- Details

This document describes state, regulative framework and recent developments in leveraging access to finance for micro, small, and medium-sized enterprises (MSMEs) in the Kyrgyz Republic through global value chain examples. Access to finance in the Kyrgyz Republic is growing and demonstrates improvement of financial inclusion of companies in the SME sector as well as of individual entrepreneurs and peasant farmers.

- Details

Women help economic growth, and growth in turn helps women, the world is now discovering. One of the issues of the IMF’s Finance & Development magazine, explores why empowering women is not just the right thing to do, it also makes economic sense.

- Details

The EBRD’s most recent annual Transition Report documents trends in governance, showing that good governance is important for economic growth, quality of life and the natural environment. It also looks at green governance and how to improve the green credentials of firms. The key message of this year’s report is that improvements in governance can create a significant payoff in terms of growth.

Read more … EBRD Transition Report 2019-20 - Better Governance, Better Economies

- Details

The EBRD published its review of economic development in 2019 and growth forecasts for 2020 in regions of its operations. According to EBRD, the Central Asian region as a whole is forecasted to expand on average by 4.9 per cent in 2019 and 4.7 per cent in 2020. The document provides brief individual economic overviews, information on growth constraints and drivers for each country.

Read more … Economic Prospects and Growth Forecasts for the EBRD Regions

- Details

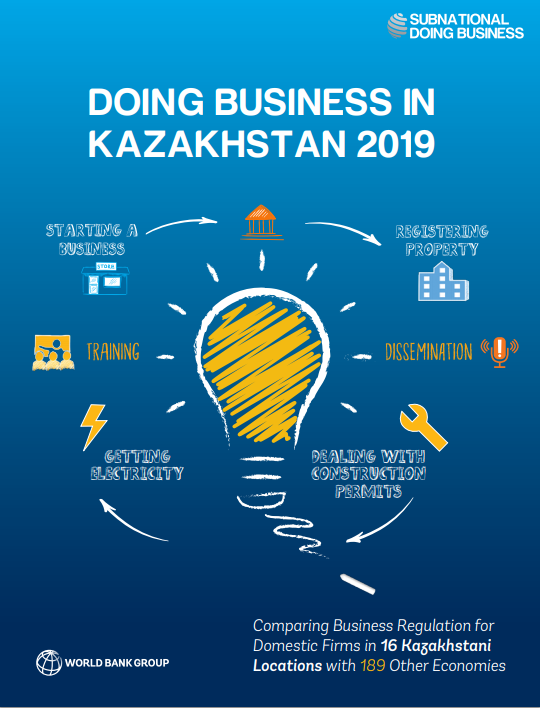

Doing Business in Kazakhstan 2019 is the second subnational Doing Business study for Kazakhstan. The study measures business regulations affecting four stages in the life of a small to mid-size domestic firm—starting a business, dealing with construction permits, getting electricity and registering property—across 16 locations in Kazakhstan:

- Details

A short history on how and why European Bank for Reconstruction and Development was setup back in 1989 at the times of the fall of the Berlin Wall.

The article can be accessed on the EBRD website via the following link.

Source: EBRD

- Details

Increasing annual investments in small- and medium-sized enterprises (SMEs) in developing countries by US$1 trillion would yield disproportionate dividends in terms of progress towards the Sustainable Development Goals (SDGs), while also delivering healthy returns for investors. Yet, less than 1% of the tens of trillions of US dollars that global asset managers have under management is currently invested in developing country SMEs.

- Details

This paper documents CGAP’s work with 18 fintech pilots in Africa and South Asia. The goal of this paper is to explain innovations in a detailed way and generate insight on whether the services (i) work as stated, (ii) create value for underserved customers, and (iii) ease age-old pain points in delivering financial services to underserved customers.

The publication is available in English via the following link.

- Details

This publication was prepared under the Asia-Pacific SDG Partnership of the United Nations (ESCAP), the Asian Development Bank (ADB) and the United Nations Development Programme (UNDP).

- Details

EBRD published a new episode of its Pocket Dilemmas podcast on “Age against the machine and the future of work”. Podcast guests: Jason Furman from Harvard Kennedy School and EBRD Chief Economist Sergei Guriev.

The podcast can be accessed in English via the following link.

Image: EBRD. Pocket Dilemmas

- Details

Google ‘value chain finance' and you will find a cornucopia of articles, case studies, and trainings. Much of the material is funded by and targeted to international development agencies with a supply-side perspective. The development-driven approach aims to set up and push goods through the value chain. The practice has merit and it contributes to economic development. Go read those materials for more of that perspective. This article focusses on value chain finance (VCF) from the financial institution (FI), demand-side, angle.

Read more … "Follow the Money" - a Blog on Value Chain Finance

- Details

The published report assesses the progress in the Kyrgyz Republic towards a well-functioning, sustainable market economy, and the challenges ahead. It provides a basis for the design of the EBRD Country Strategy for the Kyrgyz Republic and for the structure and prioritisation of ongoing and future investment activities and policy advice/advocacy in the country.

The document is available for download in English via the following link.

Image: EBRD

- ADB Working Paper on MSME Finance in Uzbekistan

- The EBRD Podcast "How to make economies more resilient"

- The IMF Published Fiscal Transparency Evaluation Report for Uzbekistan

- The European Bank for Reconstruction and Development Released "Kazakhstan Diagnostic Paper: Assessing Progress and Challenges in Developing Sustainable Market Economy"