The de-jure owner of an MSME is often different from the de-facto owner.

- Credit bureaus will often only maintain credit histories on individuals, however, even where they do collect information on legal entities, credit history information is often less useful for the analysis of MSMEs, due to the above-mentioned reasons.

- Official financial accounts often do not reflect the actual economic situation of a specific MSME due to aggressive tax optimization strategies and other reasons.

- Real estate and other fixed assets that are part of a business are often owned by other related parties or by individuals. These entities may be legal owners, while the person who actually controls the asset is not indicated in any official documentation.

To compensate for the aforementioned characteristics of MSMEs in emerging markets, leasing companies need to develop other metrics using various variables to determine the credit ratings of their MSME clients. These variables should be easy to measure and relatively easy to document in order to support the goal of quick decision making that can, ultimately, be verified by internal audit and/or management. The easiest variable to document is the ownership of assets that are required by law to be registered or licensed. This includes cars, trucks, construction equipment, and other similar equipment.

The second variable that can be documented (formally or informally) is the company's revenue figure. In general, even if revenue is frequently underreported, certain assumptions or corrections may be made to the reported figures. In addition, most entrepreneurs maintain management accounts where a complete picture of income can be seen.

The third variable that can be measured in some countries is the credit and legal history of an individual or MSME.

Thus, the creation of an internal scoring model or segmentation matrix begins with these three variables.

Models

In order to demonstrate how a model could be developed, we can start with some examples:

Customer A: prospective Customer A applies for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer A already has 10 similar Volvo trucks and a monthly turnover of USD 40,000. Customer A has some history of obtaining SME loans, no problems were reported to credit bureaus and a review of legal databases does not show that Customer A has ever been sued for non-payment by a bank or leasing company.

Customer A will receive a high internal credit rating, which we will set at '5'.

Customer B: potential Customer B is applying for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer B has one delivery truck built in Russia with a market value of USD 20,000 and a monthly turnover of USD 3,000. Customer B has a long track record of obtaining SME loans, no problems were reported to credit bureaus, and a review of legal databases does not show that Customer B has ever been sued for non-payment by a bank or leasing company.

Customer B will receive a low internal credit rating, which we will set as a “1” or “2” score. The upgrade to "2" could be due to credit history.

Customer C: prospective Customer C applies for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer C has one delivery truck built in Russia with a market value of USD 20,000 and a monthly turnover of USD 2,000. Customer C has a long history of obtaining loans from banks. Problems with other banks were reported and Customer C was sued for non-payment.

Customer C will receive an unsatisfactory internal credit score, which we will set as a '0' score.

Terms and Conditions for Each Rating

Intuitively, financing the requested transaction for Customer A should only include proof of company income, ownership / registration documents for the ten trucks, and a review of the legal databases. That’s it, nothing more!

For Customer B, the rating of the proposed transaction looks weak, but nevertheless, this is a client that the leasing company would like to finance. Therefore, to mitigate the risk, the client may be required to make a substantial advance payment, say 50%, to bring the monthly payment down to around USD 2,300. Or he/she could be persuaded to buy a less expensive truck.

Customer C will be denied funding due to his/her credit history. However, if Customer C would find a guarantor with good credit ratings, he/she could potentially get funding for a low-cost Russian truck with a 40-50% advance payment.

Developing the Model

The examples above show the extremes of potential ratings or segmentation models. Individual leasing companies and professionals would then have to determine the indicators of the above variables (i.e.> 10 similar trucks is "very good",> 5 but <10 is "good", similarly, if the monthly revenue is > 10x the monthly rental payment, this is “very good”), in order to determine what variables or indicators would be necessary to assign scores between 1 and 5. Similarly, once the credit score parameters have been determined, the company will determine what advance payment levels, interest rates and lease terms are available for each credit rating level.

Asset Risk

The main factor that impacts asset risk is liquidity.

Key liquidity comparisons:

- Low value assets are generally more liquid than high value assets (for similar assets).

- New assets are more liquid than older ones, even though they may be more expensive.

- Vehicles are usually more liquid than equipment.

It is important for leasing companies to understand the dynamics of market values and residual asset values over time. This is especially important if a more aggressive credit risk policy is required in order to be competitive. It is important to develop internal residual value curves in order to correctly assess the ratio of the market value of the leased asset to the outstanding principal of the respective lease agreement.

To gain a competitive advantage, increase margins and add value to partnerships. Knowledge of assets allows the leasing company to take on additional credit risk, finance riskier clients, and generate higher risk-adjusted returns.

Supplier Risk

While banks and new entrants to the leasing industry often pay too much attention to customers' credit risk, they often overlook the risk associated with the supplier of the leased item. It is important to remember that this “hidden” risk is potentially much greater than the customer's credit risk (based on a single transaction). After all, the supplier gets the cash from the transaction!

Specific aspects of credit or performance / delivery risk associated with suppliers are as follows:

- Does the supplier own the asset that you plan to acquire?

- Do they have tax arrears or other debts?

- What is their situation regarding VAT?

The worst-case scenario for a leasing company is that it agrees to buy equipment from a supplier, this supplier does not own the equipment at the time of purchase but plans to buy it from a third party. If the leasing company transfers money to the supplier and the latter has a tax debt that results in the forfeiture of the account, then the leasing company has an unsecured claim on the supplier and the property that the leasing company planned to buy is still in the possession of the original owner.

To mitigate or manage these risks, financial institutions and leasing companies are encouraged to:

- Work only with authorised dealers (if possible).

- Conduct appropriate due diligence, including site visits and supplier credit analysis, especially with respect to tax arrears.

- Verify ownership of assets and understand shipping and delivery terms;

- If unacceptable risks are identified, the leasing company may require that title to the leased asset be transferred prior to payment, including taking physical ownership/possession of the asset by the leasing company or the lessee client.

Management of Lease Contracts

One of the key issues when considering developing a leasing company focused on MSMEs is potential investment in software and information management technologies.

Basically, two key software components need to be addressed:

Accounting

In general, all countries have accounting software that is appropriate for managing the accounting of leasing operations. The complexity and standardisation required are quite low. Therefore, this is usually not a serious obstacle to the development of the leasing business.

«Middle Office»/Contract Management

In addition to the accounting software, leasing companies generally need software to manage their lease agreements. The first question should be: is there a national solution that integrates easily with local accounting software? This is often the most difficult area for new entrants.

It is important to remember that any software that supports the operations of a business must be tailored to the operations, processes, and procedures of a particular company. It is not recommended to buy off-the-shelf software, especially if it is software developed overseas, without a good understanding of its underlying logic. In the absence of a local solution that can be easily integrated with the accounting software, keep in mind that Excel (if you can find a VBA developer) can be used to manage up to 500-1,000 transactions. In the case of more than that, it may no longer work effectively. Regardless of what IT solution is chosen, it must be flexible and you must have your own programming team.

Keys to Success: Speed and the ability to react to market changes are keys to success. This requires constant adjustments to risk parameters and products. This becomes impossible if a company implements an inflexible off-the-shelf product that cannot be updated to match market changes.

Other non-IT Issues

As the owner of the leased asset, lessors should be aware of the following issues:

- Special registration and taxation requirements that arise due to their ownership of the leased assets.

- Traffic fines (for vehicles) and related fees.

- Liability for negligence.

- Responsibility for “choosing” the leased asset: does your leasing legislation protect the lessor? In a number of countries, leasing legislation directly assigns responsibility to the lessee for the choice of the leased asset and the supplier.

In addition to the legal advice required to properly assign the responsibility for the choice of the leased asset and the supplier, legal advice and analysis is required to determine potential liability issues and recourse that a leasing company may have in the event that its property (i.e. the leased asset) is involved in the administrative or criminal violation of local laws. This includes setting up procedures to properly administer, pay and collect on traffic fines and other similar violations.

Collection – Repossession - Resale

As noted in this paper, MSME leasing companies must find a way to assume more aggressive credit risks than banks. Consequently, if you are taking on more credit risk than a bank, you should prepare for less strict payment discipline and you must have policies and procedures in place for collecting potential arrears.

In the event of a delay in payment from your customers, it is important to respond quickly and efficiently:

- Your property (i.e. the leased asset) is often the main source of income for MSMEs. It is your collection team's job to continually reinforce this fact. If the asset is repossessed by you (the lessor), the customer loses a key asset and all income associated with it.

- If you do not position yourself as the main creditor, the client will pay others before he/she/it pays you.

- If you do not demand due money in a timely and consistent manner, some of your clients will not pay (on time).

Repossession and Resale: Minimising Losses

Speed and efficiency are important when dealing with arrears. Assets depreciate at a rate of 1-3% per month, and even faster when they are in the hands of someone who stops servicing them. Borrowing costs are another +/- 1% per month. This is why, after six months of accrued arrears, you can already assume that you have lost about 15-25% of the value of your investment.

Repossession of leased assets is a unique business process, which requires attention, training and specialists. It is difficult to outsource this activity as the circumstances of the individual arrear and the types of leased assets can be very different.

We encourage you to develop relationships with equipment dealers who can help you efficiently store and resell seized assets. It is also recommended to develop internal expertise in asset valuation. This helps reduce transaction processing times during the contract preparation process and facilitates faster decision-making when selling seized assets.

Conclusion

Never forget these two main characteristics of MSME leasing:

- This segment can be subject to significant competition from banks; and

- The value of each transaction is relatively small.

Therefore, all management and strategic decisions should be made taking into account the following principles: speed and efficiency.

Supplier relationships are an important marketing tool that leasing companies should develop as they value the non-price characteristics of your services. In addition, suppliers value quick decision making and your asset knowledge.

To bankers: it may look like a loan and feel like a loan … but It is not a loan! For a leasing product to be successful, it needs (i) its own marketing strategy and (ii) its own specific approach to risk management that fully reflects the relatively solid collateral provided by the lessor’s ownership rights.