The world of training is changing

Financial institutions are adjusting themselves to new realities. The fast progress in IT technologies and digitalization is changing business models and modus operandi of financial service providers. Approaches, which for years were guarantors of success in the financial service business, are now becoming outdated or at least are being put to the test.

Digitalization has consequences for staff needs of financial institutions and their training needs as well. In this article we will raise just a few issues related to how training is affected.

Increasing importance of HR as strategic business driver

Having the right staff in the right job is a key driving force in ensuring sound and sustainable operations of financial institutions. Therefore, continuous staff evaluation, determining staff needs (not just numbers but also qualification levels, etc.), staff development and training should be a priority. As the world in which financial institutions are moving is changing, these aspects are gaining in significance. Whereas digitalization may be making some classic job profiles obsolete as automation of processes takes hold, it is also creating the need for new profiles, new skills and new people: people, who are able to make use of the possibilities of digitalization and people who can do the work that cannot be automated, such as jointly developing tailored product solutions with a corporate business client. All of this has significant consequences for the kind of people needed and for how they should be trained. As a result, HR in principle and staff development and training in particular, are increasing in their importance as strategic business drivers and key to sustainable success of financial institutions.

Ensuring preservation of knowledge and know-how within the institution

Ideally, the process of acquiring new knowledge and retaining already acquired knowledge should never stop. This goes for an individual as well as for a financial institution (or any institution) overall. While this seems obvious, experience shows that the knowledge of experienced staff may be lost as a result of job changes within a given institution or of staff leaving the respective institution for good. In practice, ‘holes’ left by ex-employees are more common than one would have guessed.

In short, in order to build and retain knowledge and know-how, it is necessary to have processes in place for upgrading and retaining know-how. This includes ensuring individuals enhance or at least do not lose existing qualifications as well as ensuring processes for safeguarding that a given institution overall enhances and retains know-how, e.g. through building reserve cadres in a timely manner or developing special courses for refreshing knowledge of staff. But it also means that institutions are thinking about staff in a more strategic manner than before. Staff requirements are shifting to more highly qualified staff. Also, the speed at which actual job requirements are changing is increasing.

All of this means that institutions need to pay more attention to staff selection, staff training and to developing staff over time. This includes paying attention to timing and content of training. It can be rather costly and usually is also not very effective to try and train staff in topics or processes not immediately needed. It is also not as easy as it may seem at first glance (if at all possible) to cross-train staff into new functions. It also means that institutions are having to give more consideration to how to retain staff, i.e. career development planning, evaluation systems, payment systems, promotion systems, etc., as it will not be easy to replace personnel, if lost.

Effective training

Furthermore, the ways in which staff learns are changing. While class room and face-to-face training and coaching remain the preferred option for learning or deepening new skills, simple transfer of information and knowledge can be done more effectively and cost-efficiently by means of online training. - And the younger generations are used to using smart phones and other digital means for procuring information, learning or even practicing new skills in interactive online settings. Last, but not least, institutions need to find ways of training staff without jeopardizing business targets. This means that training sessions should be comparatively short and easy to combine with work. This also entails that combinations of theoretical training and practical training on the job are advisable – not only because of the fact that the trainee can spend more time at work, but also because of the advantages of putting newly acquired knowledge/know-how directly to practical use.

So, to sum up some of the most salient points:

- Just in time: training should be offered to fit with actual job needs to be most effective

- Online training: once set up, online training allows for cost-effective and efficient transfer of knowledge and information. Online training can be effectively used to replace at least part of the classic syllabus of topics especially new employees have to undergo, e.g. topics related to corporate principles, basic learning materials on acquiring, serving and financing clients or similar. As technical possibilities are developing further, online training also allows for effective practicing of newly acquired skills

- Gamification: this is closely related to the above; interactive online games can be used to develop and practice newly acquired skills

- Keep training units short: this increases effectiveness and allows to combine training and work without jeopardizing effectiveness of either the one or the other

- Hybrid training and on-the-job coaching: combining online, possibly class room and on-the-job training allows to put newly acquired knowledge/know-how to direct use – this has proven highly effective in terms of learner success while allowing to control costs and absences from work.

Apart from inviting external trainers, some financial institutions establish their own in-house corporate universities, training centres, or at least delegate training functions to particular specialists. More recently, financial institutions have also started to add online training facilities to supplement other training.

The role and importance of expert-trainers

Usually, trainers working for financial institutions can be grouped as follows:

- Corporate trainers, e. in-house trainers, staff members who administer and implement general training programmes (e.g., "The bank's corporate culture", "Business communication", "Time management", "Effective sales", etc.). The primary function of this type of trainer/HR staff is to organize and implement training. Please, note that this can also include organizing staff participation in certain online training measures and similar.

- Expert-trainers – these are specialists of a particular department of the institution (e.g. SME department) who teach others those things they know and can do well due to their own professional experience and expert knowledge of the subject. For these trainers, training/coaching is usually an additional function, in addition to the duties associated with their day-to-day professional activities. Expert-trainers can also be external experts specifically invited to share specific know-how.

- Experts in developing online training: these are specialists who can convert respective training or informational material into interactive online training.

While all forms of training and types of trainers have their advantages and disadvantages when it comes to cost-effectiveness, effectiveness in actually transferring knowledge and or developing skills it should be noted that corporate universities, etc. and online training – at least for the foreseeable future – cannot meaningfully replace the impact and effectiveness of expert-trainers.

Learning directly from an expert always has been one of the best ways of passing on know-how.

Therefore, we will now turn to some of the methods for identifying, training and developing expert-trainers, i.e. trainers who are knowledgeable in a respective area, have practical experience in this field and are quite capable of passing on this knowledge/know-how and in teaching others on how to do something. Please note, that we differentiated three separate requirements: (theoretical) knowledge, (practical) know-how and ability to train, i.e. to successfully and effectively pass on this knowledge and know-how to others. Finding this combination in staff is not as easy as it may seem. Not everyone who knows how to do something is also good at teaching others. Good teachers may not always have the desired degree of in-depth practical know-how to effectively transfer needed know-how. So the focus needs to be on testing/checking for all three items.

In practice, different financial institutions use different approaches to the development of their in-house expert-trainers.

Suitable candidates

A suitable in-house expert-trainer is an employee who – in addition to sound technical knowledge and practical expertise - enjoys and is talented in passing on knowledge and know-how to others as well as shares the financial institution’s corporate values, understands its philosophy, is aware of the institution’s overall strategy and is ready to follow it. Since, ideally, an expert-trainer does not only conduct training, but also develops training programs, his/her ideas and moral values, motives, and attitudes toward events and people should be in line with those of the institution as trainers actually represent the institution when teaching. When selecting and developing such specialists, special attention should be paid to their interpretation of the institution’s values and corporate culture, their loyalty and attitude towards the institution’s strategy, in addition to screening technical skills, know-how and teaching talent.

Main focus when selecting in-house expert-trainers

Ideally, the term trainer implies that such an expert can implement training but also has knowledge and skills to develop training programs. Financial institutions, however, are often faced with the fact that a corporate trainer, who has general training skills, often lacks specific knowledge and experience to provide training on specialized topics, e.g. analysis of SMEs as compared to micro businesses. At the same time, if we plan to employ for example an SME expert as a trainer, we can be faced with a situation where an excellent professional lacks the personal qualities to be good trainer. In short, financial institutions need to screen for the ability to actually teach others and develop training programs in addition to screening for technical knowledge. This should include teaching in a class room setting as well as – ideally – providing on-the-job training.

Main tasks of an in-house expert-trainer

The range of tasks of an expert-trainer may vary depending on how training is set up at a given institution. Typical tasks of an expert-trainer include:

- Identifying staff training needs, conducting pre-training knowledge testing

- Gathering ideas and planning training courses and programs

- Gathering, studying, and processing data for developing/improving training modules/courses/programs

- Developing training courses/programs, including testing and adaptation, if needed

- Building balanced training programs: developing course material, slides, handouts, tasks, and exercises for knowledge consolidation and skills development (case studies, role-plays, discussions, etc.)

- Conducting workshops, seminars, working groups

- Coaching staff on the job

- Post-training support (Ideally, a trainer would also be able to provide material for subsequent conversion into online training material or would be able to convert material him- or herself)

Expert-trainer selection

Typically, expert-trainers are identified by superiors, who observe staff actually training other staff on the job or as part of staff evaluation by managers and/or by the HR department. It has also proven effective to announce the possibility of becoming a trainer in-house and conduct an internal recruitment process for possible expert-trainers. Like most other professions, a good teacher follows a calling rather than just doing a job, so volunteers, people who like to train are usually more suitable than other candidates – even if they may not yet have acquired necessary didactic techniques, etc.

A candidate for an expert-trainer position must always demonstrate excellent technical expertise on the subject matter in addition to a certain talent for teaching.

After initial identification of candidates based on technical expertise and basic readiness to teach, candidates should be screened more thoroughly by reviewing evaluation results, fulfilment of key performance indicators, possibly interviews or even assessment centers. Assessment criteria should clearly also include aspects related to the candidate’s motivation (interest) in teaching and ability to teach.

Character traits of suitable candidates

Not all technically fit professionals are automatically also good teachers/trainers. Suitable candidates should have the following characteristics:

- Intrinsic motivation to enhance the knowledge/know-how of others/help them approve their skills

- Certain charisma, which allows to spell-bind participants (students)

- Positive attitude towards learners

- Well-developed communication skills, ability to express oneself clearly, concisely and in a structured, easy to understand manner

- Ability to structure information in a logical manner

- Empathy, i.e. the ability to put oneself in the position of the other and a certain broad-mindedness to be able to understand questions or issues learners are grappling with

- Readiness and ability to develop, organize and implement training and training programs

- Ideally, specific qualities or knowledge relevant for the respective area of expertise

Necessary skills

An ideal trainer should be good at methodological work and actual teaching/training/coaching. Apart from profound subject knowledge, an expert-trainer should have:

- Methodological competence — ability to structure content (information/skills/ etc.) and to "pack" them into a concrete training and/ or training program;

- Training competence — ability to effectively transfer or reinforce knowledge, know-how to and build skills in others.

Training of an expert-trainer

In most cases, expert-trainer candidates can be identified who have what it takes to become an expert-trainer in the future. To find somebody who is already a finished trainer is the exception. Regardless of technical expertise in a certain field, developing and organizing training requires certain skills and know-how, i.e. the art of training is a field of expertise as well. In order to be a really good trainer, a trainer should also develop expertise in the field of training.

Most identified candidates will have the talent to develop needed skills and know-how, but will not yet have the knowledge, expertise and skills in training per se. The simplest way to build needed expertise is to put suitable candidates through a train-the-trainer program, where they will learn how to train, how to organize training and how to develop training material and courses. This should be combined with on-the-job training, i.e. being coached by an experienced trainer for some time in training-related tasks. Design and duration of the train-the-trainer program (including coaching) may differ depending on the tasks to be assigned to a given trainer, the institution’s preferences, etc., but certain basic training skills should be covered. Below we provide an example.

After completing initial training as trainer, expert-trainers can then continue to refine and develop their expertise as trainers over time.

Train-the-trainer Example

A bank decided to provide an intensive training course to its trainers. The course will cover basic adult learning tools, group exercises, skills and competencies development assignments, and train-the-trainer methods involving up-to-date concepts.

The Table 1 below lists several modules to be included in the intensive training course:

Table 1: Train-the-trainer modules (a short version)

|

Suggested modules |

|

|

1 |

Fundamental principles of adult learning |

|

2 |

Planning training measures |

|

3 |

Setting learning goals and objectives |

|

4 |

Elaborating seminars/workshops/working groups |

|

5 |

Learning forms and training methods |

|

6 |

Trainer presentation skills development |

|

7 |

Varying the different types of activities during a training session |

|

8 |

Working with an audience (holding the attention of the audience, managing difficult participants, overcoming resistance, question-answer activities) |

|

9 |

Peculiarities of conducting a training |

|

10 |

Pre- and post-training support tools |

One should keep in mind that a training event should always take into account: (a) target orientation; (b) a science-based educational process; (c) a system of teacher-student interaction; (d) evaluation criteria for training results; (e) modern teaching methods, including when and how to use them.

On-the-job training

Following this intensive training course, objectives and plans should be set for the expert-trainer to put newly acquired know-how and skills to use. Initially, this should be done under the supervision of an experienced trainer. This will enhance the further deepening and use of acquired skills in a controlled environment. This serves to prevent misunderstandings of training concepts, etc. or bad practises from taking hold while boosting the confidence of the new trainer in using acquired know-how. In practice, this usually means that a co-trainer (with solid experience) will assist the new trainer in designing training measures and will be present in the classroom when the new trainer implements training. After the respective session, the co-trainer provides detailed feedback. It is the discussion of results, less successful and more successful aspects of the training that will help the new trainer develop and hone his/her training skills. This is mainly based on discussing certain concrete situations, difficult moments, non-standard reactions of students, etc.

The subsequent training process for a trainer should be of a cyclical nature – practice-theory-practice-theory – just like training for any other staff.

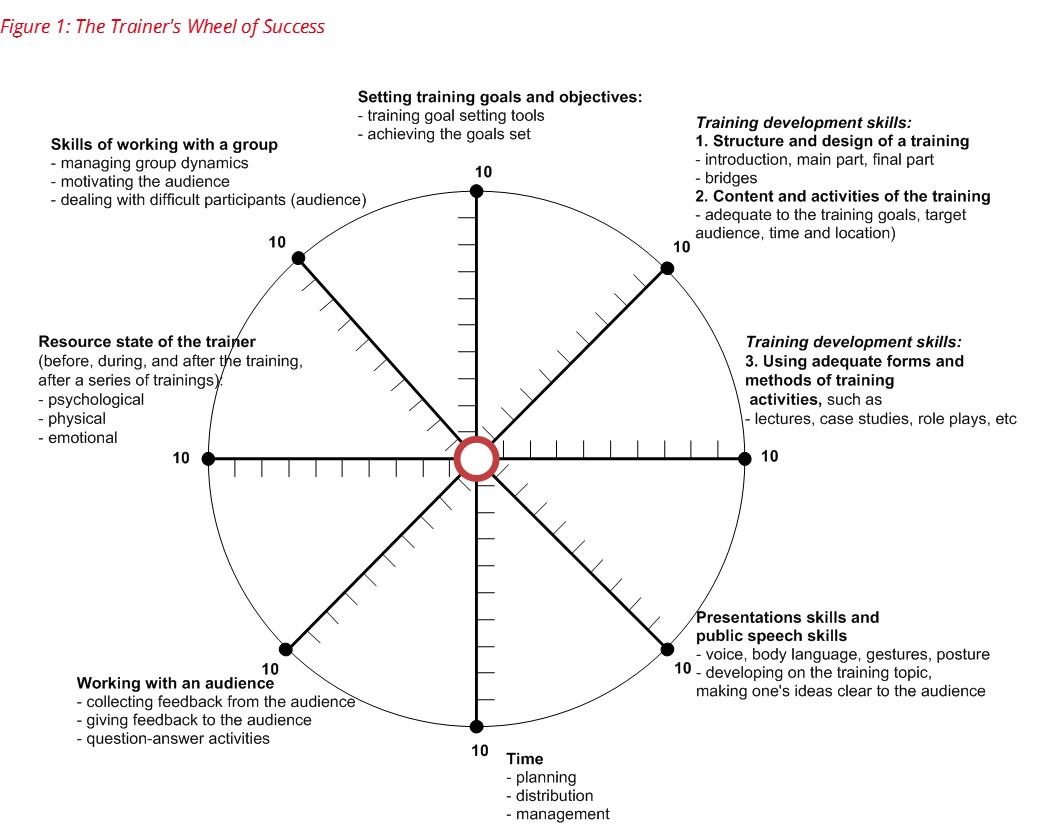

The Trainer's Wheel of Success shows the areas of knowledge, competencies and skills that an expert-trainer should develop and reinforce:

Enhancing and retaining abilities of trainers

One last aspect deserves particular attention. In order to preserve, enhance and further develop the expert-trainer’s technical knowledge, know-how and expertise it is crucial that such trainers continue to work in the field and only teach/train part-time. Otherwise there is a big risk that trainers may lose their technical qualification in the respective field(s). Ideally, information awareness and professional knowledge of expert-trainers should be higher than that of students. At the same time, expert-trainers should also implement enough training to stay in practice and further develop their skills as trainers. This obviously also includes undergoing regular theoretical and practical training as trainer.

In order to optimize the system of expert-trainers, work and career development plans for this staff should take this into account and foresee regular training as trainer, implementation of training-related tasks, working in the field and undergoing technical training in their field to retain and enhance know-how and skills. Financial institutions should also give consideration to building up reserve expert-trainers in a timely manner to ensure smooth operations in case of the loss of a trainer.

Functional separation of sales and credit risk assessment

Overall effectiveness of a financial institution largely depends on its ability to take the right decisions regarding the size and functions of its structural units, the functional duties of its staff, the reporting and communication system as well as on the institution’s ability to recognize the need for making changes and to implement needed changes to organizational structure, processes, procedures and staff requirements in a timely manner.

In this paper, we take a closer look at the advantages of and conditions for separating different functions in crediting small and medium enterprises (SMEs). The purpose is to give financial institutions some food for thought on how they could, if indicated, optimize organizational structure, processes, procedures and staff requirements used to finance SMEs. Obviously, there is not a one-fits-all model but a variety of solutions. Which fits best for a particular institution depends on a number of factors, ranging from shareholder/management preferences to environment, main types of clients, quality of staff, etc. Separation of duties in the lending process for SMEs (and corporate clients) has proven effective in ensuring due diligence in assessing creditworthiness while ensuring a comfortable service environment for clients. The drive for separating duties in serving larger business clients, including SMEs, results from market pressures (which demand more cost-effective and more service-oriented solutions), related investor preferences, international and national practices as well as recommendations made by national supervisory authorities and put forward in international accords.

According to the Basel Committee, the function of credit risk assessment should be separated from the structural business units of a bank. One of the main requirements is complete independence of risk management divisions (both structurally, and financially) from departments that take on risks directly (front offices), register the fact of risk acceptance and monitor exposures (back offices). It is important to rule out any conflict of interest between credit risk management and other divisions of the financial institution. Therefore, a bank (or financial institution in principle) should observe the key organisational principle of separating duties of front office and back offices in the lending process.

|

The mission of the front office is to identify suitable clients, i.e. potentially profitable clients for the financial institution who are able and likely to repay loans on time. And, in the case of a loan application, the front office task is to process the respective application and make an initial assessment of a given client's business. In serving SMEs and corporate clients, front-office staff is often referred to as "client relationship managers" or similar as their main function is to maintain relations with clients and support clients in developing their business, simplifying business operations or overcoming shortcomings by means of offering solutions based on the financial institution’s products and services. In the case of larger clients (larger SMEs and corporate clients) this entails developing individually tailored solutions. Back office staff, often referred to as credit analysts, credit administrators and similar, typically verify the initial analysis and, where required, may conduct a more detailed analysis of the client’s business and application as well as monitor business performance after disbursement. Other back office staff will ensure that the disbursement conditions as determined by loan-decision-making bodies are fulfilled and other contractual obligations fulfilled. |

From the point of view of minimizing credit risk and other risks related to a potentially very close relationship between representatives of the financial institution and a given client, it would be ideal to fully separate duties and have no involvement of the client relationship manager or the ‘sales’ unit in assessing the client and/or loan application and no involvement of the credit analyst in client acquisition and relationship maintenance.

However, this has drawbacks: if credit analysts are too far removed from the actual business generation of the financial institution, they may get so focused on trying to cover for each and every potential risk that lending becomes so cumbersome for the financial institution and the client so that effective demand is too small to make this business a viable and sufficiently profitable venture for the institution. If client relationship managers are only trained in and focused on acquisition and know little or even nothing about credit risk assessment, there is a potential risk that they will spend significant time and effort on acquiring and processing clients and applications that end up as rejections (either by the financial institution or the client) so that, again, effective demand is too small to make this business viable.

Obviously financial institutions need to weigh risk and business opportunities and find the correct balance. This applies to the degree to which duties are separated as well as to which processes and procedures are applied in the lending process. As stated above, there is no one-fits-all solution. Each institution needs an individual solution, based on a detailed analysis of its market, its processes, strategies and goals, its target segments, the professional level of staff, the institution's maturity, future plans and objectives, etc.

Recent experience shows that proper segmentation of clients is crucial in optimizing organizational structures, processes, procedures and staff requirements for working with clients, especially SMEs. More specifically this means understanding which organisational structure, which processes and procedures to apply to the different segments in order to achieve the results the financial institution is aiming for and in order to optimise business performance.

In practice, the two most common approaches to organising duties within SME structural units are: (I) the functions of sales and credit analysis (the front-office and the back-office) are combined; and (II) the functions of sales and credit analysis are separated.

I. COMBINED FUNCTION OF SALES AND CREDIT ANALYSIS

In case of this option, we are talking about a universal loan officer or sales manager whose duties include: (а) active client acquisition and direct sales of (loan and other) products, (b) providing advice to the target client group, (c) analysis of client payment capacity and credit risk assessment, (d) preparation of credit cases for presentation to the respective decision-making body, (e) post-lending support, including (f) working with problem loans.

This approach can work if the numbers that can be generated are sufficiently big and the quality of operations sufficiently high to generate the profit needed to make this approach a viable business option for the financial institution. Therefore, such an approach is typically associated with retail banking and working with micro businesses. In working with SMEs, this approach can be justified if a financial institution has launched SME lending only recently and is planning to go for easy to reach mass market segments, i.e. rather standard clients with standard, simple needs and applications for relatively small loan amounts. In this case, the loan portfolio will be generated as a result of disbursement of loans insignificant in size and with similar credit risk features. Portfolio risk will be diversified and mitigated, i.e. spread over a large number of loans while the risk-and-yield balance of the loan portfolio can be ensured.

In this approach the role of the "universal" loan officer/sales manager is manifold and multidisciplinary.

A key advantage of this approach is that the financial institution creates an environment for the client where all matters can be addressed to one person. For the financial institution this approach has the advantage of allowing for a simple organisation of processes as most is concentrated "in a single pair of hands", i.e. it is easier to set tasks for such an employee and to control performance.

However, this model entails an inherent risk for the organization as it gives rise to possible conflicts of interest and is lacking in safeguards against mistakes and fraud: Loan officers/sales managers may have an inclination to prefer conducting analyses and risk assessment as opposed to selling, or, the opposite may be the case. In the first case, the financial institution may face the problem of many loan rejections and slow portfolio growth, which may even result in portfolio stagnation. In the second case, the financial institution may face inflated disbursements, if staff is focused on pursuing quantitative performance indicators and less concerned with risk assessment. This may lead to a situation where staff - intentionally or unintentionally – may take a negligent approach to analysis and risk assessment. Experience also teaches, that a financial institution choosing this approach may end up with less repeat clients than other institutions - if loan officers are NOT carefully chosen and trained, if NOT fully competent in other products and services of the institution and are NOT given key performance indicators/business targets that take cross-selling, etc. as well as quality of the portfolio and client loyalty into account. Often, at best, we usually will witness a series of consecutive loan applications. Usually, the underlying reason for this does not rest in the client, but in the fact that a "universal", transaction-oriented loan officer/sales manager, who is good at selling loan products rather than other products and services, will focus on selling loans rather than building a relationship with the client, understanding the actual needs of the client and tying the client to the institution by successfully offering other needed services to the client in a timely manner.

The financial institution may miss out on attracting and maintaining suitable clients interested in a broad spectrum of services for whom the institution could plan a long term relationship and potential returns.

In some instances – as in the example provided above – it may be the correct decision by a financial institution to knowingly accept the potential drawbacks described above and go for the universal loan officer/sales manager.

If a financial institution decides to use this approach, it should pay attention to the following three aspects: (1) qualification of loan officers/sales managers, (2) target setting and (3) internal control.

Qualification of staff

For the combined sales-and-analysis function financial institutions need staff equally able to sell and analyse and with a high degree of integrity. Suitable staff needs to be able to quickly sum up situations, analyse situations and draw conclusions/arrive at an assessment. At the same time, suitable staff needs to be sufficiently critical to remain open-minded and able to change assessments in case new information surfaces.

Financial institutions may recruit internally from their base of specialists, if available, or hire experienced loan officers/sales managers from other financial institutions. Usually, for such staff the new position and/or salary will be important. It should also be noted that to grow qualified experts within an institution takes considerable time and resources so that it is important to set stimuli to retain staff. In any case, for both types of experts to be successful, and if financial institutions wish to avoid the drawbacks described above, financial institutions need to adopt suitable hiring and indoctrination procedures, a suitable motivation system and systematic professional training.

Target setting

Target setting should be closely linked to the motivation system. As described above, target setting should be geared to encourage cross-selling and building client loyalty in addition to the other typical items included, such as number and volume of loans disbursed, outstanding portfolio and portfolio quality indicators.

Internal control

It is also important to establish internal controls for all stages of the SME credit cycle, to assign roles effectively and clearly between the different functional units (clear job descriptions, clear assignment of responsibilities and authorities, etc.) and design processes to allow for smooth interaction.

|

Strong internal control, which, in any case, should be an integral part of any financial institution, is of particular significance in case of a combined sales/analysis function to ensure transparency of credit decisions, monitoring results, etc. An effective internal control system requires effective communication channels to ensure that all staff fully understand and observe the policies and procedures relating to their duties and responsibilities. Internal controls should be an inherent part in each business process and ensure that all business activities are in line with established rules and regulations, so as to reduce the likelihood of operating losses and their consequences. With regard to working with SMEs, the focus of the internal control system should be on controlling that the analysis of respective business activities of borrowers are conducted according to the lending technology of the financial institution as well as in accordance with its established policies, procedures and processes, the law and rules and regulations of the regulator. |

Table 1. Internal controls in the lending process

|

Selected stages of the credit cycle |

Front- and back-office functions |

Internal controls |

|

Client acquisition |

|

|

|

Determining suitability/ creditworthiness/ analysis |

|

|

The more complicated processes and functions performed by staff are, the more important it is to pay close attention to internal controls integrated in the process to avoid conflicts of interest, especially if different processes and functions are incompatible from a control perspective.

II. SEPARATON OF SALES AND CREDIT ANALYSIS

Any functional separation should be regarded as a reinforcement of the internal control system and an increase in business process efficiency.

For financial institutions targeting larger clients, - even if not made mandatory by the regulator - it may be worthwhile to give some consideration to separating duties. Larger clients often have complex businesses, are quite demanding regarding the financial institutions and services they use, often require individually tailored solutions and have high expectations regarding professionalism of staff. For institutions targeting such clients, a competent client relationship manager, with whom clients can discuss business issues and possible solutions on equal footing, is the superior option. This approach allows financial institutions to offer a complex of products and build long-term client relationships.

This approach is typically also more appropriate when risks of an individual customer are assessed on an individual basis and loans do not form a pool of uniform loans.

In this approach, the function of the client relationship manager is to acquire as many suitable, i.e. potentially profitable, loyal and long-term clients for the financial institution as possible, identify their needs and develop suitable solutions for, respectively, together with the client. This does not refer specifically to loans but to all products and services a financial institution offers. The client relationship manager acts as a representative of the bank and is the key contact person for the client.

It is of crucial importance that client relationship managers should not only be sales and client oriented, but should also have a sound understanding of analysing businesses, credit analysis and business in principle. Only then can these experts fulfil their tasks effectively and efficiently. As indicated above, sales orientation alone will most likely result in the processing of pointless applications with the outcome of high rejection rates, unhappy clients and ineffective use of institutional resources. Incompetent client relationship managers will also have difficulties in building long term and loyal relationships between client and financial institution. These aspects, regretfully, are often underestimated. Our experience has been that financial institutions often do not give sufficient consideration to the skills, know-how and character traits competent client relationship managers need. Instead, they try to retrain staff from other positions or bring in sales people from other business areas without the necessary experience in assessing businesses, risks, etc.

The functions of a credit analyst include analysis of borrowers’ financial and economic activities, assessment of potential credit and other related risks, preparation and presentation of credit resumes for the risk management and other divisions.

Advantages of the approach:

- building long-term client relationship by providing the client with a continuous counterpart and a product mix that best meets the needs of clients

- an individual approach to each client

- an opportunity for bank specialists to focus on activities they do best

- objective assessment of lending projects and objective credit resumes due to an impartial approach to clients and their business.

In the past, the split was frequently done in such a fashion that client relationship managers just communicated and promoted products and left all actual analytical work to credit analysts. However, experience has shown that such an approach has two major drawbacks: one – as already addressed above – rests in the risk of acquiring and processing unsuitable clients. The other major drawback rests in the approach to the relationship itself. Splitting the sales and analysis function in such a way will lead to a situation where a client has to build up a relationship of trust with different representatives of the bank. This approach makes life unduly complicated and also uncomfortable for clients: during the stages of client acquisition and first interview, the client deals with one specialist, but then all financial data is to be disclosed to another person who is new for the client. This can be stressful for a client and also make retrieval of meaningful and full information more difficult. Therefore, if such an approach is nevertheless deemed most suitable for a given financial institution, it is of high importance for a credit analyst to have excellent communication and social skills in addition to being good with numbers.

As regards this approach, it should also be pointed out that the respective “sales” person and analyst must be able to communicate clearly and fully with each other. In practice, misunderstandings between sales people and analysts are not uncommon and may result in conflict situations, which may adversely affect the quality of customer service.

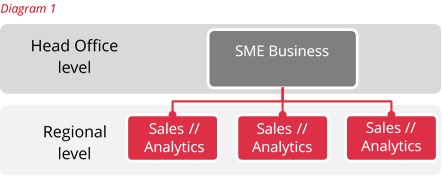

Model 1 envisages functional separation in all or some regional divisions (branch, directorate, office, etc.) (See Diagram 1).

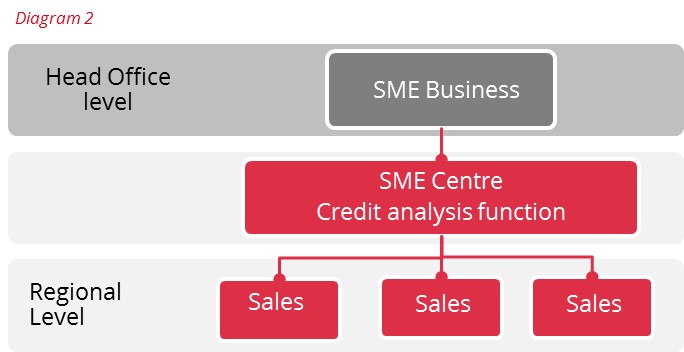

Model 2 envisages establishment of so-called SME centres providing services for small and medium-sized clients (see Diagram 2). In these centres, a group of analysts gather information, perform credit analyses and assess business activities of potential clients, including making visits to the place of business of clients.

SME centres can be established both on the head office level, and on the regional level. In this model the function of credit analysis is centralized. Centralisation, as a tool, allows maintaining effective processes and internal control. In other words, centralisation is a compromise which ensures continuous customer service on the regional level and optimization of staff costs. However, one should understand that in case of full centralization, the speed of project processing will be lower. Therefore, if a bank focuses on a smaller segment, it may make sense to consider decentralization. Alternatively, if technology permits and access to centralized databases for verifying clients are easily accessible and reliable it may make sense to fully centralise loan analysis verification and decision-making even for very small business client applications.

In any case, the client – obviously - should be the primary focus of any model adopted by a financial institution to ensure sustainable achievement of business goals. In the long run, clients have the final choice and clients tend to have a long memory when it comes to bad service, unsuitable products, etc.

Thus, if a financial institution plans to optimise its business processes, reorganise structures, and increase operational efficiency, it should take the following factors into consideration: processes, client segmentation, available resources and the qualification level, characteristics, talents and professionalism of the staff, the performance of its information systems, risk appetite, strategy, and the key goals and objectives.

If resources are limited, financial institutions will be ready to get rid of the so-called “sales people” more easily. However, it always makes sense to analyse how these measures would affect the business in the long run.

To sum up, on each stage of its structural development, a financial institution needs to assess the effectiveness and efficiency of its current business processes, analyse their components and quality of the staff involved in each of these components.

“Whenever you see a successful business,

someone once made a courageous decision.”

Peter F. Drucker

Why is SME finance so challenging?

This article is based on a discussion paper compiled by Managing director of IPC, Dörte Weidig and published by CGAP (see http://www.cgap.org/comment/531#comment-531).

Although the discussion paper was published several years ago, the topic remains current. Matching external finance with the actual needs and capacities of small businesses was, is and most likely will continue to present a challenge. It remains a fact that inadequate financing – amounts, maturities, repayment schedules and security – can negatively affect not only actual repayment performance, but also the development of (small) businesses. Inadequate financing can lead to over-indebtedness and business failure. In other words, inadequate financing may actually contravene and undermine the actual goal underlying much of SME finance, i.e. to enhance small business development and strengthen the small business sector in an economy.

Three myths about SME finance

Small and medium enterprises (SMEs) are again at the center of attention of the international community. New international, regional and local initiatives aim at supporting and reinforcing SMEs as their crucial role in strengthening an economy has become obvious. At the same time, achievement of expected results and indicators as set forth both in earlier and current initiatives is still in question.

Unfortunately, the environments in which SMEs operate are not always conducive to their growth and development. This is true for many commonly cited factors, such as regulatory framework, fiscal treatment, qualification of personnel and, last but not least - access to finance.

Being at the center of attention for many years meant that SMEs received significant support in terms of business development services, policy dialogue, “political” empowerment and – not least - provision of funding for external financing of these businesses.

The results of several recent studies on SME demand for loans confirm what we, as consultants who have been working with SMEs for decades in many countries on four continents, have seen on the ground: access to finance is not always the main problem.

Our hands-on experience has revealed a number of mistaken assumptions about SME finance. I shall highlight three core myths about SME finance:

Myth #1:

“There is a huge financing gap for SMEs – more funds are needed to close this gap”

Myth #2:

“Commercial banks know how to finance SMEs”

Myth #3:

“In order to foster economic growth it is important to provide finance to SMEs, no matter how”

Despite the abundance of liquidity available to financial institutions in many parts of the world, only few SMEs have access to finance that allows for sustainable growth. Some are fortunate enough to operate in markets where liquidity flows in a way that enables them to obtain a share of it–-but at the risk of either receiving too little financing or becoming over-indebted, if creditors lack responsibility.

One issue that many financial institutions face when starting to develop SME lending is that this segment is extremely heterogeneous. While it is fairly easy to identify common features among micro enterprises and corporate businesses, it is far more difficult to classify SMEs.

Hence, a more suitable approach to customer service and risk assessment is needed to serve these businesses adequately and control credit risk. More than for any other client group, the principle of “Know Your Customer” applies. However, the lack of capacity or willingness of many financial institutions to invest in understanding the financial needs of SMEs has caused and will continue to cause more harm than good for both - SMEs and the financial institutions issuing loans.

To underline my arguments, I shall focus on the financial situation of two SMEs that illustrate the “myths about SME finance”. Although every situation has its own unique features, the descriptions presented below are by no means isolated cases, and my colleagues and I often encounter similar examples. They reflect some of the negative consequences that can result if financial institutions do not understand the client’s business (potential) and financial needs:

Scenario 1 - irresponsible financing

Business description

An entrepreneur produces plywood and wooden components for doors. The business was founded in 2001 by Mirlan and Assel K. and developed steadily until 2006. In 2007, driven by the economic upturn, production capacities were expanded, followed by a series of further investments in view of optimistic business projections. The enterprise has 28 employees. A column on the right side shows the SME’s actual financial statements as of January 2008 and June 2009.

Behind the scenes

As of June 2009, the business had 14 outstanding loans received from five different banks and one leasing company. Although the main business income is generated in local currency, all loans were disbursed in EUR and USD, which means that currency risks were completely ignored by the lending institutions. As a result, the client incurred over-indebtedness as investments in equipment exclusively financed by external borrowing denominated in foreign currency require a respective increase in sales volume and/or profitability. In fact, however, the client’s actual sales and profits dropped. The impact of the financial and economic crisis on the business just was the top of an iceberg.

Balance sheet, in USD

|

Item / Date |

01.01.2008 |

% |

01.06.2009 |

% |

|

Current assets |

481,233 |

41 |

402,105 |

26 |

|

Fixed assets |

701,011 |

59 |

1,126,983 |

74 |

|

BS total |

1,182,244 |

100 |

1,529,088 |

100 |

|

Short-term liabilities |

168,739 |

14 |

252,571 |

17 |

|

Long-term liabilities |

809,407 |

68 |

1.443,575 |

94 |

|

Owner's equity |

204,097 |

17 |

-167,058 |

-11 |

|

BS total |

1.182.244 |

100 |

1.529.088 |

100 |

Profit & Loss statement, in USD

|

Item / Date |

01.06.2008 – 31.12.2008 |

% |

01.01.2009 – 31.05.2009 |

% |

|

Sales revenue |

184,687 |

100 |

107,492 |

100 |

|

Gross income |

71,969 |

39 |

64,181 |

60 |

|

Disposable income |

47,605 |

26 |

-10,147 |

-9 |

|

Total installment on all loans |

32,124 |

17 |

32,124 |

30 |

This SME is currently facing many problems, but has no difficulties obtaining access to finance. Although SME lending is apparently booming in many markets worldwide, irresponsible lending practices, such as ignoring currency risks or a client’s over-indebtedness may cause more harm than good for SMEs in transitional and developing economies. Therefore, financial institutions need to understand the businesses of clients and provide adequate financing in order to foster growth of the SME segment.

Scenario 2 – inadequate financing

Business description

Emil A., an entrepreneur, imports and produces perfumes. He founded his business 18 years ago. He owns three stores, of which two are in the center of the city and one in a large shopping mall. To optimize his taxation, he transferred ownership of the stores to his niece and two nephews. He purchased one of the stores quite recently. Emil has a diploma in business administration. He is the sole director of his business and has six employees.

The tables on the right presents information available on his 2010 official and actual financial reports.

Behind the scenes

Emil financed the purchase of the last store and replenished his working capital by means of credit cards and short-term loans. At the time of the analysis, the enterprise had 8 credit card with limits and five short-term loans received from eight banks. The only long-term loan was for working capital, for a maturity of 2.5 years and with 6-month grace period. Emil received this loan from a bank where he has been a permanent client since 1992.

Баланс на 31.12.2010, в долл. США

|

Item / Date |

Official |

% |

Actual |

% |

|

Current assets |

56,493 |

83 |

56,493 |

16 |

|

Fixed assets |

11,791 |

17 |

307,211 |

84 |

|

BS total |

68,284 |

100 |

363,704 |

100 |

|

Short-term liabilities |

56,323 |

82 |

56,323 |

15 |

|

Long-term liabilities |

5,733 |

8 |

5,733 |

2 |

|

Owner's equity |

6,227 |

10 |

301,648 |

83 |

|

BS total |

68,284 |

100 |

363,704 |

100 |

Profit & Loss statement, 01.01.-31.12.2010, in USD (monthly average figures)

|

Item |

Official |

% |

Actual |

% |

|

Sales revenue |

9,254 |

100 |

21,469 |

100 |

|

Gross income |

2,684 |

29 |

9,661 |

45 |

|

Disposable income |

648 |

7 |

4,346 |

20 |

This SME enterprise also has no problems accessing finance, but the funding it receives is not adequate. Credit cards are an acceptable tool for purchases abroad, but they should not be used to finance permanent working capital needs, as maturities of these debts do not correspond to the operational cycle of the business and the cost of fundinig is unnecessarily high. A maturity mismatch in financing structure creates a high liquidity risk for all types of business.

What these examples show is that many financial institutions do not understand the needs of enterprises and have not yet recognised the real potential of SMEs. This is the only conceivable explanation as to why so few have “invested” in developing a sustainable capacity to serve SMEs in a responsible way and to the client’s satisfaction. Catering to real SME needs requires a substantial up-front effort and SME lending models developed for stable markets with reliable documentation cannot be applied to markets that are still largely informal.

Financial institutions that are genuinely interested in serving SMEs need more long-term support from donors and development finance institutions so that they can develop the capacities needed to serve SMEs on a sustainable basis. In other words, support that goes beyond funding and short-term advisory is necessary for real institution building.

Readers of this article may note that the arguments are shaped in a way to make a case for more consulting and technical assistance. Well, yes, this is partly true. Opponents may come up with different arguments – but engage in real discussions with some SMEs about their lending experience – and some of the above-mentioned popular beliefs will be quickly demystified.

ANALYSIS OF FINANCIAL RATIOS FOR THE PURPOSES OF MONITORING PROBLEM LOANS

This paper focuses on the analysis of financial ratios which can be used in case of problem borrowers and/or borrowers whose business shows adverse trends potentially jeopardising successful loan repayment. These financial ratios may be helpful in assessing risks and prompt decision-making regarding further steps to be taken concerning borrowers.

Additional financial ratios and indicators are especially useful when a financial institution’s portfolio at risk is growing and economic losses of clients become noticeable.

Financial ratios are an important tool in analysing business clients (for more information on financial ratios please see an e-lesson on the RSBP Knowledge sharing and exchange platform www.rsbp-ca.org).

Apart from the basic ratios used for the analysis, in case of problem loans, we can recommend the following additional indicators:

- Break-even point

- Liquidity

- Inventory safety margin (financial stability ratio given inventory)

- Total equity-to-debt ratio (ratio of equity to total credit exposure).

Break-even point (BEP) in money terms

The BEP shows the minimum sales volume in money terms that allows a company to break even, i.e. to operate without profit or loss (at a zero profit). There are several formulae used for BEP calculation. The most common formula used in analysis of micro and small enterprises (MSEs) is the following:

FC – total fixed or quasi-fixed costs (actual costs of the reporting period)

FE – family expenses

I – total interest accrued (on all business loans)

S –sales revenue

VC –variable costs

The BEP is used for the analysis of sales trends and shows the volume of sales a client should maintain in order to match his/her liabilities (excluding loan principal instalments) without affecting owners’ equity. The BEP is useful when considering debt restructuring.

Since business and family cash flows are difficult to separate and a business is often the main or even the only source of funding for a family budget, it is recommended to include family expenses in the BEP calculation for the MSE segment.

Please be careful in your calculations as the BEP is not stable and may change depending on the conditions of business operations. For example, costs will usually inevitably increase as a result of production expansion or the opening of new points of sale: additional premises will lead to higher rent expenses, and hiring additional staff results in a rise in payroll costs, etc. Business growth will result in a higher break-even point.

If business conditions remain unchanged but the break-even point increases, this can be a signal of a company’s deteriorating financial condition.

The importance of the BEP in analyzing a business can also be seen when the BEP is compared to other financial indicators. For example, when analysing sales trends, the BEP can be used to calculate profitability for respective periods.

Liquidity

Deteriorating business conditions primarily affect liquidity levels of a company. In order to maintain their sales volumes, companies may increase the share of sales at deferred payment conditions, thus increasing the share of accounts receivable. The result: there is a profit, but there is no cash to repay debts.

Available liquidity as of the date of the balance sheet allows to draw conclusions about a company’s ability to make timely loan payments. Available liquidity can be determined by drawing up a Cash Flow statement. There is also another method of determining liquidity without preparing a Cash Flow statement:

L – liquidity

OCB – opening cash balance

TCF – total cash inflow for the period

OCF – other cash inflows

P – purchases made and paid within the analysed period

TFC – total fixed costs

TI – total instalment on all loans, incl. consumer loans

FE – family expenses

This indicator shows the immediate liquidity of a business. It can also be used for liquidity projections for the upcoming months, which is especially useful for businesses with pronounced seasonality.

Inventory safety margin

It is not uncommon for a business to maintain acceptable liquidity levels and meet existing liabilities although actual financial results may be negative. In order to meet its liabilities, a business could use proceeds from the sale of fixed or working assets (more commonly, inventory). As a result of declining investments in inventory, the inventory volume decreases, thus affecting not only the financial result but also the very existence of the business in itself. An ill-considered inventory reduction can lead to a shut-down of the business and, thus, jeopardize loan repayment.

For the economic assessment of such business situations, we recommend calculating the inventory safety margin. This ratio shows the number of months that a client can cover liquidity needs using existing inventory, provided all other business conditions remain unchanged.

ISM – inventory safety margin

NP – net profit of the period (month)

TI – total instalment for all business loans

This indicator should be compared to the number of months remaining to loan maturity. If the number of months remaining to loan maturity is more than the ISM, this signals the need to take a management decision regarding loan roll-over, early loan repayment with proceeds from the sale of company assets, etc.

However, it should be borne in mind that in most cases a decline in inventory will lead to a decline in sales volume and, accordingly, to a lower financial result as well as a lower inventory safety margin.

Equity-to-debt ratio (total equity to the aggregate outstanding principal)

Businesses tend to use several sources of finance and, especially if business is going down, businesses will try to use all available sources of credit with a view of delaying payments or building up inventory in the hope of generating more sales, etc. Nowadays, it is also not uncommon for borrowers to have several outstanding loan products, and the small business segment is no exception.

The equity-to-debt ratio helps loan officers to assess the degree of client-reliance on external financing and shows the ratio of the owners’ total equity (in the business and beyond the business) to the aggregate outstanding loan principal, including consumer loans.

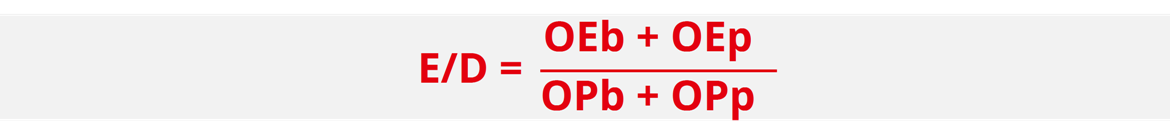

E/D – owners’ equity to debts

OEb – owner’s equity in the business,

OEp – owner’s equity beyond the business (private),

OPb – outstanding principal of all business loans,

OPp – outstanding principal of all private loans

For micro businesses and the lower-end segment of small businesses the recommended minimum for this ratio is 1. It is important to remember that - especially for micro and very small businesses - the amount of debts should not exceed the owner’s/owners’ own stake in the business. If the amount of all current loans is larger than the borrower’s total equity, the risk for a financial institution is very high.

Needed data

For the calculation of the above ratios, at least the following data needs to be obtained from the borrower:

- the amount of sales in the last month (immediate and with deferred payment);

- changes in pricing policy (trade mark-up, profitability of production)

- the amount of cash inflow in the last month;

- the amount of purchases in the last month (immediate and with deferred payment);

- fixed or quasi-fixed costs (payroll, taxes, rent, transport costs, etc.);

- family expenses (including changes in income of other family members);

- the sum of all current instalments (on business and consumer loans) from all financial institutions, subject to possible changes[1];

- liquidity;

- available inventories;

- fixed assets;

- accounts receivable and payable with respective repayment deadlines;

- outstanding loans from other financial institutions[2]

[1] Even better is to include all other obligations, if available, including from informal sources, but it is not always possible to get this information; furthermore, repayments may be more negotiable than in formal finance

[2] See above

Case study:

The client is a retail trader in silver jewellery. In June, the client received a working capital loan in the amount of 500,000 for 16 months (with a monthly loan instalment of 35,000). In recent months, the client has violated the loan repayment schedule. In the course of monitoring (in January of the year following the reporting year), the loan officer gathered the following information:

|

The client is a retail trader in silver jewellery. In June, the client received a working capital loan in the amount of 500,000 for 16 months (with a monthly loan instalment of 35,000). In recent months, the client has violated the loan repayment schedule. In the course of monitoring (in January of the year following the reporting year), the loan officer gathered the following information: |

|

|

Sales of the past few months |

October – 400,000 November – 250,000 December – 325,000 |

|

Variable costs |

October – 307,692 November – 192,308 December – 250,000 |

|

Fixed and quasi-fixed costs, including all interest accrued |

40,000 |

|

Family expenses (including repayment of a consumer loan) |

20,000 |

|

Cash in hand |

0, since all accumulated cash was used to repay loan instalments. |

|

Opening cash balance at the beginning of the previous period |

0, since all accumulated cash was used to repay a loan instalment (in December) |

|

Inventories |

400,000 |

|

Inventories as of the date of the loan disbursement |

500,000 |

|

Outstanding principal balance of a business loan |

280,000 |

|

Outstanding principal balance of a consumer loan used for the purchase of real estate |

1,000,000 |

|

Owner’s equity in the business |

500,000 |

|

Owner's equity beyond the business |

1,500,000 |

|

Cost of merchandise inventories purchased last month |

230,000 |

For the calculation of the BEP, we use the average amount of sales for the past three months – 325,000 ((400,000+250,000+325,000)/3) and the average variable costs – 250,000 ((307,692+192,308+250,000)/3).

The resulting BEP will look as follows:

So, for the company to breakeven, its minimum sales volume should be 260,000. If we compare this to the client’s actual sales, we see that the November result was negative.

Failure to comply with the repayment schedule indicates liquidity problems at the client’s business.

The estimated liquidity as calculated will be:

Calculated liquidity confirms that the client provided correct data.

The average monthly net profit of the last three months is 15,000 (NP=325,000–250,000-40,000-20,000). This profit amount cannot cover the current loan instalment. The client must have been repaying the loan at the expense of inventory, which is gradually decreasing. This assumption is confirmed by the decreasing inventory balances.

Inventory safety margin:

The entrepreneur will be able to maintain the liquidity of the business at the expense of the current volume of inventory for 20 months, provided that the business situation does not change. Given that there are only 10 months remaining to loan maturity, the entrepreneur should be able to manage this credit exposure and the business should be able to continue.

The equity-to-debt ratio calculation:

Total business and private equity is 1.56 times higher than total liabilities. This ratio is within the acceptable norm (i.e. >1).

Conclusion:

The client has been in breach of the repayment schedule due to the overall deterioration of the financial and economic condition of the business, which is confirmed by monitoring. The calculated ratio values helped to determine the degree of this deterioration, but showed that the client should be able to manage the current loan burden and keep her business running. However, the client has certain liquidity problems, so we can recommend reviewing the client’s payment schedule, more specifically, splitting the loan instalment into two (or three) smaller instalments. This will help the client to shorten the period of liquidity accumulation.

Another possible option is to find a more suitable date for instalment repayment in consultation with the client and by moving the date to a date where there are no other payments. In addition, regular monitoring should be done to prevent a possible default in case of deteriorating business performance.

The financial ratios described here, along with other financial tools used in analysing business, allow for identification of problems and difficulties at client businesses and, therefore, for prompt reaction to any changes in the business situation and for taking appropriate action to avoid default and resolve problematic debts.