- Details

"Blended finance programs combine public and private funding to ease credit constraints of specific firm segments. While rapidly gaining popularity, little evidence exists on their economic impact. Female clients of treated banks increase net borrowing and investment, especially those with higher capital productivity. Beneficiary firms grow their sales and profits, diversify suppliers, and exit less."

- Details

The International Finance Corporation (IFC) has published an article on SME finance based on the stories of women entrepreneurs from the Kyrgyz Republic.

Read more … Women Helping Women Out of Poverty—One Business at a Time

- Details

"A strong relationship has been observed globally between Cash-In, Cash-Out (CICO) agent network coverage and greater use of Digital Financial Services (DFS), especially by low-income and rural customers. However, the expansion of these networks has not automatically translated into an increase in the proportion of women with access to DFS as customers and agents, hindering their ability to reap the benefits of DFS."

- Details

"The narrative among policymakers about women’s entrepreneurship is slowly shifting from encouraging the creation of a high number of startups to focusing on supporting women who are well positioned to lead growth-oriented enterprises. Innovative women entrepreneurs can be agents of change and provide new solutions to global challenges, yet they face multiple barriers to growing their businesses. This policy brief examines the following four areas of constraints and provides evidence on measures to reduce gender gaps in each: 1. Human capital, including gender gaps in access to skills and networks 2. Factors constraining access to finance 3. Factors constraining technology uptake and market expansion, and 4. Contextual factors, including legal and regulatory constraints, social norms, access to care, and gender-based violence."

- Details

"This brief analyzes ways to economically empower women in rural Tajikistan and highlights how better integrating measures into the development of critical transport infrastructure projects can help narrow the substantial gender gap."

- Details

"The Gender Inclusivity Toolkit equips young entrepreneurs with resources to promote gender equality and inclusivity in their businesses. This toolkit provides a pathway for transformative change, enabling entrepreneurs to cultivate an inclusive workplace that attracts and retains a gender-diverse talent pool. It aims to raise awareness of gender biases and discrimination, offering practical measures for addressing them."

- Details

"The policy brief highlights the essentiality of women in agriculture and their potential role in shifting to sustainable agriculture, increasing food security and increasing agricultural productivity when they have access and ability to adopt innovative agriculture techniques such as climate-smart agriculture practices (CSA). This policy brief identifies key actions that can remove barriers or women in agriculture, including collection of gender disaggregated data for gender-sensitive planning, research analysis, advocacy for equitable access to productive assets, capacity building and awareness raising, and cross-sector collaborations to enable gender-equitable access to infrastructure, financial capital, productive assets and other services."

Read more … Women as Agents of Change for Greening Agriculture and Reducing Gender Inequality

- Details

"Women, Business and the Law 2023 is the ninth in a series of annual studies measuring the laws and regulations that affect women’s economic opportunity in 190 economies. It identifies barriers to women’s economic participation and encourages reform of discriminatory laws. This year, the study also includes research, a literature review, and analysis of 53 years of reforms for women’s rights and makes an important contribution to research and policy discussions about the state of women’s economic empowerment."

- Details

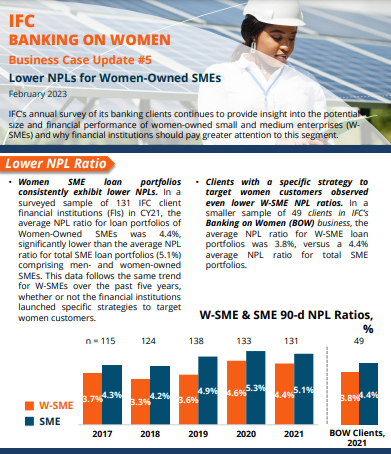

"IFC’s annual survey of its banking clients continues to provide insight into the potential size and financial performance of women-owned small and medium enterprises (WSMEs) and why financial institutions should pay greater attention to this segment". Survey results show that women SME loan portfolios consistently exhibit lower NPLs, average loan sizes to Women-SMEs were smaller than average loan sizes to total SMEs, and average size of deposits from W-SMEs was comparable to the average size of total SME deposits.

- Details

"This paper presents the findings of a comprehensive literature review to identify evidence on what works to support women entrepreneurs in developing countries. It covers both the evidence of constraints women entrepreneurs are facing and evidence of intervention effectiveness in We-Fi’s four focus areas: access to finance, access to skills and networks, access to markets, and an enabling environment."

Read more … Supporting women entrepreneurs in developing countries: what works?

- Details

"An increasing number of National Financial Inclusion Strategies are now highlighting the need to promote women’s financial inclusion. However, this new analysis from WBL and CGAP finds that they could do more to promote access to credit for women entrepreneurs, and to enhance the national-level collection and analysis of sex-disaggregated financial data."

- Details

Authors of this research work investigate the factors affecting firms’ ability to adjust production in response to the COVID-19 outbreak. For the purpose of this research, four CAREC countries were chosen from the survey data conducted by the World Bank: Azerbaijan, Georgia, Kazakhstan, and Mongolia. "The results showed that firms which successfully adapted to the COVID-19 crisis were younger, foreign firms that had been innovative in the recent past, with female managers, a formal firm strategy with key performance indicators, and their own website."