What is a metrics hierarchy and what is it for?

The metrics hierarchy is a structure that helps you navigate through a large number of different metrics and make informed decisions for further product development. It shows not only the metrics (indicators) themselves, but also how they are related to each other, how they influence each other and, ultimately, the success of the product as a whole.

Using a hierarchy of metrics, you can:

1. Achieve a clearer prioritisation

A hierarchy of metrics can help to prioritise the backlog (list) of tasks for a product more efficiently - you choose which metric you want to grow and define related tasks that will help to improve this metric. This allows more precise selection of tasks in the release[1] and the team understands more clearly why this or that functionality is being done.

2. Provide clear visualisation

It is a good tool to visualise product metrics, it is not always possible to see in a large amount of information the metrics that are important and affect the success of a product

3. Show connectedness and achieve transparency

A hierarchy of metrics helps to establish how they are related to each other. Often in large organisations, each department has its own KPIs, but it is not always clear whose actions influenced the product results.

The bottom line is that the metrics hierarchy is not just a fancy term, but a powerful tool that makes product work more efficient, transparent, and effective.

How do you build a hierarchy of metrics?

Building a hierarchy of metrics is a process that will require a bit of analysis of your product and its goals. Here are some steps to help you do just that:

- Define the primary purpose of your product this will be the top of the hierarchy

- Break down the goal into its components - what factors influence the achievement of the main goal?

- Decompose each factor - keep breaking factors down into smaller components until you get to metrics that can be measured directly.

- Build a hierarchy - organise the metrics into levels, starting with the primary goal at the top. Link the metrics with lines to show how they relate to each other.

- Check the logic - make sure each level of metrics flows logically from the previous one. If a metric is not related to the main objective, it may be worth removing or moving it.

How to properly decompose metrics?

The groups into which metrics can be divided in the hierarchy depend on the product and the target metric that the financial institution is developing. In general, three main groups can be distinguished:

- Business metrics are generalised business goals, they are usually at the top as they are the highest priority for the company. In a bank or financial organisation, such metrics would be profit, size of loan portfolio, size of deposit base, etc.

However, based on these metrics, it is not always possible to assess the real picture of interaction with the product, as many of them are "lagging" - it is possible to track the failure to meet the expected indicators after the fact, when the profit has already decreased, or the loan portfolio has fallen. Therefore, there is a separate category of metrics that allow you to monitor the situation every day and correct actions promptly -- you need to find "leading" metrics for the product and add them to the hierarchy.

- Product metrics are metrics that show how your user interacts with your product.

These include, for example, the following metrics: DAU (daily active users), MAU (monthly active users), NPS (Net promoter score), number of successful loan applications, LTV, CAC, etc.

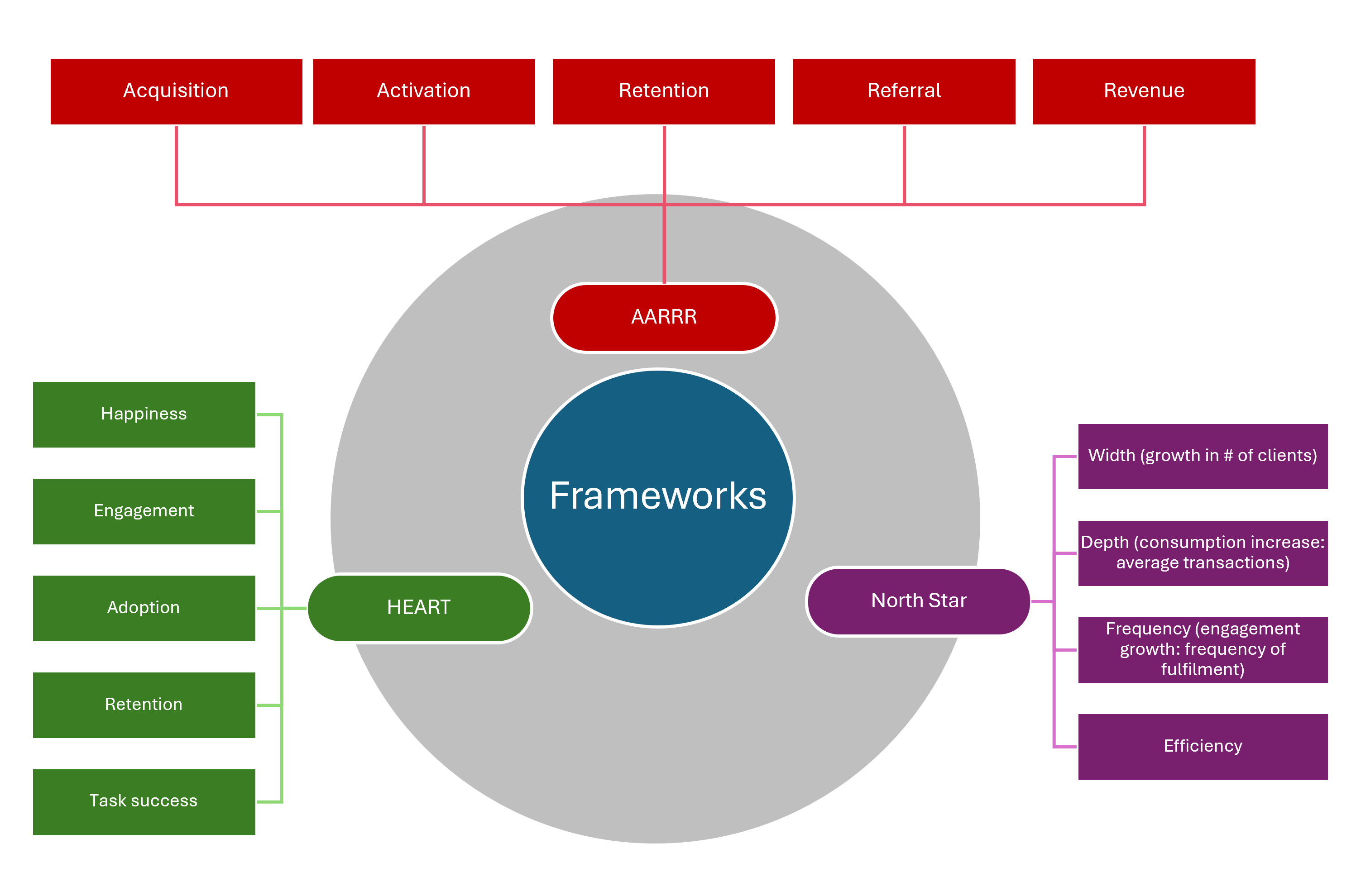

Tracking product metrics helps to monitor business metrics, make changes to the product and continue to develop it. There are a large number of product metrics and they are also categorised into groups. In order to organise all product metrics, many frameworks have been developed to define product metrics and each of them can be used for better visualisation - AARRR, North Star, OMTM, HEART (presented below in Diagram 1).

- Intermediate metrics (also called product quality metrics) - these don't show the final metrics themselves but are very helpful in using product metrics.

For example, calculating the conversion of an application to an approved loan, "Time to Yes" - the time during which the client receives approval for the loan.. Or the speed of completing a loan application. This group also includes technical metrics related to error rates, such as the number of unsuccessful transactions, etc.

Intermediate metrics allow you to look at the details of the user's interaction with the product.

Diagram 1: Existing frameworks for visualising product metrics

Example of building a hierarchy of metrics

Let's take a bank's mobile app and try to build a simple example of a metrics hierarchy.

Level 1

The metric that the financial organisation wants to increase - most often profit - will be included on top.

Level 2

Let's go down a level. To do this, let's answer the question: what affects the profit of a mobile app? Usually, it is the following indicators:

- New app users - The more app users an app has,, the more likely they are to make transactions that will generate revenue

- Returning users are loyal active customers who use the app on a regular basis.

Level 3

Go further and at each level identify metrics that have a direct impact on the level above:

What does the number of new users depend on?

- From the number of downloads of the app: the more downloads, the greater the likelihood of getting new users..

- However, there is an intermediate metric to consider here, such as "conversion to registration". After all, it is important that users not only download the app, but also become a full-fledged user and successfully complete the registration process in the app.

What does the number of returning users depend on?

- From the number of active users. Here it could be useful to evaluate: how many people are using your app regularly? You can add metrics such as DAU (daily active users), MAU (monthly active users) and track unique users who logged in and made targeted actions in your app during a day or month.

- From the number of reactivated users. Ask the question: Did you manage to get back those users who stopped using the application?

Level 4

Transactions. The next group of metrics that affects revenue is how many transactions and how much money our users make.

- Number of clicks on services: are users interested in banking products?

- Conversion to transaction: how many clicks turn into real revenue-generating actions?

- Successful transaction rate vs non-successful transactions?

Further, by defining each next level of the metrics hierarchy, you break down the complex mechanism of a mobile application into understandable components. And you can see which factors influence the success of the product and can work on improving them in a targeted way.

Building a hierarchy of metrics for a credit product

Let's make an example of a hierarchy of metrics for a credit product, following the algorithm described above.

Level 1

The main goal of a loan product is profitability, so this metric will be at the top of the hierarchy.

Level 2

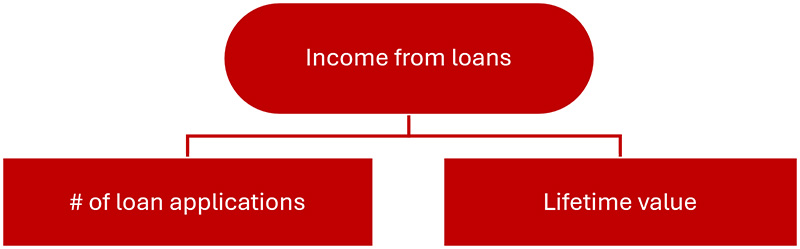

At the next level, we identify important components that affect the profitability of the loan portfolio:

- Number of loan applications - the more applications, the more potential loans the bank can issue

- Lifetime value - profit from one customer for the whole time of working with him/her

Diagram 2: Outcome of the metrics hierarchy (level 2)

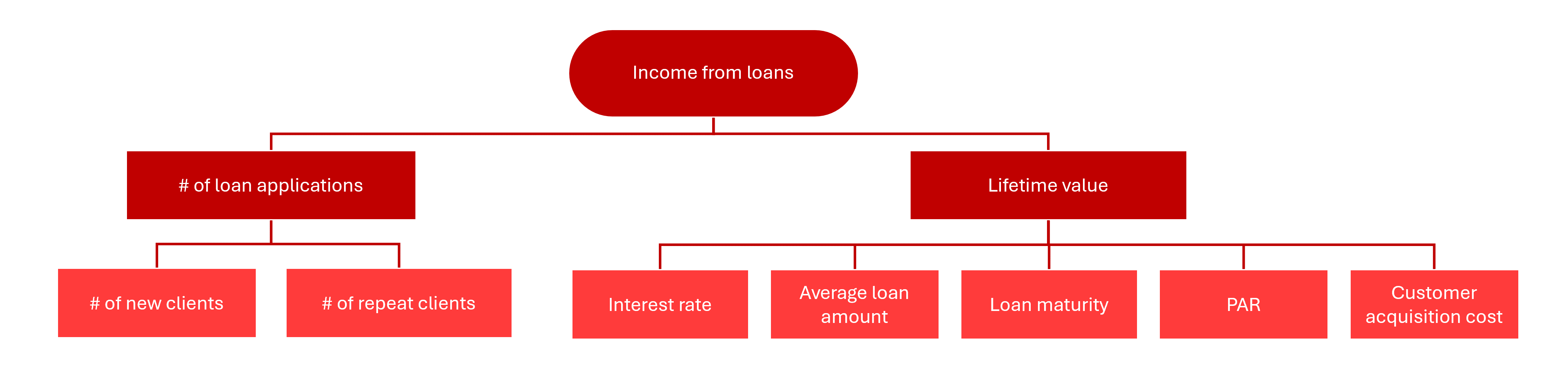

Level 3

Let's go down to the next level of the hierarchy.

Answering the question: what does the number of loan applications depend on?

- On the number of new customers: the higher number of new customers you have, the more likely they are to submit credit applications.

- On the number of repeat customers: How many repeat customers who had previously obtained a loan from our bank were we able to retain and reissue new loans to them?

What does Lifetime value depend on?

- From the average loan amount - an increase in the average amount of disbursed loans directly increases the portfolio volume, in the case of this metric we also have to take into account the risks and solvency of borrowers.

- From the interest rate on the loan.

- From the term of the loan - how long the customer will pay interest on the loan.

- Default rate - if the number of defaulted loans is very high, this can significantly reduce LTV.

- Customer acquisition cost (CAC) - the cost of customer acquisition.

Diagram 3: Intermediate result of the construction of the metrics hierarchy (level 3).

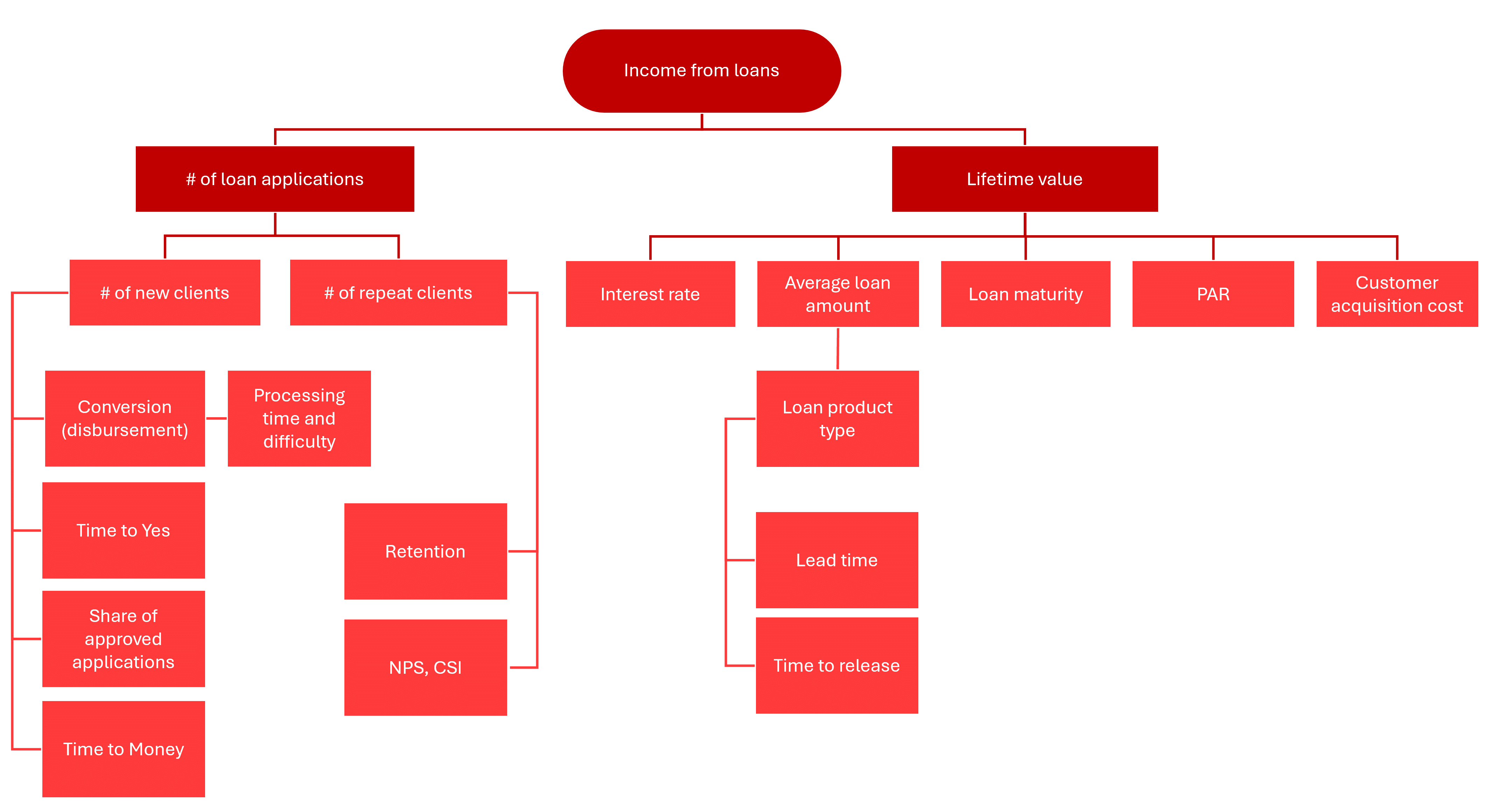

Level 4

Next is level 4:

What does the number of new customers depend on?

- From the number of meetings with a credit expert, the number of calls from the call centre, the number of visits to the website, the number of downloads of the mobile app - depending on the engagement channel.

- From conversion to successful loan application - what percentage of all new customer applications were successfully received by the bank.

- From the time of filling in and the difficulty in completing the loan application (number of fields, length of the session).

- From the percentage of approved loans for new customers - shows how effective the scoring and risk assessment system is.

- Time to Yes - the faster a customer receives a decision, the higher their loyalty and likelihood of approval.

- Time to Money is an important factor in today's world, and customers appreciate promptness.

What does the number of repeat customers depend on?

- From customer retention rate (Retention - retention rate, Churn - churn rate)

- From customer experience - what's the difference between repeat acquisition and primary acquisition

- Net promoter score - coefficient

- Customer satisfaction index

What does the average loan amount and term depend on?

- From the type of product: consumer loans are often lower amounts, mortgages or car loans are larger amounts.

- At this level, you can begin to measure the product development team's performance metrics: Lead time (Time from team commitment to release and customer use of new functionality); Time to release (Time from task readiness to when it hits the production environment)

Diagram 4: Summary of the metrics hierarchy (level 4).

The hierarchy can be decomposed further on, but we will stop at this step and start analysing it:

- Add data for each metric = this will allow you to check if the relationships between metrics are correctly defined and if you have accounted for all metrics.

- Analyse the hierarchy and identify bottlenecks.

- Compose and prioritise hypotheses affecting the growth of weak metrics.

- Update your product backlog with the above in mind.

By carefully monitoring all these metrics, it is possible to get a clear picture of how well the loan product is performing at each stage, identify weaknesses and promptly improve them. After all, the ultimate goal is not just to attract customers, but to build long-term and mutually beneficial relationships with them!

In times during which the financial sector is transitioning to remote and automated processes, the assurance of high-quality client communication channels plays an extremely important role.

This transition requires call centre staff to become remote assistants responsible for supporting clients with a wide range of requests. During the transition period and full-fledged roll-out of new remote services, clients are very likely to encounter an array of issues related to the use of a new app or platform or have questions regarding new services or document requirements. In such cases, the task of financial institutions (FIs) is to help customers adapt to a changing environment.

Thus, ensuring the smooth operation of a call centre is one of the most pressing issues for many FIs. In this context, more and more questions arise: How do you increase the efficiency of a call centre? How do you manage staff turnover in a call centre? How do you ensure high-quality service provided by call centre employees?, etc.

The answers to such questions lie within a few basic elements that need to be considered before launching a call centre and that must be analysed and improved upon through the monitoring of a call centre’s operations on an ongoing basis.

These elements include:

- Defining the goal and objectives of a call centre

- Budgeting and choosing technical solutions (incl. equipment)

- Proper design of processes and service standards

- Staff selection and training as well as creating appropriate conditions for effective work

In this article, we will review the basic aspects that directly affect the operation of a call centre. The topics related to staff management are rather extensive, which is why we will focus on these topics in a future publication.

Defining the objectives of a call centre

First, we should define the reasons for establishing a call centre within your financial institution. It is important to avoid generalised statements such as, “To improve the quality of client service”.

Based on the goal(s) determined, the tasks to be assigned to the call centre are identified. More specifically, the tasks describe exactly what the call centre employees will do on a day-to-day basis.

At this point, we need to differentiate a call centre from a contact centre, as they perform different functions. Contact centres use multiple communication channels (e-mail, social media, chats, etc.); however, they focus almost exclusively on customer support via telephone.

Currently, it is recommended to consider integrating the centres and their functionalities. However, this may require additional investments: first, more complex technical solutions; second, pre-formulated tasks and third, a smooth-running call centre. This article is devoted to the first priority, i.e., setting up an efficient call centre or improving the work thereof.

There are several possible areas of responsibility for call centre employees. Therefore, defining responsibilities is the first step in the process of organising an effective call centre for a financial institution.

Based on the specifics of how the calls received are handled, call centres fall into three categories:

- Centres for inbound calls: These centres receive and process incoming calls and are responsible for providing consultations and resolving client requests. The staff may also provide telemarketing services to existing and potential clients.

- Centres for outbound calls: These centres are engaged in actively calling customers. Their main goal is to establish contact with potential clients for a follow-up meeting or to make direct sales calls. This type of call centre may also collect client feedback, remind clients about upcoming loan payments, etc.

- Blended call centres: These centres carry out a combined function and support and implement the goals of the financial institution.

The table below outlines a list of possible objectives and customer groups for each type of call centre within a financial institution:

|

EXAMPLES OF PROPOSED TASKS FOR THE DIFFERENT TYPES OF CALL CENTRES WITHIN FINANCIAL INSTITUTIONS |

|||

|

Task |

Customer groups outreach |

Examples of possible inquiries / Task description |

|

|

Existing |

New |

||

|

1. INBOUND CALL CENTRES |

|||

|

1.1 Customer service - product inquiries |

+ |

|

Application status, account balance, updating, date of payment, etc. |

|

1.2 Customer service - technical issues |

+ |

|

Access to Internet banking, how to fill out an application form for selling currency, etc. |

|

1.3 Consultations on product terms and conditions |

+ |

+ |

Commissions and interest, document requirements, application process, etc. |

|

1.4 Dealing with applications for new products / renewal of a product |

+ |

+ |

If remote applications are permitted by law |

|

1.5 Dealing with applications for products and services (or requests) |

+ |

+ |

Identifying the needs of a client on the phone and making them the best offer to meet their needs |

|

1.6 Handling complaints and resolving conflict situations |

+ |

|

Resolution of operative claims and documenting the reasons for complaints |

|

2. OUTBOUND CALL CENTRES |

|||

|

WORK WITH POTENTIAL CLIENTS: |

|||

|

2.1 Telemarketing |

+ |

+ |

Increase visibility, spread information about promotions, special offers |

|

2.2 Telephone sales |

+ |

+ |

Consulting databases to screen leads identified and conclude sales over the phone |

|

2.3 Calls to screen potential customers |

|

+ |

Further redirection of suitable clients to an appropriate department |

|

2.4 Calls to screen customers and arrange meetings with potential customers identified |

|

+ |

Can be used for applications received through alternative digital channels or cold calls |

|

MARKET RESEARCH: |

|

|

|

|

2.5 Existing customer surveys |

+ |

|

Determine the level of customer satisfaction with the quality of service, identify possible improvements in current processes and products |

|

2.6 Potential customer surveys |

|

+ |

Learn about customers’ criteria for selecting an FI as well as their priorities, primarily with the aim to assess the FI’s position in the market |

|

2.7 Working with former clients of the FI |

+ |

|

Identifying the reasons for client turnover to 1) try to regain the client, 2) improve weaknesses identified |

|

CURRENT CUSTOMER SUPPORT: |

|

|

|

|

2.8 Supporting existing clients |

+ |

|

Reminding clients of payments and expiry dates of current offers, notifying of any changes in the terms and conditions, etc. |

|

2.9 Maintaining contact with existing clients |

+ |

|

Informing clients of the latest FI news, determining the current situation of clients, identifying potential demand, cross-selling |

|

2.10 Dealing with arrears (collections) |

+ |

|

Typically, at the early stages of default and for small loan amounts |

In the financial sector, a call centre can perform quite a wide variety of tasks. The key to success is to determine in detail what functions the call centre already performs or shall perform at your FI in the future and for which groups of clients. This makes it possible to define clear job requirements, purchase the necessary equipment, etc.

For example, the job requirements of employees performing tasks 1.1 (in the table above) will differ significantly from the requirements of employees performing tasks 2.2 or 2.5. Respectively, these differences shall be considered when recruiting and training call centre employees.

If your organisation does not yet operate a call centre, it is possible to begin with basic operations and expand these over time.

It is advisable to avoid situations in which call centre employees have no clear understanding of which inquiries they are responsible for processing and which inquiries should be redirected to specialists from other departments.

In addition, information about the functions selected for a call centre must be communicated to all employees within your financial institution. This contributes to the smooth handling of client requests and helps avoid misunderstandings.

It is common to redefine the responsibilities of a call centre, as well as its organisation, based on changes to operational or strategic goals within your financial institution. Therefore, when planning a call centre and/or when the tasks of a call centre need to be redefined, it is important to consider the expansion capacity as well as upgrade options and make an estimate of the additional resources required to manage the changes.

Budgeting and technical solutions

By defining the call centre’s range of functional tasks, you will be able to make specific requests to specialised companies which provide technical support to call centres. These companies can also help you estimate the workload and staffing requirements.

It is worth paying close attention to this issue, i.e., compare options available and select the option that best suits the needs of your institution. More advanced technical equipment can greatly facilitate the fulfilment of tasks carried out by call centre employees, ensure smooth operation, and thus create a foundation for providing the best service to customers. On the other hand, budget limitations for equipment vary from institution to institution and may narrow the range of choices.

However, it is important to remember that in addition to investing in complex technical systems and relevant software, it is important to invest in appropriate basic office equipment for your team. This includes essentials such as headsets for call centres, computers, monitors, ergonomic chairs, and keyboards that are in constant use during shifts. Creating a comfortable and ergonomic environment lays the foundation for more efficient output.

Hardware and software should offer the following functionalities:

- Automated call logs

- Collection and storage of customer data in the database, call history analytics

- Call distribution

- Call recording

- Data processing tools and work schemes of individual operators and the entire centre

- Sound notification and visual display of information on incoming and missed calls

- Creating a call queue, call forwarding, activating call waiting mode, and other options for working with calls.

An in-house or outsourced call centre?

In order to optimise expenditures, companies often outsource call centre services; however, this is rather complex when it comes to FIs, as they work heavily with personal data, which is an area that is becoming increasingly more regulated.

In addition, nearly all inquiries made to a call centre are related to an FI’s existing products. To be able to answer these questions, an operator must have access to an FI’s internal systems, which outsourcing companies do not. If a FI uses outsourced call centres, then the business processes must be closely interlinked, and information must be updated.

For this reason, outsourced call centres are most often used to conduct surveys and promotions of new products in the financial sector and only sometimes are they are used for the purpose of debt collection.

To properly equip your in-house call centre, there are a variety of technical solutions currently available in the market. Some offers are quite expensive and include lexico-semantic analysis systems that determine keywords in a client’s request and route the inquiry to the right specialist.

It should be noted that, despite a clear trend towards automation, these types of systems mainly support the processing of routine questions such as “Where is the nearest branch?”. Additional investments in chatbots and IVR (Interactive Voice Response) may reduce the workload of call centre employees by filtering out routine questions and thus make it possible to handle more complex client requests and reduce call waiting times.

Nevertheless, most experts agree that call centre operators should focus on advising clients with regard to complex and urgent issues. Therefore, in addition to automation efforts, FIs should continue to create optimal conditions for operator efficiency, which we will cover in the next section.

Service standards, processes, question-answer base

Without a well-defined set of standards, call centre employees will treat customer requests as they see fit, which may sometimes differ from what the FIs envision. To avoid such situations, it is worth establishing standards: a set of guidelines that call centre operators should follow when interacting with customers.

The standards should be defined in line with the strategy, values, and vision of your financial organisation. There are several options, but in general, call centre service standards include the following:

- Focus on minimum call waiting time

- Focus on finding a good solution to an inquiry without having to forward a call

- Asking the client if they are satisfied with the solution and why

- Be polite, patient, and friendly

- Listen actively, use optimal speech speed, articulate clearly

Efficient call centres are made up of more than just telephones and other equipment ─ they run smoothly because they follow an established process. Having processes in place reduces waiting time and helps resolve issues faster, which improves customer satisfaction.

It is recommended that the processes established for your call centre be designed in manner that they can be carried out by your team on a day-to-day basis. Here are some questions that established processes should address:

- What happens when a phone rings? What do the operators say when they answer a call?

- In what cases should operators resolve requests themselves?

- What happens when an operator is unable to answer a question? Who (or what resource) should they turn to?

- How should agents follow up on customer requests?

- What happens after a call ends?

- How is the productivity of call centre employees measured?

It will certainly take time to develop a comprehensive approach that addresses these questions and to develop a clear process for each case. However, this prior work will save you a great deal of time in the future, ensure smooth operation, and reduce the level of pressure on employees.

It is also recommended to create conversation scripts for your call centre employees. Scripts are pre-written patterns that employees follow when talking to a client.

It should be noted that there are many ongoing discussions regarding scripts. Some experts believe that scripts are not the best solution, as a conversation may not develop naturally; furthermore, they argue that a script relieves operators from responsibility to a certain extent and that they no longer feel the need to be flexible and actually think of a suitable solution.

When it comes to sales to VIP clients, we agree with this opinion. However, in general, especially at the initial stages, scripts are the best solution, as they provide an extremely dynamic way of working as well as cover a variety of tasks. To avoid the impression of a “pre-packaged” approach, it is possible to take a few of the measures described below.

To create efficient scripts, work with your entire team ─ from managers to front office employees ─ to identify relevant responses and phrases specific to your financial institution. Form groups for each area that the call centre will cover and have your employees brainstorm what they would like to say in every possible situation. Another approach would be to “shadow” your most successful employees talking on the phone with clients and write down ideas for the script.

Next, when preparing written scripts, practice reading them aloud. This will help you to avoid artificial, unnatural language, which your customers will immediately recognise. Also, make sure that the scripts are flexible and offer a variety of response options. Develop a tree of possible responses and, accordingly, the best response for an operator in every case.

Finally, no matter how well developed your call centre scripts are, they cannot fully predict what customers may say or ask in all cases.

Encourage your team to deviate from the script as needed and to make sure they know as much as possible about your products and services and know where to find an answer quickly if a question or a issue cannot be solved using the scripts.

If call centre employees are unable to answer a question (or the client wants to speak to a higher-level person), establish a process for escalating a customer request. Make sure this process is communicated to your entire team and conduct a few test calls to address any roadblocks or service gaps.

Also, make sure your team is aware of other customer self-service options in your company, such as your website, FAQs, videos, and forums, and ask your employees to share these options with customers as needed.

Creating a base of questions and answers

Creating a knowledge base for call centre employees in financial institutions is often difficult, due to the wide range of issues faced by clients and the nuances of each department.

Customer questions can be related to a wide range of topics: terms and conditions of bank cards, questions on how to fill out certain applications, the methods of calculating interest, the reasons for payments not going through, etc.

Indeed, you can hardly expect that call centre employees can competently provide advice on absolutely every topic in the organisation or resolve all requests without preparation.

Without proper preparation, due to the wide variety of incoming questions, call centre employees will likely forward most incoming calls to front office employees, who in turn may have less time to provide high-quality telephone consultations.

To maximise the autonomous work of call centre operators, it is important to carry out several steps at the preparation stage:

- Have a clear understanding of which issues can be addressed by your own call centre and which issues can be forwarded to other departments

- Do not try to cover all possible inquiries, but first focus on one specific area and then gradually add new areas as more experience and knowledge are gained

- Allocate sufficient time to train team leaders and senior call centre specialists in selected departments, consider the possibility of short-term rotation of front office specialists/representatives of relevant departments in the call centre to support and train employees

- Compile a database of practical answers to the most frequent questions from each department ─ as comprehensive as possible without references to lengthy instructions and technical documentation

- If possible, distribute functions within the call centre; in any case, it is important to set up a clear screening algorithm to redirect queries to the right specialist within the call centre or to quickly contact the right specialist from another department (if a client’s question is not covered by the call centre functions)

- Make a clear list of contact persons regarding specific topics within the FIs and alternative contact persons if the primary contact is not available

- Make a convenient catalogue of the existing knowledge base

- Ensure timely communication of any changes and news from all FI departments

- Provide alternative ways for customers to find answers themselves ─ create a high-quality, convenient system to collect and publish frequently asked questions (FAQs) on the online resources of the FI

Finally, implement a process for recording calls and inquiries from customers by your team for the purpose of regular analysis and the correction of mistakes. Regardless of the type of control mechanism you are using, manual or digital, make sure your team’s call tracking process is coordinated and consistent. Coordination is key when analysing performance, its impact on the business, and aspects that can be improved upon within your call centre.

By properly considering and preparing of the abovementioned elements, you will lay a solid foundation for increasing effectiveness of the call centre within your organisation. Finally, you should regularly review the strategy, objectives, and customer feedback, and take actions for further improvement.

Climate risk is financial risk

The changing climate represents a rapidly growing risk and opportunity for financial institutions globally. To be prepared, financial institutions must start planning a response to climate change today to mitigate future adverse scenarios and to avoid being left behind.

Impacts related to a changing climate and climate action failure were described as the greatest long-term global risks by the World Economic Forum in 2020.[1] While leaders from 184 nations pledged in 2015 through the Paris Agreement to take nationally determined actions to keep the rise of the global temperature “well below” an increase of 2°C above pre-industrial levels[2], and G20 leaders pledged in October 2021 to limit increases to 1.5°C, global temperatures have continued to rise. The Nationally Defined Contributions (NDCs) currently committed to by countries are insufficient to achieve the Paris Agreement goals, even with recent progress at the 2021 United Nations Climate Change Conference (COP26). The Intergovernmental Panel on Climate Change (IPCC) calculates that emissions must be halved by 2030 to achieve carbon neutrality by 2050, which has further increased recognition of the need for an international economic transformation to mitigate and adapt to climate change.

With the amount of funding required to drive that economic transformation and meet the goals of the Paris Agreement far exceeding the scope of traditional development finance (and with public financing only able to provide a portion of the requisite capital), the involvement —and transformation — of the global financial sector will be essential.

With the amount of funding required to drive that economic transformation and meet the goals of the Paris Agreement far exceeding the scope of traditional development finance (and with public financing only able to provide a portion of the requisite capital), the involvement —and transformation — of the global financial sector will be essential.

While finance designated for green purposes has exponentially grown in recent years, it is clear that simply scaling up green finance volumes will be insufficient in and of itself to address the changing climate, and systemic change in the financial sector will be required. Financial institutions will need to not only mobilise and deliver significant increases in climate-related finance, but also to fully integrate climate risks and opportunities into their institution strategies and operations. The topic of climate must move to being a key aspect of a financial institution’s governance, strategy, business operations, risk management, and reporting/evaluation.

Fortunately, there is growing recognition globally at both regulators and leading financial institutions that climate risk is financial risk, while climate change mitigation and adaptation investments also represent a significant economic opportunity, potentially leading to innovation, technological development, and overall growth.[3] However, although regulators, funders, customers, are increasingly prompting financial institutions to take action to embed climate considerations into their strategies and structures, a recent climate pulse survey by EBRD completed by 134 financial institutions found that many institutions are constrained by a lack of awareness, skills, internal capacities, standard approaches, and available tools.[4] As a result, many financial institutions struggle to identify the most fitting and effective means to become more resilient to climate change and respond to the changing climate.

What is climate risk?

While most organisations, including financial institutions, recognise that impacts of climate change will have damaging economic and social (as well as environmental) consequences, the unique nature of climate change makes it challenging to accurately quantify or precisely assess impacts, in part due to an inability to rely on historical (time series) data. As a result, “many organisations incorrectly perceive the implications of climate change to be long term and, therefore, not necessarily relevant to decisions made today.”[5]

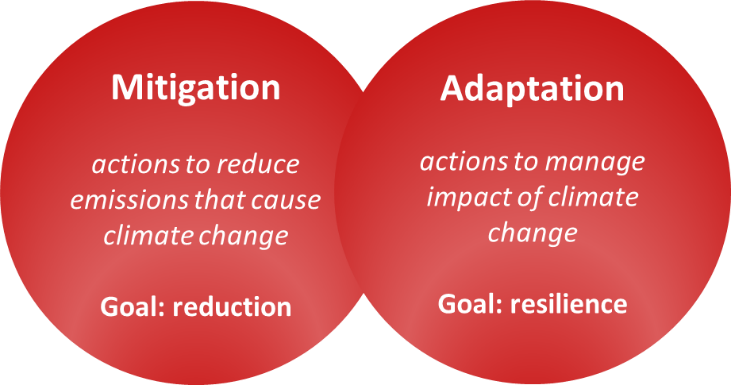

Climate risks are typically categorised into two major categories: physical and transition.

Physical risks arise from the physical impacts of climate change and can be: a) event-driven (acute) such as extreme events (hurricanes, floods), or b) related to longer-term shifts (chronic) in weather patterns (sustained temperature rises, rising sea levels).

Transition risks, on the other hand, are those risks related to the transition to a lower-carbon economy and may include policy and legal risks, technology risks, market risks, and reputational risks for financial institutions.

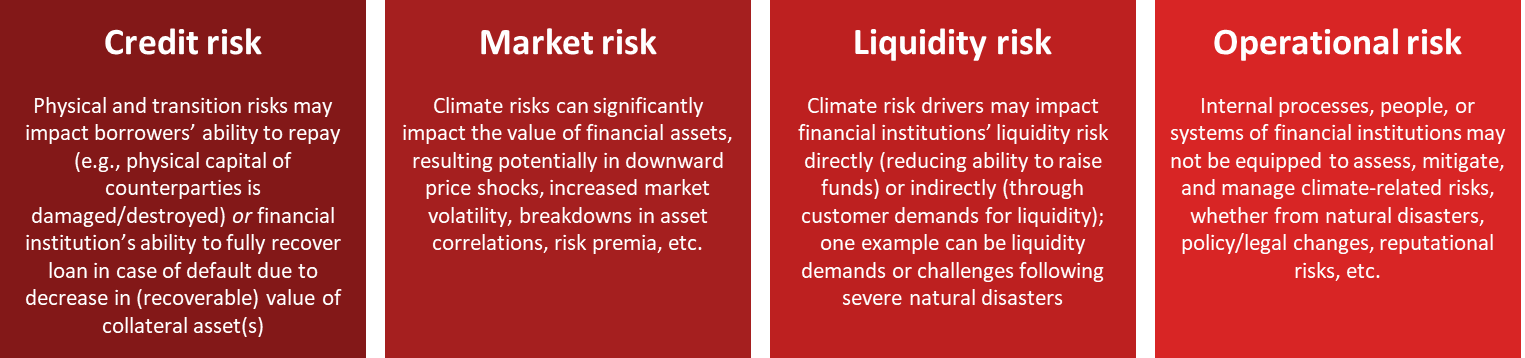

As highlighted by the Basel Committee on Banking Supervision (BCBS), climate risk — whether physical or transition — is not a “separate risk” but in fact manifests itself in the other risks with which financial institutions are very familiar: credit risk, market risk, liquidity risk, and operational risk. BCBS identifies numerous macro- and micro-economic transmission channels, or causal chains, explaining how climate risk drivers give rise to financial risks that impact financial institutions directly or indirectly through counterparties, assets, or economies.[6]

Figure 1: Core financial risks affected by climate-related risks

Source: IPC, adapted from Basel Committee on Banking Supervision 2021, Climate-related risk drivers and their transmission channels.

TCFD: what is it and what does it mean for FIs?

Recognising the lack of decision-useful, climate-related information available in financial markets, the Financial Stability Board (FSB) of the G20 established the industry-led Task Force on Climate-related Financial Disclosures (TCFD) in 2015 to design a set of voluntary and standardised recommendations for disclosure to aid financial market participants in understanding climate-related risks.

The TCFD issued its Recommendations of the Task Force on Climate-related Financial Disclosures document in 2017, and the framework and approach described within the document for describing and disclosing on climate risk has become the gold standard globally. The TCFD has additionally provided general and sector-specific practical guidance on implementing climate-related disclosure requirements, through a guidance document entitled Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, which was most recently updated in 2021.

While the TCFD Recommendations remain voluntary, regulators and investors globally are increasingly incorporating elements of the TCFD Recommendations into their regulations, policies, and due diligence/assessment processes. As a result, it is critical that financial institutions increase their awareness of the Recommendations, regardless of the current status of incorporation into their national regulatory frameworks.

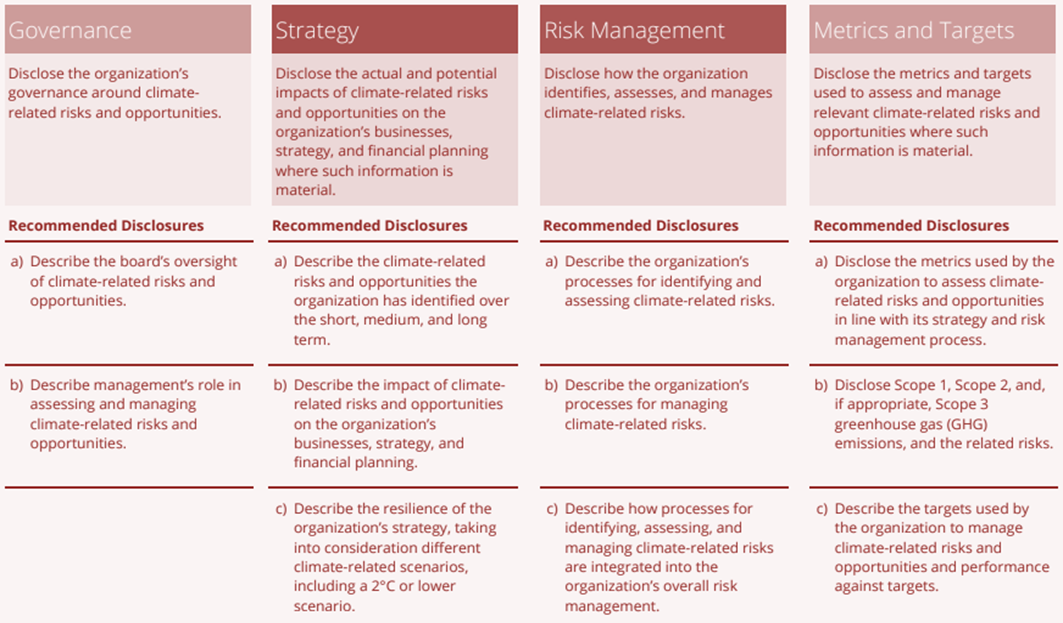

The TCFD structured its disclosure-related recommendations around four thematic areas related to the operations of each organisation:

- Governance – the organisation’s governance around climate-related risks and opportunities

- Strategy – the actual and potential impacts of climate-related risks and opportunities on the organisation’s business, strategy, and financial planning

- Risk Management – the processes used by the organisation to identify, assess, and manage climate-related risks

- Metrics and Targets – the metrics and targets used to assess and manage relevant climate-related risks and opportunities

Under each of the above thematic areas, TCFD provides recommended disclosures for an organisation, as may be seen in Figure 2, taken from the TCFD Recommendations document.

In addition, TCFD has provided additional supplemental guidance for specific financial sector groups, including banks, insurance companies, asset owners, and asset managers.

TCFD also provides high-level guidance to organisations on how to engage in scenario analysis, identifying and assessing the potential implications of a range of plausible future states under the conditions of uncertainty provided by a changing climate — all with the goal of identifying potential exposures to climate-related risks.

Figure 2: TCFD Recommendations and Supporting Recommended Disclosures

Source: TCFD 2021, Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, pp. 15.

A changing climate also provides opportunities – for those ahead of the curve

A changing climate also provides new opportunities for forward-looking and early-moving financial institutions. In exploring internal operations, as well as potential markets for financing, financial institutions can explore a variety of opportunities related to resource efficiency (e.g., energy efficiency, water efficiency, material efficiency etc.); energy generation (e.g., renewable energy); low-emission products or goods; new markets; resilience development; etc.

Financial institutions not exploring such opportunities run the risk of missing out on first-mover advantages, and financial institutions not developing capacities around climate risk management run the risk of being stuck with riskier (or more opaque) portfolios — along with higher costs in the future to adapt to regulatory changes.

[1] https://www.weforum.org/agenda/2020/01/top-global-risks-report-climate-change-cyberattacks-economic-political/

[2] Ideally below 1.5 C

[3] The recent establishment of the Glasgow Financial Alliance for Net Zero (GFANZ) at COP26 further underscores the increasing focus on climate matters at FIs.

[4] EBRD 2021. Readiness of the Financial Sector for the Impacts of Climate Change.

[5] TCFD 2017. Recommendations of the Task Force on Climate-related Financial Disclosures. pp. ii.

[6] Basel Committee on Banking Supervision 2021. Climate-related risk drivers and their transmission channels.