Functional separation of sales and credit risk assessment

Overall effectiveness of a financial institution largely depends on its ability to take the right decisions regarding the size and functions of its structural units, the functional duties of its staff, the reporting and communication system as well as on the institution’s ability to recognize the need for making changes and to implement needed changes to organizational structure, processes, procedures and staff requirements in a timely manner.

In this paper, we take a closer look at the advantages of and conditions for separating different functions in crediting small and medium enterprises (SMEs). The purpose is to give financial institutions some food for thought on how they could, if indicated, optimize organizational structure, processes, procedures and staff requirements used to finance SMEs. Obviously, there is not a one-fits-all model but a variety of solutions. Which fits best for a particular institution depends on a number of factors, ranging from shareholder/management preferences to environment, main types of clients, quality of staff, etc. Separation of duties in the lending process for SMEs (and corporate clients) has proven effective in ensuring due diligence in assessing creditworthiness while ensuring a comfortable service environment for clients. The drive for separating duties in serving larger business clients, including SMEs, results from market pressures (which demand more cost-effective and more service-oriented solutions), related investor preferences, international and national practices as well as recommendations made by national supervisory authorities and put forward in international accords.

According to the Basel Committee, the function of credit risk assessment should be separated from the structural business units of a bank. One of the main requirements is complete independence of risk management divisions (both structurally, and financially) from departments that take on risks directly (front offices), register the fact of risk acceptance and monitor exposures (back offices). It is important to rule out any conflict of interest between credit risk management and other divisions of the financial institution. Therefore, a bank (or financial institution in principle) should observe the key organisational principle of separating duties of front office and back offices in the lending process.

|

The mission of the front office is to identify suitable clients, i.e. potentially profitable clients for the financial institution who are able and likely to repay loans on time. And, in the case of a loan application, the front office task is to process the respective application and make an initial assessment of a given client's business. In serving SMEs and corporate clients, front-office staff is often referred to as "client relationship managers" or similar as their main function is to maintain relations with clients and support clients in developing their business, simplifying business operations or overcoming shortcomings by means of offering solutions based on the financial institution’s products and services. In the case of larger clients (larger SMEs and corporate clients) this entails developing individually tailored solutions. Back office staff, often referred to as credit analysts, credit administrators and similar, typically verify the initial analysis and, where required, may conduct a more detailed analysis of the client’s business and application as well as monitor business performance after disbursement. Other back office staff will ensure that the disbursement conditions as determined by loan-decision-making bodies are fulfilled and other contractual obligations fulfilled. |

From the point of view of minimizing credit risk and other risks related to a potentially very close relationship between representatives of the financial institution and a given client, it would be ideal to fully separate duties and have no involvement of the client relationship manager or the ‘sales’ unit in assessing the client and/or loan application and no involvement of the credit analyst in client acquisition and relationship maintenance.

However, this has drawbacks: if credit analysts are too far removed from the actual business generation of the financial institution, they may get so focused on trying to cover for each and every potential risk that lending becomes so cumbersome for the financial institution and the client so that effective demand is too small to make this business a viable and sufficiently profitable venture for the institution. If client relationship managers are only trained in and focused on acquisition and know little or even nothing about credit risk assessment, there is a potential risk that they will spend significant time and effort on acquiring and processing clients and applications that end up as rejections (either by the financial institution or the client) so that, again, effective demand is too small to make this business viable.

Obviously financial institutions need to weigh risk and business opportunities and find the correct balance. This applies to the degree to which duties are separated as well as to which processes and procedures are applied in the lending process. As stated above, there is no one-fits-all solution. Each institution needs an individual solution, based on a detailed analysis of its market, its processes, strategies and goals, its target segments, the professional level of staff, the institution's maturity, future plans and objectives, etc.

Recent experience shows that proper segmentation of clients is crucial in optimizing organizational structures, processes, procedures and staff requirements for working with clients, especially SMEs. More specifically this means understanding which organisational structure, which processes and procedures to apply to the different segments in order to achieve the results the financial institution is aiming for and in order to optimise business performance.

In practice, the two most common approaches to organising duties within SME structural units are: (I) the functions of sales and credit analysis (the front-office and the back-office) are combined; and (II) the functions of sales and credit analysis are separated.

I. COMBINED FUNCTION OF SALES AND CREDIT ANALYSIS

In case of this option, we are talking about a universal loan officer or sales manager whose duties include: (а) active client acquisition and direct sales of (loan and other) products, (b) providing advice to the target client group, (c) analysis of client payment capacity and credit risk assessment, (d) preparation of credit cases for presentation to the respective decision-making body, (e) post-lending support, including (f) working with problem loans.

This approach can work if the numbers that can be generated are sufficiently big and the quality of operations sufficiently high to generate the profit needed to make this approach a viable business option for the financial institution. Therefore, such an approach is typically associated with retail banking and working with micro businesses. In working with SMEs, this approach can be justified if a financial institution has launched SME lending only recently and is planning to go for easy to reach mass market segments, i.e. rather standard clients with standard, simple needs and applications for relatively small loan amounts. In this case, the loan portfolio will be generated as a result of disbursement of loans insignificant in size and with similar credit risk features. Portfolio risk will be diversified and mitigated, i.e. spread over a large number of loans while the risk-and-yield balance of the loan portfolio can be ensured.

In this approach the role of the "universal" loan officer/sales manager is manifold and multidisciplinary.

A key advantage of this approach is that the financial institution creates an environment for the client where all matters can be addressed to one person. For the financial institution this approach has the advantage of allowing for a simple organisation of processes as most is concentrated "in a single pair of hands", i.e. it is easier to set tasks for such an employee and to control performance.

However, this model entails an inherent risk for the organization as it gives rise to possible conflicts of interest and is lacking in safeguards against mistakes and fraud: Loan officers/sales managers may have an inclination to prefer conducting analyses and risk assessment as opposed to selling, or, the opposite may be the case. In the first case, the financial institution may face the problem of many loan rejections and slow portfolio growth, which may even result in portfolio stagnation. In the second case, the financial institution may face inflated disbursements, if staff is focused on pursuing quantitative performance indicators and less concerned with risk assessment. This may lead to a situation where staff - intentionally or unintentionally – may take a negligent approach to analysis and risk assessment. Experience also teaches, that a financial institution choosing this approach may end up with less repeat clients than other institutions - if loan officers are NOT carefully chosen and trained, if NOT fully competent in other products and services of the institution and are NOT given key performance indicators/business targets that take cross-selling, etc. as well as quality of the portfolio and client loyalty into account. Often, at best, we usually will witness a series of consecutive loan applications. Usually, the underlying reason for this does not rest in the client, but in the fact that a "universal", transaction-oriented loan officer/sales manager, who is good at selling loan products rather than other products and services, will focus on selling loans rather than building a relationship with the client, understanding the actual needs of the client and tying the client to the institution by successfully offering other needed services to the client in a timely manner.

The financial institution may miss out on attracting and maintaining suitable clients interested in a broad spectrum of services for whom the institution could plan a long term relationship and potential returns.

In some instances – as in the example provided above – it may be the correct decision by a financial institution to knowingly accept the potential drawbacks described above and go for the universal loan officer/sales manager.

If a financial institution decides to use this approach, it should pay attention to the following three aspects: (1) qualification of loan officers/sales managers, (2) target setting and (3) internal control.

Qualification of staff

For the combined sales-and-analysis function financial institutions need staff equally able to sell and analyse and with a high degree of integrity. Suitable staff needs to be able to quickly sum up situations, analyse situations and draw conclusions/arrive at an assessment. At the same time, suitable staff needs to be sufficiently critical to remain open-minded and able to change assessments in case new information surfaces.

Financial institutions may recruit internally from their base of specialists, if available, or hire experienced loan officers/sales managers from other financial institutions. Usually, for such staff the new position and/or salary will be important. It should also be noted that to grow qualified experts within an institution takes considerable time and resources so that it is important to set stimuli to retain staff. In any case, for both types of experts to be successful, and if financial institutions wish to avoid the drawbacks described above, financial institutions need to adopt suitable hiring and indoctrination procedures, a suitable motivation system and systematic professional training.

Target setting

Target setting should be closely linked to the motivation system. As described above, target setting should be geared to encourage cross-selling and building client loyalty in addition to the other typical items included, such as number and volume of loans disbursed, outstanding portfolio and portfolio quality indicators.

Internal control

It is also important to establish internal controls for all stages of the SME credit cycle, to assign roles effectively and clearly between the different functional units (clear job descriptions, clear assignment of responsibilities and authorities, etc.) and design processes to allow for smooth interaction.

|

Strong internal control, which, in any case, should be an integral part of any financial institution, is of particular significance in case of a combined sales/analysis function to ensure transparency of credit decisions, monitoring results, etc. An effective internal control system requires effective communication channels to ensure that all staff fully understand and observe the policies and procedures relating to their duties and responsibilities. Internal controls should be an inherent part in each business process and ensure that all business activities are in line with established rules and regulations, so as to reduce the likelihood of operating losses and their consequences. With regard to working with SMEs, the focus of the internal control system should be on controlling that the analysis of respective business activities of borrowers are conducted according to the lending technology of the financial institution as well as in accordance with its established policies, procedures and processes, the law and rules and regulations of the regulator. |

Table 1. Internal controls in the lending process

|

Selected stages of the credit cycle |

Front- and back-office functions |

Internal controls |

|

Client acquisition |

|

|

|

Determining suitability/ creditworthiness/ analysis |

|

|

The more complicated processes and functions performed by staff are, the more important it is to pay close attention to internal controls integrated in the process to avoid conflicts of interest, especially if different processes and functions are incompatible from a control perspective.

II. SEPARATON OF SALES AND CREDIT ANALYSIS

Any functional separation should be regarded as a reinforcement of the internal control system and an increase in business process efficiency.

For financial institutions targeting larger clients, - even if not made mandatory by the regulator - it may be worthwhile to give some consideration to separating duties. Larger clients often have complex businesses, are quite demanding regarding the financial institutions and services they use, often require individually tailored solutions and have high expectations regarding professionalism of staff. For institutions targeting such clients, a competent client relationship manager, with whom clients can discuss business issues and possible solutions on equal footing, is the superior option. This approach allows financial institutions to offer a complex of products and build long-term client relationships.

This approach is typically also more appropriate when risks of an individual customer are assessed on an individual basis and loans do not form a pool of uniform loans.

In this approach, the function of the client relationship manager is to acquire as many suitable, i.e. potentially profitable, loyal and long-term clients for the financial institution as possible, identify their needs and develop suitable solutions for, respectively, together with the client. This does not refer specifically to loans but to all products and services a financial institution offers. The client relationship manager acts as a representative of the bank and is the key contact person for the client.

It is of crucial importance that client relationship managers should not only be sales and client oriented, but should also have a sound understanding of analysing businesses, credit analysis and business in principle. Only then can these experts fulfil their tasks effectively and efficiently. As indicated above, sales orientation alone will most likely result in the processing of pointless applications with the outcome of high rejection rates, unhappy clients and ineffective use of institutional resources. Incompetent client relationship managers will also have difficulties in building long term and loyal relationships between client and financial institution. These aspects, regretfully, are often underestimated. Our experience has been that financial institutions often do not give sufficient consideration to the skills, know-how and character traits competent client relationship managers need. Instead, they try to retrain staff from other positions or bring in sales people from other business areas without the necessary experience in assessing businesses, risks, etc.

The functions of a credit analyst include analysis of borrowers’ financial and economic activities, assessment of potential credit and other related risks, preparation and presentation of credit resumes for the risk management and other divisions.

Advantages of the approach:

- building long-term client relationship by providing the client with a continuous counterpart and a product mix that best meets the needs of clients

- an individual approach to each client

- an opportunity for bank specialists to focus on activities they do best

- objective assessment of lending projects and objective credit resumes due to an impartial approach to clients and their business.

In the past, the split was frequently done in such a fashion that client relationship managers just communicated and promoted products and left all actual analytical work to credit analysts. However, experience has shown that such an approach has two major drawbacks: one – as already addressed above – rests in the risk of acquiring and processing unsuitable clients. The other major drawback rests in the approach to the relationship itself. Splitting the sales and analysis function in such a way will lead to a situation where a client has to build up a relationship of trust with different representatives of the bank. This approach makes life unduly complicated and also uncomfortable for clients: during the stages of client acquisition and first interview, the client deals with one specialist, but then all financial data is to be disclosed to another person who is new for the client. This can be stressful for a client and also make retrieval of meaningful and full information more difficult. Therefore, if such an approach is nevertheless deemed most suitable for a given financial institution, it is of high importance for a credit analyst to have excellent communication and social skills in addition to being good with numbers.

As regards this approach, it should also be pointed out that the respective “sales” person and analyst must be able to communicate clearly and fully with each other. In practice, misunderstandings between sales people and analysts are not uncommon and may result in conflict situations, which may adversely affect the quality of customer service.

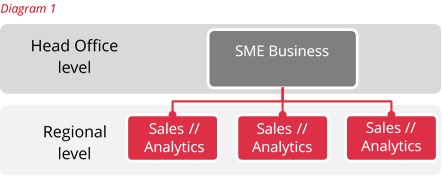

Model 1 envisages functional separation in all or some regional divisions (branch, directorate, office, etc.) (See Diagram 1).

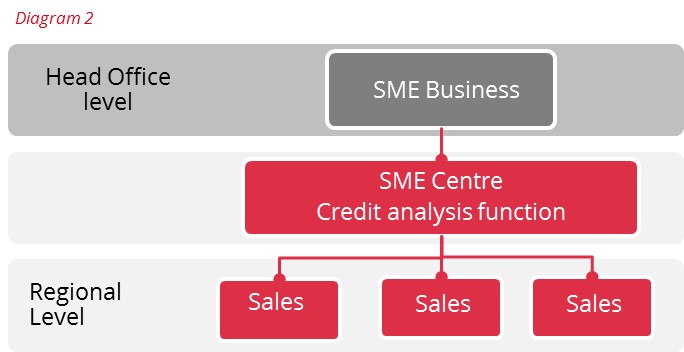

Model 2 envisages establishment of so-called SME centres providing services for small and medium-sized clients (see Diagram 2). In these centres, a group of analysts gather information, perform credit analyses and assess business activities of potential clients, including making visits to the place of business of clients.

SME centres can be established both on the head office level, and on the regional level. In this model the function of credit analysis is centralized. Centralisation, as a tool, allows maintaining effective processes and internal control. In other words, centralisation is a compromise which ensures continuous customer service on the regional level and optimization of staff costs. However, one should understand that in case of full centralization, the speed of project processing will be lower. Therefore, if a bank focuses on a smaller segment, it may make sense to consider decentralization. Alternatively, if technology permits and access to centralized databases for verifying clients are easily accessible and reliable it may make sense to fully centralise loan analysis verification and decision-making even for very small business client applications.

In any case, the client – obviously - should be the primary focus of any model adopted by a financial institution to ensure sustainable achievement of business goals. In the long run, clients have the final choice and clients tend to have a long memory when it comes to bad service, unsuitable products, etc.

Thus, if a financial institution plans to optimise its business processes, reorganise structures, and increase operational efficiency, it should take the following factors into consideration: processes, client segmentation, available resources and the qualification level, characteristics, talents and professionalism of the staff, the performance of its information systems, risk appetite, strategy, and the key goals and objectives.

If resources are limited, financial institutions will be ready to get rid of the so-called “sales people” more easily. However, it always makes sense to analyse how these measures would affect the business in the long run.

To sum up, on each stage of its structural development, a financial institution needs to assess the effectiveness and efficiency of its current business processes, analyse their components and quality of the staff involved in each of these components.

“Whenever you see a successful business,

someone once made a courageous decision.”

Peter F. Drucker