In addition to traditional loans, leasing should be considered as a strategic tool to finance micro, small and medium-sized enterprises (MSMEs). Although it is a well-known instrument for financing the acquisition of all types of equipment in countries around the world, in emerging markets, it is generally more accessible to larger companies than to MSMEs. This paper lays out a number of strategies and recommendations that leasing companies and other investors should follow in order to implement policies and procedures conducive to growing access to finance for MSMEs by means of leasing.

Definition

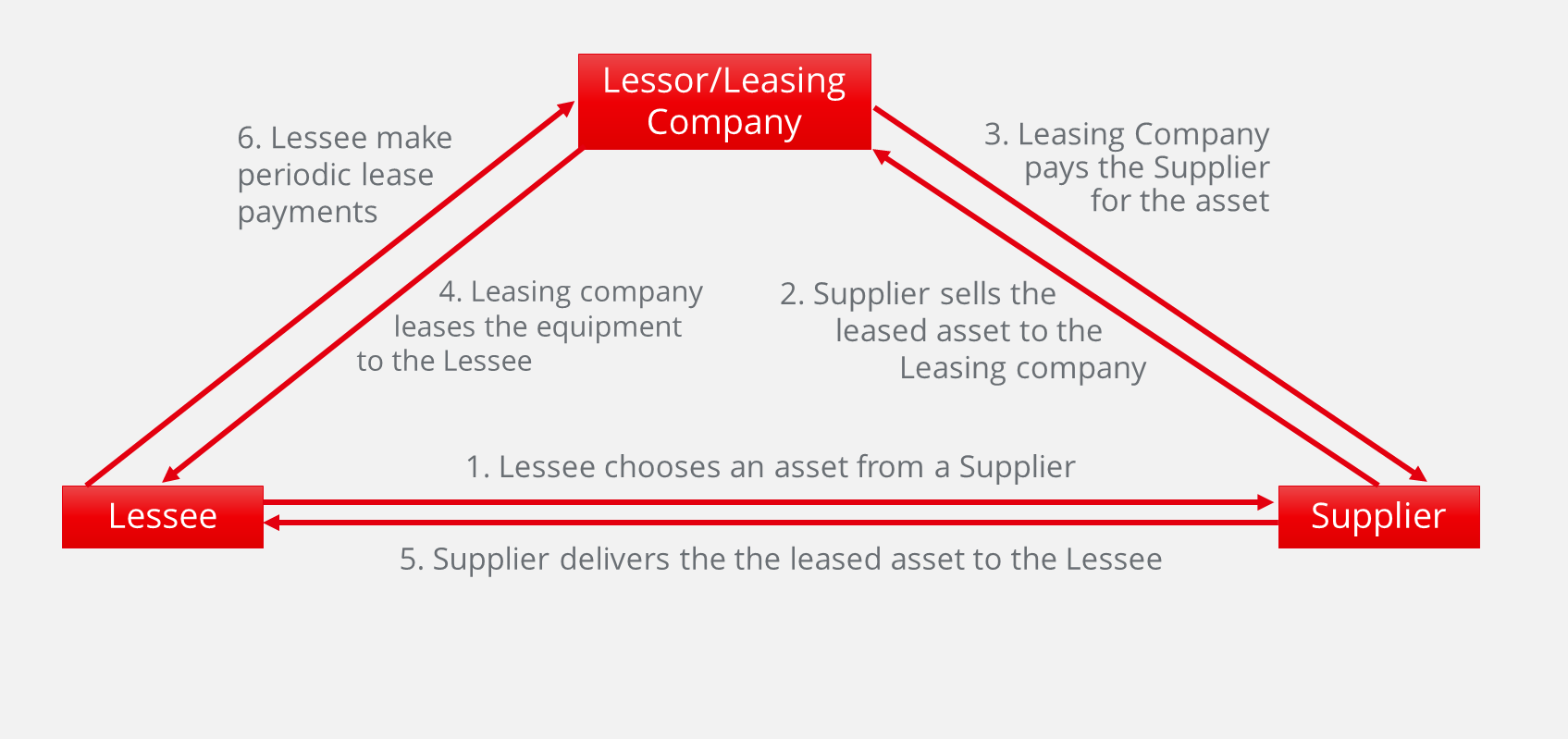

A lease agreement is a transaction whereby one entity, a lessor, leases a defined asset to a lessee. Depending on the country and its specific legislation, a lease agreement may include a third party, the supplier of the leased asset. Please note that the definition of leasing generally varies from country to country, depending on a country’s legal framework, which may include a civil code, leasing laws, and banking regulations.

The approach used to sell leasing services also differs from country to country, depending on the level of development of the financial systems, access to information on potential lessees (through credit bureaus) and the role of the informal economy. Even within one country, the approach may differ depending on the type of leased asset (for example, leasing an aircraft requires a different approach than, for example, leasing a fleet of vehicles).

For the purposes of this paper, we will focus mainly on assets that are suitable for MSMEs (an aircraft is usually not such an asset) and on the general approach to managing all aspects of leasing to this segment.

Typical Structure of a Leasing Transaction

From a macroeconomic perspective, leasing is an important source of additional finance that fills the void for small businesses with limited or no access to bank finance and can be a powerful employment engine.

For financial institutions, due to the relatively strong security provided by the right of ownership, leasing gives them access to a segment of the market that may appear to be riskier, but has the potential to generate higher margins.

Characteristics of Leasing to MSMEs

Here is a quick reminder of the general characteristics of MSME clients:

- Limited access to bank financing.

- Aggressive tax optimisation strategies.

- Dependence on a few key assets to generate income.

- Minimal back-office support for collecting documents and filling out application forms for leasing companies.

Because of the above-mentioned characteristics, MSMEs are much less interested in a strict definition of leasing. They often do not care about the difference between a lease or a loan, and they rarely benefit from any tax advantages. What they really care about is the ease of receiving a new productive asset at an “affordable” price.

As a result, leasing products that are suitable for MSMEs must:

- be simple, and ideally easier to get, or at least no more difficult to apply for than a traditional loan

- take into account the actual revenue and income generating possibilities of MSMEs (including future income)

- be a means of offering entrepreneurs a new productive asset (or a used asset) as quickly and efficiently as possible

Remember that some MSMEs already have some access to financial products based on pure credit risk: these are conventional loans, either to the owner-operators of the businesses or to the businesses themselves. This is why a leasing product should be less focused on credit risk and more focused on asset risk and supplier risk, in order to carve out a more sustainable niche.

As shown in the table below, the general approach to risk management usually depends on the liquidity of the asset and a client's exposure.

Table 1: Risk management focus depends on asset type and total exposure to a client

|

Exposure |

Equipment |

Transportation |

|

> USD 1 million |

Focus: Credit Risk |

Focus: Credit Risk |

|

USD 500,000 to 1 million |

Focus: Credit Risk |

Focus: Mixed approach; the key factor is the liquidity of assets (for instance, 4 Volvo trucks are less risky as compared to one large crane with a value of USD 500,000) |

|

USD 100,000 – 500,000 |

Focus: Mixed approach; the key factor is the liquidity of the leased asset |

Focus: Asset risk |

|

USD 50,000 – 100,000 |

Focus: Mixed approach; the key factor is the liquidity of the leased asset |

Focus: Asset risk |

|

< USD 50,000 |

Focus: Asset risk |

Focus: Asset risk |

For leasing transactions where the focus is on asset risk, a leasing company can minimise customer credit analysis because the credit risk is less important. Remember that the longer and more complex the credit analysis, the less competitive the leasing product.

Small-Ticket Leasing

In general, any lease for less than USD 100,000 can be considered a “small-ticket lease”. Usually these are vehicles, construction equipment, medical equipment and office equipment.

To be as efficient as possible, it is important to apply the following principles:

- Base your analysis on the asset risk.

- Develop internal scoring and segmentation tools to quickly set pricing and approve applications (same day approvals are ideal).

- Always tie financing to the acquisition of a specific asset. Do not provide a client with a funding quote (with an estimate of the interest rate) without an asset. Insist that the prospective client selects a product (ideally from a supplier partner) and then provide a quote that focuses on the monthly payments for that particular asset.

- Banks can expand their potential customer base. Banks that specialise in lending to MSMEs usually do not work with large companies because they do not take micro or small loans. On the other hand, these large companies are often interested in leasing low-value assets. Thus, small-ticket leasing can open up a new sales channel and generate additional income (through commissions and deposits) from large companies.

- It is necessary to constantly work on efficiency to reduce transaction costs and increase the profitability of the product.

Due to the relatively low value of each transaction, the actual risk of a single mistake is quite low. Therefore, it is important to keep in mind the need to have a diversified portfolio when developing risk models. Likewise, due to the relatively small contribution of each transaction to gross profit, one of the keys to profitability is to develop procedures and policies that focus on the efficiency aspects of operations. This starts with marketing and continues through to documentation requirements, processing times, and approval processes.

Sales and Marketing of Leasing to MSMEs

If you are a bank:

- Understand how leasing may be impacted by your existing credit business. If you are a financial institution and have a strong MSME lending business with aggressive growth goals, it will be difficult to motivate loan officers to promote a new product that they are less familiar with. The classic loan products generate commissions and bonuses for managers and loan officers.

- Remember that your lending procedures and processes are already well developed, so mastering the procedures for a new leasing product can take a long time. These new internal procedures will need to be created, tested and revised, if necessary. If combined with the sale and marketing of credit products, it will need time before the leasing operations function as well as the loan operations.

- In most cases, a potential client will be able to apply for both a regular loan and a lease agreement. What will your loan officers suggest? A product they know very well, or a product that they are uncomfortable with and that requires a third party (such as a supplier)? Experience suggests that loan officers, in most cases, will offer a classic loan to a client.

- Ask yourself the following question: is the client really looking for a lease? Or does he just need "financing"?

In the MSME Segment: cross-selling is extremely difficult. While leasing seems to be a logical extension of loan business, numerous nuances make it inefficient to market leasing via the same channels as SME loans.

If you are a leasing company:

When looking at the value proposition from the perspective of a leasing company, one of the key issues to consider is positioning relative to banks offering leasing products. Banks may be viewed as direct or secondary competitors depending on the market. This is important because banks usually have an edge in terms of funding costs and customer relationships.

Therefore, leasing companies are advised to follow, where appropriate, these recommendations when developing and promoting their products:

- Take a more aggressive approach to credit risk as the collateral associated with a lease is generally stronger.

- Specialise in specific assets/industries: better understand resale markets and industry revenue dynamics (including seasonality).

- Forge partnerships with suppliers to share risks and rewards in order to provide more competitive financial offers and/or financing to “higher risk” customers.

Leasing Companies: If you are simply selling a loan that is repackaged and renamed a lease, you better have a good cost of funding, otherwise your margins won’t be any good! The bottom line is that if you are using “banking procedures” without a bank’s cost of funding, it is very difficult to generate and maintain long-term profitability.

Marketing

Mass marketing of leasing is generally a waste of money. If a potential customer is not planning to purchase an asset, he/she does not need leasing. The most effective sales channel is usually via suppliers.

The supplier-partners are the true “clients”. The lessees are the “consumers”!

When it comes to the value proposition, suppliers generally want quick approvals and a high degree of positive decisions. They care less about the price! As stated earlier, most independent leasing companies want to avoid direct price comparisons and competition with banks, as banks tend to have a cost of funding advantage. Therefore, instead of simply selling an interest rate to a potential lessee, it is important to focus on those non-price qualities that are most valuable or important to suppliers.

Another important point to remember about small-ticket leasing:

- For lessees, the lower the cost of the leased asset, the less sensitive they are to higher rates, and the more willing they are to “pay” for fast service!

The most effective marketing tool – a recommendation from a supplier partner!

Risk Components of Leasing Transactions

Leasing has the following three types of risks:

- Credit Risk

- Asset Risk

- Supplier Risk

Credit Risk

As stated earlier, due to the complexity of leasing as compared to traditional lending, leasing companies and professionals need to be more flexible about credit risk, but better understand the risks associated with assets and suppliers.

The general approach depends on the amount at risk (client exposure) and asset liquidity. In principle, the credit risk of a lease agreement is lower than for a loan. In order to further lower the risk of a transaction, especially if the client has a sub-optimal rating, is to put an increased focus on asset risk. One of the main risk management tools used by leasing companies to enhance the strength of asset risk coverage is via advance payment. In principle, the higher the credit risk, the larger the advance payment should be.

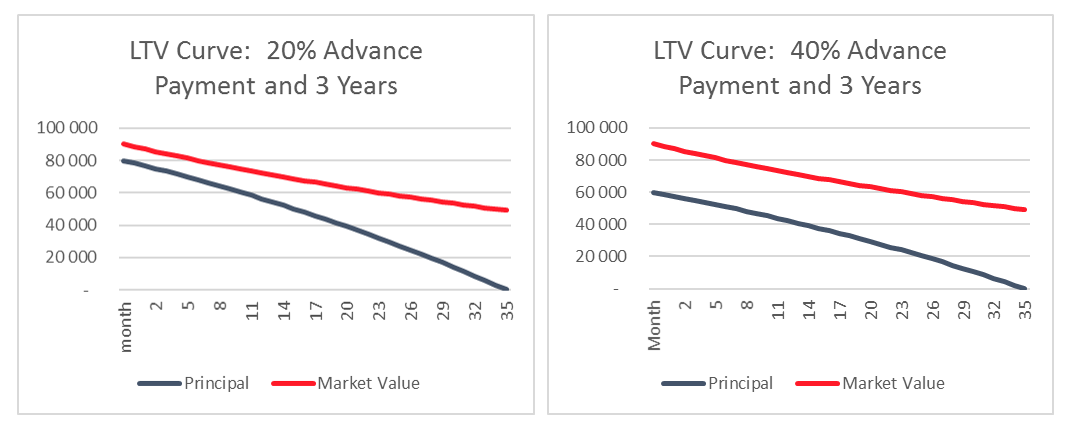

The influence of differing advance payments for risk coverage:

In the graph above, we can compare the curves for two leases with two different advance payments. As we can see, a significant reduction in risk occurs with a larger advance payment.

While the coverage of risks (asset value/lease debt) on the first day of a lease with a 20% prepayment is about 112%, for a transaction with a 40% prepayment, the coverage is 150%. This risk coverage only increases over the lease term, offering the lessor an even higher level of comfort.

|

Key Issues to remember when analysing and structuring lease deals for MSME |

→ Remember: for small-ticket leasing, it must be easier to get a lease than a loan! Otherwise, it will be difficult for the leasing company to compete against more aggressive banks. |

Scoring and Segmentation Models for MSME

In developing markets, there are a number of reasons why the utilisation of complex scoring models is difficult, these include:

- MSME legal entities tend to open and close at a high rate, therefore, these legal entities often lack long-term financial track records.

- The de-jure owner of an MSME is often different from the de-facto owner.

- Credit bureaus will often only maintain credit histories on individuals, however, even where they do collect information on legal entities, credit history information is often less useful for the analysis of MSMEs, due to the above-mentioned reasons.

- Official financial accounts often do not reflect the actual economic situation of a specific MSME due to aggressive tax optimization strategies and other reasons.

- Real estate and other fixed assets that are part of a business are often owned by other related parties or by individuals. These entities may be legal owners, while the person who actually controls the asset is not indicated in any official documentation.

To compensate for the aforementioned characteristics of MSMEs in emerging markets, leasing companies need to develop other metrics using various variables to determine the credit ratings of their MSME clients. These variables should be easy to measure and relatively easy to document in order to support the goal of quick decision making that can, ultimately, be verified by internal audit and/or management. The easiest variable to document is the ownership of assets that are required by law to be registered or licensed. This includes cars, trucks, construction equipment, and other similar equipment.

The second variable that can be documented (formally or informally) is the company's revenue figure. In general, even if revenue is frequently underreported, certain assumptions or corrections may be made to the reported figures. In addition, most entrepreneurs maintain management accounts where a complete picture of income can be seen.

The third variable that can be measured in some countries is the credit and legal history of an individual or MSME.

Thus, the creation of an internal scoring model or segmentation matrix begins with these three variables.

Models

In order to demonstrate how a model could be developed, we can start with some examples:

Customer A: prospective Customer A applies for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer A already has 10 similar Volvo trucks and a monthly turnover of USD 40,000. Customer A has some history of obtaining SME loans, no problems were reported to credit bureaus and a review of legal databases does not show that Customer A has ever been sued for non-payment by a bank or leasing company.

Customer A will receive a high internal credit rating, which we will set at '5'.

Customer B: potential Customer B is applying for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer B has one delivery truck built in Russia with a market value of USD 20,000 and a monthly turnover of USD 3,000. Customer B has a long track record of obtaining SME loans, no problems were reported to credit bureaus, and a review of legal databases does not show that Customer B has ever been sued for non-payment by a bank or leasing company.

Customer B will receive a low internal credit rating, which we will set as a “1” or “2” score. The upgrade to "2" could be due to credit history.

Customer C: prospective Customer C applies for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer C has one delivery truck built in Russia with a market value of USD 20,000 and a monthly turnover of USD 2,000. Customer C has a long history of obtaining loans from banks. Problems with other banks were reported and Customer C was sued for non-payment.

Customer C will receive an unsatisfactory internal credit score, which we will set as a '0' score.

Terms and Conditions for Each Rating

Intuitively, financing the requested transaction for Customer A should only include proof of company income, ownership / registration documents for the ten trucks, and a review of the legal databases. That’s it, nothing more!

For Customer B, the rating of the proposed transaction looks weak, but nevertheless, this is a client that the leasing company would like to finance. Therefore, to mitigate the risk, the client may be required to make a substantial advance payment, say 50%, to bring the monthly payment down to around USD 2,300. Or he/she could be persuaded to buy a less expensive truck.

Customer C will be denied funding due to his/her credit history. However, if Customer C would find a guarantor with good credit ratings, he/she could potentially get funding for a low-cost Russian truck with a 40-50% advance payment.

Developing the Model

The examples above show the extremes of potential ratings or segmentation models. Individual leasing companies and professionals would then have to determine the indicators of the above variables (i.e.> 10 similar trucks is "very good",> 5 but <10 is "good", similarly, if the monthly revenue is > 10x the monthly rental payment, this is “very good”), in order to determine what variables or indicators would be necessary to assign scores between 1 and 5. Similarly, once the credit score parameters have been determined, the company will determine what advance payment levels, interest rates and lease terms are available for each credit rating level.

Asset Risk

The main factor that impacts asset risk is liquidity.

Key liquidity comparisons:

- Low value assets are generally more liquid than high value assets (for similar assets).

- New assets are more liquid than older ones, even though they may be more expensive.

- Vehicles are usually more liquid than equipment.

It is important for leasing companies to understand the dynamics of market values and residual asset values over time. This is especially important if a more aggressive credit risk policy is required in order to be competitive. It is important to develop internal residual value curves in order to correctly assess the ratio of the market value of the leased asset to the outstanding principal of the respective lease agreement.

To gain a competitive advantage, increase margins and add value to partnerships. Knowledge of assets allows the leasing company to take on additional credit risk, finance riskier clients, and generate higher risk-adjusted returns.

Supplier Risk

While banks and new entrants to the leasing industry often pay too much attention to customers' credit risk, they often overlook the risk associated with the supplier of the leased item. It is important to remember that this “hidden” risk is potentially much greater than the customer's credit risk (based on a single transaction). After all, the supplier gets the cash from the transaction!

Specific aspects of credit or performance / delivery risk associated with suppliers are as follows:

- Does the supplier own the asset that you plan to acquire?

- Do they have tax arrears or other debts?

- What is their situation regarding VAT?

The worst-case scenario for a leasing company is that it agrees to buy equipment from a supplier, this supplier does not own the equipment at the time of purchase but plans to buy it from a third party. If the leasing company transfers money to the supplier and the latter has a tax debt that results in the forfeiture of the account, then the leasing company has an unsecured claim on the supplier and the property that the leasing company planned to buy is still in the possession of the original owner.

To mitigate or manage these risks, financial institutions and leasing companies are encouraged to:

- Work only with authorised dealers (if possible).

- Conduct appropriate due diligence, including site visits and supplier credit analysis, especially with respect to tax arrears.

- Verify ownership of assets and understand shipping and delivery terms;

- If unacceptable risks are identified, the leasing company may require that title to the leased asset be transferred prior to payment, including taking physical ownership/possession of the asset by the leasing company or the lessee client.

Management of Lease Contracts

One of the key issues when considering developing a leasing company focused on MSMEs is potential investment in software and information management technologies.

Basically, two key software components need to be addressed:

Accounting

In general, all countries have accounting software that is appropriate for managing the accounting of leasing operations. The complexity and standardisation required are quite low. Therefore, this is usually not a serious obstacle to the development of the leasing business.

«Middle Office»/Contract Management

In addition to the accounting software, leasing companies generally need software to manage their lease agreements. The first question should be: is there a national solution that integrates easily with local accounting software? This is often the most difficult area for new entrants.

It is important to remember that any software that supports the operations of a business must be tailored to the operations, processes, and procedures of a particular company. It is not recommended to buy off-the-shelf software, especially if it is software developed overseas, without a good understanding of its underlying logic. In the absence of a local solution that can be easily integrated with the accounting software, keep in mind that Excel (if you can find a VBA developer) can be used to manage up to 500-1,000 transactions. In the case of more than that, it may no longer work effectively. Regardless of what IT solution is chosen, it must be flexible and you must have your own programming team.

Keys to Success: Speed and the ability to react to market changes are keys to success. This requires constant adjustments to risk parameters and products. This becomes impossible if a company implements an inflexible off-the-shelf product that cannot be updated to match market changes.

Other non-IT Issues

As the owner of the leased asset, lessors should be aware of the following issues:

- Special registration and taxation requirements that arise due to their ownership of the leased assets.

- Traffic fines (for vehicles) and related fees.

- Liability for negligence.

- Responsibility for “choosing” the leased asset: does your leasing legislation protect the lessor? In a number of countries, leasing legislation directly assigns responsibility to the lessee for the choice of the leased asset and the supplier.

In addition to the legal advice required to properly assign the responsibility for the choice of the leased asset and the supplier, legal advice and analysis is required to determine potential liability issues and recourse that a leasing company may have in the event that its property (i.e. the leased asset) is involved in the administrative or criminal violation of local laws. This includes setting up procedures to properly administer, pay and collect on traffic fines and other similar violations.

Collection – Repossession - Resale

As noted in this paper, MSME leasing companies must find a way to assume more aggressive credit risks than banks. Consequently, if you are taking on more credit risk than a bank, you should prepare for less strict payment discipline and you must have policies and procedures in place for collecting potential arrears.

In the event of a delay in payment from your customers, it is important to respond quickly and efficiently:

- Your property (i.e. the leased asset) is often the main source of income for MSMEs. It is your collection team's job to continually reinforce this fact. If the asset is repossessed by you (the lessor), the customer loses a key asset and all income associated with it.

- If you do not position yourself as the main creditor, the client will pay others before he/she/it pays you.

- If you do not demand due money in a timely and consistent manner, some of your clients will not pay (on time).

Repossession and Resale: Minimising Losses

Speed and efficiency are important when dealing with arrears. Assets depreciate at a rate of 1-3% per month, and even faster when they are in the hands of someone who stops servicing them. Borrowing costs are another +/- 1% per month. This is why, after six months of accrued arrears, you can already assume that you have lost about 15-25% of the value of your investment.

Repossession of leased assets is a unique business process, which requires attention, training and specialists. It is difficult to outsource this activity as the circumstances of the individual arrear and the types of leased assets can be very different.

We encourage you to develop relationships with equipment dealers who can help you efficiently store and resell seized assets. It is also recommended to develop internal expertise in asset valuation. This helps reduce transaction processing times during the contract preparation process and facilitates faster decision-making when selling seized assets.

Conclusion

Never forget these two main characteristics of MSME leasing:

- This segment can be subject to significant competition from banks; and

- The value of each transaction is relatively small.

Therefore, all management and strategic decisions should be made taking into account the following principles: speed and efficiency.

Supplier relationships are an important marketing tool that leasing companies should develop as they value the non-price characteristics of your services. In addition, suppliers value quick decision making and your asset knowledge.

To bankers: it may look like a loan and feel like a loan … but It is not a loan! For a leasing product to be successful, it needs (i) its own marketing strategy and (ii) its own specific approach to risk management that fully reflects the relatively solid collateral provided by the lessor’s ownership rights.

For high-quality lending decisions, financial institutions carry out an all-round analysis of a client's business. They examine formal reporting and managerial data, business scheme and model, cross-check and analyze obtained information. At the same time, you can see that specialists involved in data collection and processing of information, and decision-making on loans cannot always quickly focus on the main aspects and specifics of a particular field of activity. Understanding the specifics of each individual field/line of business allows you to conduct the first client meeting more effectively and competently, in the course of which you can determine the potential client’s needs taking into account the type of business, assess the prospects of cooperation with the client, and prepare him/her for the more detailed business analysis, and, more importantly, to conduct a meaningful and high-quality business analysis, which involves:

Asking the business owner and other persons involved in the business competent, correct and pertinent questions, processing obtained information, cross-checking it, analyzing it allows you to make high-quality loan decisions and decisions on further cooperation with a potential client.

This article focuses on the analysis approach used for the following types of business activity:

Before delving into the topic, we would like to note that during the first stage of analysis it is important to understand what kind of business the client is engaged in, study the business scheme and model. This helps you to define your course of action when analyzing any field of activity. In addition, clients from each sector will usually also have individual specifics. Therefore, invite the client to talk about how the business is organized, how information is stored, how calculations are done before examining available formal and managerial documentation.. This will help make the analysis more sensitive and focused.

In this article, we will look at the main aspects and nuances to focus on when analyzing businesses of the above-named industries.

Let us start with trade.

| TRADE |

Retail and wholesale trading companies purchase goods from other companies (including manufacturers) for then reselling them. Examples of trading activities may include trade in groceries, household goods, clothes, footwear, stationery or flowers etc. The points of sale can be physical outlets and online stores (virtual). The goal of any trading business is to resell goods for a price higher than the purchase price. In other words, the sales price should be high enough to cover the purchase price, operating costs, and leave enough profit for the business ‘to make sense’.. Thus, in a general sense, earnings in trade are formed as the difference between sales and purchase prices, and the business itself focuses on buy & sell transactions.

Retail and wholesale trading companies purchase goods from other companies (including manufacturers) for then reselling them. Examples of trading activities may include trade in groceries, household goods, clothes, footwear, stationery or flowers etc. The points of sale can be physical outlets and online stores (virtual). The goal of any trading business is to resell goods for a price higher than the purchase price. In other words, the sales price should be high enough to cover the purchase price, operating costs, and leave enough profit for the business ‘to make sense’.. Thus, in a general sense, earnings in trade are formed as the difference between sales and purchase prices, and the business itself focuses on buy & sell transactions.

The analysis will focus on issues related to thepurchase and sale of goods, as well as on operating costs. It is important to analyze the following information:

- whether the trading terms meet current client requirements and market trends;

- seasonality;

- marketing policy and promotion of goods on the market;

- balance sheet indicators of a trading enterprise, including inventory turnover rates;

- profitability trends and change-factors;

- sale/purchase schemes; contractual relations with suppliers and buyers: study contracts, the terms of delivery of goods, analyze the customer base, as well as the terms of sale of goods, find out if payment deferrals are possible etc.

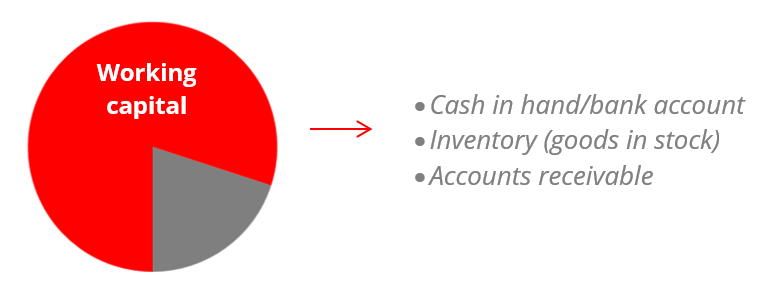

The balance sheet profile of a trading company is usually characterized by a high share of current assets: cash, inventory, and possibly accounts receivable (especially relevant in the case of wholesale) (see Chart 1). To conduct continuous trading activities, businesses need cash and cash equivalents. However, the structure of current assets may differ from company to company, depending on the specifics of a particular client (business). Retail chains normally sell goods without payment deferrals (retail customers usually pay for goods immediately upon purchase), therefore the share of accounts receivable from customers in their asset structure will be low. In wholesale trade, the situation can be different: the share of accounts receivable from customers for goods can be high. Many wholesalers offer deferred settlement terms as part of their terms and conditions of cooperation.

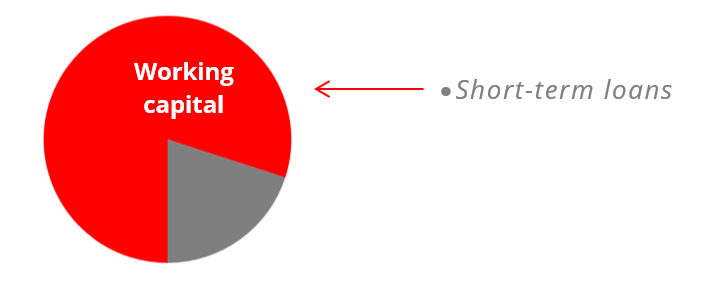

Chart 1. The share of current assets (working capital) in the asset structure

However, if, for example, a business has invested in the purchase of premises, then the structure will be different with a high share of fixed assets and/or their predominance over working capital.

Inventory is the most important asset for a trading company. During the analysis, it is worth paying special attention to the structure of inventories and turnover rate which measures how fast goods in stock turn over (sell) on average. With regard to the structure of goods, a financier should determine which goods are liquid and which goods may be subject to write-off or will be sold at a large discount; which of the goods belong to the business, and whether there are goods on credit or on “sell or return” terms, what are the entrepreneur’s liabilities on purchased goods well as what the mark-ups on different groups of goods sold are and what the weighted average mark-up is at each point of sales.

It is important to assess whether the volume of current inventories is compatible with the volume required. In this way, you can identify the risk of "overstocking" or "understocking" goods.

Compare the client’s inventory turnover rates with those of similar businesses and average industry indicators. If your client’s inventory turnover rate is higher or lower if compared to similar businesses and industry-/region-average indicators, then this is a reason for a more careful examination of such deviations. For example, if the average inventory turnover rate for similar trading businesses in a given region is 5 days, then a ratio of 8 days for your client may be a reason for more detailed investigation of reasons. Of course, for different commodity groups, inventory turnover rates will differ: perishable goods should turn over faster than clothes or equipment.

It makes sense to discuss any discrepancies with the client. A very large, non-typical volume of goods in stock may have its objective explanation. For example, a client changed his/her business line and purchased a new group of goods, which may be dictated by demand. In order to make the offer more attractive and meet customer demand, the client needs to offer a certain assortment. In this case, at a particular point in time, the client may have an unusually large volume of inventory if compared to previous periods or similar clients. But there may be another situation where a large volume of inventory can be attributed to lower seasonal sales than expected so that our potential client may be forced to sell these at a discount. It may also turn out that the good is not in demand at all. Generally, a large amount of unclaimed inventory may indicate that the potential client has a poor idea of the level of supply and demand in the market. There may also be other factors: for example, the late arrival of a certain batch of goods delivered much later than expected due to closed borders etc.

But it is not indicated to label high or low inventory turnover rates as good or bad. It is important to look at the actual situation of client and evaluate it on a case-by-case basis.

On the balance sheet of a trading company, we can see short-term liabilities comparable to its working capital (see Chart 2). If there is a bias then it makes sense to examine the situation more closely, e.g. if inventories are financed with "long money" or there are "short-term liabilities" that are not comparable to working capital assets.

Chart 2. The purpose of short-term loans is to finance working capital

It is also important to analyze the quality of accounts receivable from customers. If an analyst understands that the debt of a customer is unrecoverable, then this debt should not be included it in the balance sheet as accounts receivable. This may also affect future inventory purchases.

Trading businesses are subject to demand fluctuations: demand can be high or low, depending on the commodity group and season. There are many options to measure profitability of sales (ROS, i.e. return on sales reflects the share of profit in total sales). For example, for a retail store, you can use the classic approach: the ratio of net profit to total sales revenue. The return on sales ratio shows you how much profit is earned per one monetary unit of revenue. This indicator must be higher than zero. Sometimes, in order to attract more customers or “push out a competitor,” owners (managers) decide to reduce trade mark-ups, which can ultimately reduce their profit margin. It is worth understanding these nuances and being able to assess the profitability of sales as this can be indicative of pricing policy issues.

As with other types of business, it is also important to assess quality indicators of trading companies, such as quality of management, staff turnover rates, marketing, quality of services, quality of the documentary flow regarding various authorities (tax authorities, landlords, etc.). Let's take personnel as example: it is common knowledge that one seller is able to sell a certain good, while another seller cannot. Sometimes there is a direct relationship between the level of sales and staff turnover. And the staff turnover may increase or decrease sales volumes at an outlet. The marketing policy also affects the level of sales in a market, while poor quality documentary operations can undermine the smooth running of any business.

While operating conditions of different trading companies may vary significantly, there are a few common factors that indicate a ‘good’ state of affairs and make trading businesses more attractive to financiers:

- favorable location;

- modern approach to customer service;

- high demand for goods;

- ever-growing customer base and the presence of regular customers;

- well-established and stable cooperation with suppliers;

- stable liquidity;

- sufficient and high-quality inventory and a sufficient range of goods;

- permanent staff and low staff turnover;

- positive profitability; retained earnings sufficient for business development.

| PRODUCTION |

Manufacturing is a field of activity where raw materials are processed and converted into ready-for-sale goods (either semi-finished and/or finished goods). For this field of activity, technologies, equipment, specialists, distribution channels, etc. are important. Production can involve the use of high-tech equipment and manual labor.

The starting point of the analysis of a manufacturing business is the study of what is produced, the business scheme and the production cycle. It is recommended to get answers to the following questions:

- What does the business produce?

- Is there demand for the product or not?

- Is the technology used up to date?

- What is the quality and price of the goods produced?

- Is there competition? How competitive is our client in terms of product quality, price, etc.?

- How is the production process organized?

- What equipment is involved in the production cycle?

- What is the maximum and actual equipment capacity? What equipment is involved in the production cycle? Is it used at its maximum capacity or only partially?

- Is there a seasonal dependence of production?

- What is the duration of the production cycle?

- What are the volumes of production and the volumes of sales?

- Other

Depending on the scale of the enterprise and the production process, the approaches to collecting and processing information will also differ. If it is a small production business (for example, one production line for chips), then the business process will be quite simple and easy to analyze. But if an enterprise produces many different products or there is one production line that produces different types of products, then analyzing the production cycle will be quite laborious. In this case, it is recommended to divide the core production process and auxiliary production and analyze processes separately by area of production (by production line, by workshop, etc.).

In any case, it is important to assess production volumes and distribution of products. These are two interdependent indicators. For a business to work effectively and develop, it is important to produce such goods and in such amounts that can be realistically sold. If a manufacturer produces more products or fewer products than the business can sell, this is usually bad. In the first case, this will mean accumulation of unsold products in warehouses and lost income. In the second case (when a manufacturer produces less than it can sell), it may indicate inefficient organization of production, lost opportunities and/or problems in production as well as the risk of losing customers.

Estimate the demand for products and compare the volumes of goods produced and sold. After all, the volume of production depends on the demand for products in the market. These are two inter-related indicators. Analyze trends in the volumes of production and sales, look at the seasonality and consider the ups and downs in the production of a particular product. It should be kept in mind that manufactured products that could not be sold within reasonable time limits will usually be written off in the future. Analysts often make the mistake of using production volumes to assess the volume of sales.

One serious aspect to be considered is the fulfillment of contractual obligations by the client under supply contracts. Therefore, it is important to study the client’s supply contracts with customers. Failure to fulfill delivery plans under contracts may result in a decrease in revenue, profits and penalties envisaged by supply contracts. Let us take flour production as an example: A company produces 1,000 tons of flour per month on average. However, according to supply contracts, over the past 6 months, it has been selling only 500-600 tons of flour per month. This means that the rest of the manufactured flour has been going on stock. How long can flour be stored in a warehouse and will it be sold in the future at the same price …? This is a cause for careful analysis.

Production implies that an enterprise must have working capital needed for manufacturing goods. When analyzing production enterprises, it is important to pay attention to the efficiency of the use of current assets. It is recommended to pay special attention to the stock of raw materials available for the production cycle, evaluate and compare the following information: storage periods of raw materials and their turnover, purchase amounts and the sufficiency of raw materials as per calculation to ensure a continuous production process. It may turn out that material is being stocked that will not be used (overstocking). It is worth examining this situation in more detail and finding out why this happened.

In the process of the analysis, we pay attention to the condition of equipment, its service life, the source of financing its procurement, availability of ownership and other documents (certificates etc.) and whether such equipment is liquid today (easy to sell). We should understand that production activities are associated with high production risks. Firstly, if equipment is used without required documents, there may be a risk of fines and penalties imposed by respective supervisory authorities (due to violations of fire safety, labor protection requirements etc.), and you will not be able to take such equipment as collateral if the client does not have ownership documents for it. In addition, equipment that is used without proper documentation and/or without proper care can have a negative impact on the environment and personnel.

Fixed assets are usually characterized by a rather long service life, but you should keep in mind that they are subject to regular maintenance and overhaul, which implies costs.

It should be noted that the organization of production usually requires large investments, therefore we need to look very carefully at the sources of funding, i.e. own investments or borrowed funds.

Remember that production activities typically require more permits and licenses than trade and services. If any permits/licenses are missing, this implies increased risk. Unlike service and trading companies, manufacturing companies are less flexible in the event of emergencies and force majeure situations. Therefore, it is best to be skeptical and assume that such events can occur in any manufacturing process. The business cycle is usually longer and, therefore, liquidity may vary at certain points in time. Manufacturing relies on qualified personnel who operate and maintain production facilities.

In a trading business, the issue of pricing and cost of goods sold is quite clear. As opposed to this, in a manufacturing business, calculation and accounting of production costs depends on the accounting methodology adopted by the company for cost accounting and for calculation of the cost of production.

It is important to understand the manufacturer's own calculations. This can save you a lot of time: once you understand how to calculate certain positions, you also understand what and how you should calculate. You study how production costs are calculated by the business and what costs are included in the cost calculation per unit of production. This calculation may include the cost of raw materials and supplies, wages and other remuneration of personnel directly involved in production, payroll tax deductions of these workers, utility costs and the cost of heat and energy resources consumed in the production process, the cost of waste/losses and other production costs etc.

We have listed only the main features of the analysis of a production enterprise and what to focus on when collecting information about production, but even from this, it is clear that the analysis itself and the approach to it can be quite difficult. Often, it may take up to several days for a loan officer to collect and process all necessary information, and involvement of different specialists on the side of the manufacturing company (specialists from the production hall, accountants, managers etc.). Therefore, loan officers must have a high level of training.

| SERVICES |

Cafes, restaurants, hairdressers, beauty salons, car washes, private kindergartens, fitness clubs, foreign language schools, legal services etc. are examples of service providers. This spere of business typically has the common advantages such as minimal start-up investments and high profitability levels. Of course, there are service areas where start-up investments caan be significant, for example, IT or car services.

Cafes, restaurants, hairdressers, beauty salons, car washes, private kindergartens, fitness clubs, foreign language schools, legal services etc. are examples of service providers. This spere of business typically has the common advantages such as minimal start-up investments and high profitability levels. Of course, there are service areas where start-up investments caan be significant, for example, IT or car services.

Companies providing services have individual specific features which may differ significantly depending on business specifics. These will affect profitability and balance sheet features, and, ultimately, the focus of the analysis. For example, in the case of taxi services, the analysis will usually show a large share of fixed assets on the balance sheet total, while the share of fixed assets is likely to be low in the case of legal services,, and, therefore, the focus of the analysis in the first and second cases will be different. From the table below, you can see that for all types of services, the analysis will focus on the availability of intellectual/skills resources (i.e. competent specialists), working scheme and the number of orders, while the need to lookdeeper into working capital and fixed assets will depend on the specific features of a given business.

The length of the business cycle in the services sector may also vary significantly: from several minutes/hours (hairdressing salons, photo studios, cinemas, other consumer service providers) to several months (companies that work on large individual orders).

Consequently, the financial ratios of service providers will vary significantly, especially those based on balance sheet indicators, and deviations from standard normative values can also be significant: for example, working capital turnover rate, the ratio of fixed assets, the debt-to-equity ratio etc.

Table 1. Comparing different types of service providers

|

Activities |

Specialists |

Number of orders |

Operating scheme |

Current assets |

Fixed assets |

|

Car service |

|

|

|

|

|

|

Medical services |

|

|

|

|

|

|

Passenger and cargo transportation |

|

|

|

|

|

|

Rental services (real estate, equipment, vehicles) |

|

|

|

|

|

|

Consulting (legal, financial) |

|

|

|

|

|

|

Information Technology |

|

|

|

|

|

|

Cleaning services |

|

|

|

|

|

|

Tourist services |

|

|

|

|

|

As a rule, the share of current and fixed assets in the structure of the balance sheet will be relatively low in most cases. Inventories in the service sector either do not exist at all (for non-production services), or account for an insignificant share in the structure of current assets (spare parts and components). Accounts receivable may account for the main share of current assets, while for enterprises that work on condition of 100% advance payments by customers, working capital will consist primarily of cash on hand and in bank accounts.

Service sector companies do not usually have long-term liabilities on their balance sheets. But there may be exceptions, as in the case of services involving the operation of fixed assets. Short-term liabilities consist of accounts payable to suppliers and advance payments received from customers and other payables, and, in the case of larger organizations, these are mainly accounts payable to subcontractors. Consequently, service enterprises tend to have small amounts of passive accounts.

In most cases, the cost of services will not be calculated, since no raw materials are involved:

- For services based on the operation of fixed assets, the main expense is associated with their maintenance.

- For knowledge- and information-based services, the main expense is labor costs.

When analyzing service companies and depending on the specifics of each client, the focus should be on the business scheme, the number of standing orders, staffing, quality of services and/or collection of information on the expenditure side.

The specificity of the services sector and its diversity make it rather difficult to analyze the activities of such enterprises. And for this reason, loan officers must learn to focus on common/standard features and the specific features of each individual area of activity of the services sector.

In conclusion, all three areas of business activities - trade, services and production - require a different approach to the analysis. More than that, not only a different approach but also special knowledge. Trade is usually easier to analyze than services and manufacturing. In addition to the nuances that we highlighted in this article, there are other specific features that exist in each separate industry. And the task of all specialists engaged in the analysis of any sphere of business is to be attentive to these features, since an error in calculations can lead to an incorrect result and decision.

It is not uncommon to start searching for suitable candidates by publishing a job advertisement. At the same time, many job requirements are often worded in a vague manner or limited to general phrases like "working experience is welcome."

This article focuses on an important aspect which is often overlooked by financial institutions, i.e. how to make your recruitment process efficient. After all, this process requires preparation and begins long before posting the advertisement for a vacancy.

Generally speaking, we can specify a few key conditions for ensuring high-quality work with personnel:

- A systematic staff search and selection process;

- A well-designed internship program;

- A system of regular staff evaluation of achievements and competencies;

- A system of training needs assessment and regular training;

- Conditions for career advancement and career planning.

This article provides a detailed description of the first stage of staff development activities: best practices in organizing staff search and selection process, including a description of mandatory components and practical recommendations on their successful implementation.

Importance of the preparatory stage

The importance of quality staff recruitment is difficult to overestimate. Hiring a candidate who cannot cope with assigned tasks due to a lack of necessary qualities and skills leads to significant losses of time and resources of an organization, as well as to lost opportunities.

To find the right employee, it is important to start with preparatory activities, not only focusing on formal requirements but on analyzing which candidate would be able to perform the tasks associated with a certain position. It is also necessary to create conditions for objective and prompt decision-making by elaborating clear selection stages and evaluation criteria for candidates.

It is important for the HR department of any institution to carry out preparatory work that will ensure the most effective process of finding suitable candidates and, most importantly, create conditions for hiring candidates who are most suitable for a concrete position.

As a result, due to targeted staff selection, a decrease in training costs may be expected, higher staff efficiency and lower staff turnover.

As in the case of any other process, for successful implementation of the staff selection process, it should be systematized and described in detail. This will lay the foundation for objective assessment and selection of the most suitable candidates for the specific task.

How should this process be organized according to global best practices?

Designing a job description/profile

As the first preparatory step in quality recruitment, it is recommended to develop a detailed job description for each existing position at a financial institution.

It is important to indicate the desired education or work experience as well as necessary, specific practical knowledge, skills, and qualities that a successful employee should have for a specific position.

A job profile for each position is prepared as a separate document which should include the following information:

- List of responsibilities in a specific position;

- Requirements to potential candidates;

- Proposed working conditions.

A table below outlines a sample structure of a job profile description.

|

Sample Job Description: Structure |

| (1) Purpose / role of the job |

| (2) Sphere of the main responsibilities |

| (3) Round of duties |

| a. Primary (core) duties |

| b. Secondary duties |

| (4) Requirements to the candidate: |

| a. Education / Working experience |

| b. Professional knowledge |

| c. Competencies (skilss, abilities, personal qualities) |

| (5) Working conditions and employee rights |

| a. Remunaration structure |

| b. Working time and vacation |

| c. Professional development plan |

| d. Evaluation of efficiency |

| e. Career advancement opportunities |

It is important to define clearly the primary and secondary duties for each position. For initial compilation of this list, it is useful to set up a working group including specialists of the HR department and the department to which this job belongs. You can start by defining the general tasks of the department and then indicate the functional duties of each employee of this department.

The more precise this list is, the easier it will be to find the right candidate for a concrete position. With a clear idea of what duties will be performed by an employee in a concrete position, it will be easier to proceed.

The next step is to determine the knowledge, skills, and personal qualities that an ideal candidate for this position should have. It is important to pay special attention to this item.

In the "Requirements to the candidate" item, employers often indicate formal requirements, such as higher education, computer skills. However, it is more efficient to select candidates by their personal qualities and professional skills. And there is a good reason for this.

- For example, even if a potential candidate for the arrears department is suitable in terms of education and comes with excellent recommendations but is not good at dealing with conflict situations, then s/he is not likely to cope with his/her duties in this job.

| Here are some of the skills that candidates must have to work at a financial institution |

|---|

|

It is easier to describe required skills by analyzing the list of daily tasks and match them with various competencies that are easily available in the public domain. As a next step, you should choose the most important skills for carrying out the daily tasks associated with a given position. You should also remember about secondary duties and add the respective skills to the list.

Another useful method of collecting the necessary competencies is to analyze the qualities of successful employees in this position in your organization.

Determining the required competencies is not an easy task, but by doing this you can significantly improve recruitment efficiency. Once you have completed the description of duties and requirements to potential candidates, you have the necessary basis for the next step.

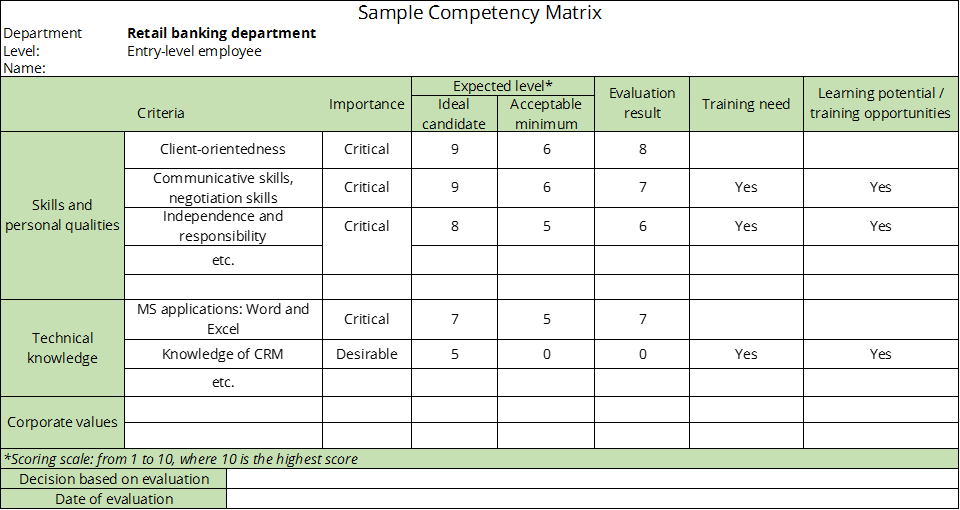

Drafting a competency matrix

In this matrix you list all competencies required to perform the duties in a particular position. It is recommended to derive competencies from the competency list compiled for a given job profile and add them to the matrix, usually grouping them in personal qualities and technical skills. It is recommended to limit the list to the most indispensable competencies for each position. If the list is too long (more than 10 competencies), this will complicate assessment. Given that different positions are associated with different responsibilities and responsibility levels, the number of competencies on the lists for different positions may be different, depending on the complexity of each concrete position.

The next step is to define a measurement scale, for example, a scoring scale from 1 to 10 (where 10 is the highest score), or a scale of qualitative indicators: "Low - Medium - Above average - High", and, accordingly, indicate the proficiency level required for each skill for successful performance in a given position.

As a rule, a competency matrix is developed for a specific department and for each staff level: a specialist, a senior specialist and the department head. Accordingly, the expected level of proficiency for a particular skill will be indicated depending on the expected level of experience required for each position.

When defining the scale of expectations of an ideal employee, it is important to consider the degree of importance of each competency for the respective department.

- For example, employees of the Retail Department must have a high level of communication skills (9-10 of 10, based on the scoring scale mentioned above). As for candidates for positions in the Accounting Department, while communication skills are important for intra-team interaction, such candidates are not expected to have the highest level of communication skills.

At each of the stages described, it is important to avoid generalization. It is recommended that in your description, you indicate specific skills required by your institution.

For example, when it comes to credit risk specialists, they are expected to have a high level of analytical skills. This requirement can be specified as follows:

- Analytical skills: ability to process quickly large volumes of diverse information, identify the most important aspects, possible risks, draw independent conclusions and propose solutions.

Or, another sample description of communication skills expected from a loan officer:

- Communication skills: ease in communication with potential clients, ability to explain products/procedures correctly and in an understandable way, ability to collect effectively exhaustive information for credit and risk analysis, ability to handle objections, resolve conflict situations.

It is important to add management skills to descriptions of leadership positions. For example: initiative, planning skills (organizational or control skills), the ability to develop and motivate others. The presence of required management skills should be envisaged as a prerequisite for career advancement. In such cases, the development of these competencies will serve as an incentive for experienced employees with a prospect for promotion.

As an additional option, competences can be divided into critical (indispensable) and desirable. The first category includes qualities or skills that are absolutely necessary and without which high-quality performance of the functions described for a given position will be impossible or extremely difficult.

- An example of critical competencies: attention to detail for the position of an Accountant

It should be borne in mind that a competency matrix describes an ideal employee for a given position, and potential candidates may not necessarily have all the necessary qualities at the desired level. In this case, it is important to pay attention to the potential of candidates for developing a particular skill and available resources in your organization (for supporting candidates in developing needed skills). It is also recommended to pay attention to the readiness of candidates for further growth and their additional strengths that may (partially) compensate for the insufficient level of any of the required skills.

At the same time, if no candidate is found who meets the minimum set of critical competencies, it is recommended to avoid compromises and continue to search, because hiring an unsuitable candidate will usually have more negative consequences and will cost your institution more in terms of time and money than continuing to search for a more suitable candidate.

It should be remembered that not everyone is suited for any job, even if a lot of time and effort is invested in training. In most cases, employees who cannot cope with tasks due to a lack of necessary qualities become dissatisfied and unmotivated, which ultimately leads to unsatisfactory results and staff turnover.

There is a general recommendation for all financial institutions to start with a simple matrix. Over time, this matrix can be adjusted based on staff performance, staff evaluation and experience gained.

Once the competency matrix is ready, it makes an excellent basis for assessing potential candidates as well as evaluate current employees and identify areas for improvement. If staff evaluation shows that some employees lack necessary competencies, identified gaps serve as basis for developing an effective training plan.

There are many options for building such a matrix, and it is important to define a workable model for your institution. As an example, below is one of the possible structures.

Defining recruitment stages and an approach to candidate assessment

Based on the requirements for specific positions, it is worth considering the most optimal recruitment/selection stages for each position. It is important to describe the recruitment process, which includes clear steps, a system of evaluation and a passing score.

Possible recruitment stages include initial screening of CVs, selection of applicants who meet the criteria; general testing, filling out questionnaires; analyzing the results and selecting candidates for an interview; several stages of individual and/or group interviews; conducting specialized testing.

Each of these steps helps to identify different qualities of a potential candidate. By combining different stages with clearly described evaluation criteria, we significantly increase the efficiency and objectivity of the screening process.

It is worth determining selected stages to be applied to in-house candidates. It is also necessary to consider the job level and the selection periods. However, it is important to apply a competency matrix or a list of required competencies for experienced external candidates as well as for in-house candidates. Several years of work in a similar position do not guarantee the expected level of competence.

For interviews, you should prepare blocks of questions to determine the level of certain skills and experience. Accordingly, for an interview, blocks of questions are chosen depending on the required skills determined in the matrix or in the list of competencies required for a specific job. It is also recommended to include situational questions on the previous experience of an applicant.

Here is a possible list of questions to assess self-organization and time management:

- How does your day usually go? Do you plan it in advance?

- How do you prioritize your tasks for the day?

- What helps you with your planning of the day?

- What will you do if you need to fulfill several tasks at the same time?

- Tell us about your plans for the next month.

For convenience and systematization, it is helpful to develop a Candidate Evaluation Form for individual interviews. This can be easily done based on the matrix or list of required competencies.

Questionnaires are a good tool to identify competencies. Group interviews are especially useful for identifying personality types. To conduct them, it is also necessary to prepare questions for discussion and an assessment form in advance. It is also possible to include situational case studies and divide applicants into teams. For an interview, it is advisable to involve several employees since you will need a discussion moderator(s) and an observer(s). For the role of moderators, it is advisable to involve employees of the department for which the applicants are recruited, with support from an HR department specialist in the role of an observer.

It is important to select a proper location for a group interview. On the one hand, participants should feel comfortable to freely express their opinions, so it its preferable to avoid small confined spaces. On the other hand, staff of the financial institution observing the interview process should be able to clearly hear the opinion of each participant.

Depending on the job type, the list of qualities to be assessed will be different and will be selected based on the matrix or the required competencies list. It is important to develop a Candidate Evaluation Form for a group interview.

For example, for a group interview, the following assessment criteria can be included:

- First impression

- Ability to express ideas, communication skills

- Initiative, leadership qualities

- Ability to give arguments

- Ability to work in a team

This screening method is not applicable to all positions and usually used for situations involving many applications for a position. Group interviews are recommended as an efficient method when there are many candidates and competition is high. This method can also be used for evaluating final year students before graduation, in order to select the most talented candidates.

Testing, in turn, can be conducted either to test basic skills / general level of development of applicants, or the level of highly specialized professional knowledge. It is recommended to create an extensive database of possible questions and answer options in advance, to be able to compose different versions of tests without additional input of resources.

It is also important to define the testing procedures in advance, testing time, scoring method and to set the minimum passing score.

It is important to keep the results of initial assessment of selected candidates, in particular, their completed competency matrixes, as this is the starting point of an employee’ further development path.

It is possible to recruit applicants without the expected experience, with only partial technical knowledge, but always with a set of necessary personal qualities. It is recommended to pay close attention to how a candidate fits the job profile, because it is much easier to teach technical knowledge to a person than to change his/her personality.

An in-house professional training system is a good way out. Think in advance of the type of training you can offer to trainees to develop their most important competencies. Depending on the level of the selected candidate, an internship plan is drafted, a teaching method is selected with a list of topics and materials prepared in advance.

Job advertising and searching for candidates

The final stage of the preparation process is the drafting of a job advertisement.

It is important to provide a description of future responsibilities based on the job profile and the main competencies expected. A candidate must clearly understand what functions s/he is to perform.

It is also important to use various media for posting a job advertisement, not just the official website of your organization. Searching for candidates within and outside your organization expands your choice. The wider the outreach of your ad, the more chances that your ideal candidate will notice it. One of the general success factors is to make every effort to ensure that there are enough potential candidates to be able to choose from the best on the market.

It is important to indicate different ways for candidates to submit their resumes and to ensure that none are left without attention or lost in the process. It is recommended to create a positive impression of your organization from the very first contact with applicants by providing all required information and communicate professionally and politely with each applicant.

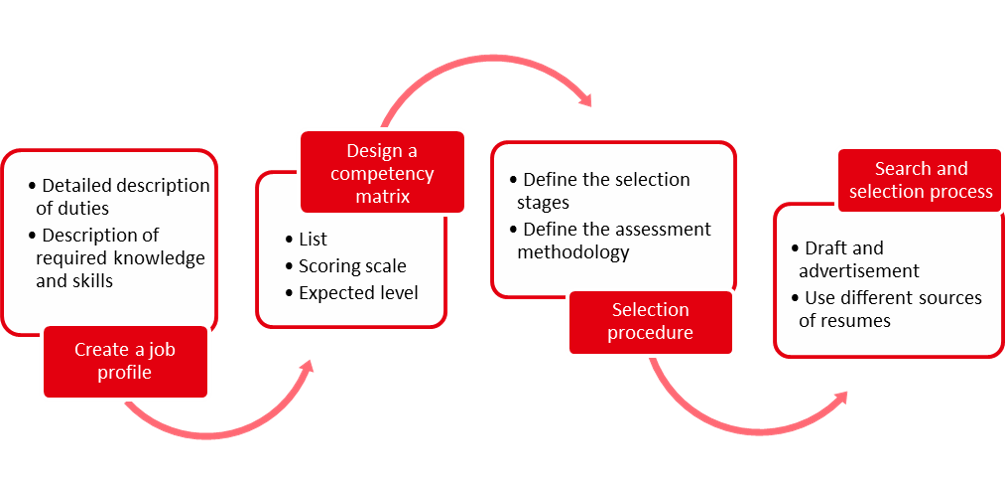

In conclusion, we present a scheme for organizing the staff selection process based on best practices.

Once you have done this preparatory work and applied the developed criteria in practice, you have a basis for optimizing the process, for a systematic and transparent approach as well as for equal treatment of all evaluated candidates. As a result, the best and most suitable candidates will be selected for long-term work for the benefit of your financial institution. Well selected employees able to fulfill their tasks are the key to higher efficiency, productivity and motivation at lower cost.