- Details

This paper aims to deepen current understanding of the state of play of green bonds that are financing climate resilience-related assets, projects, and activities (hereafter referred to as Green Bonds for Climate Resilience). The report contains an overview of the global state of play of green bonds with resilience-related use of proceeds, including highlights from select regions. The barriers for issuing resilience-related green bonds in four case study countries are identified and recommendations on how to address them are proposed. An analytical tool, the Green Bonds for Climate Resilience Capacity Assessment Framework, has been developed to inform this analysis and can in turn be used by public and corporate issuers to assess their internal capacity and external enablers to issue Green Bonds for Climate Resilience. Based on the analysis and findings, a roadmap to scale-up this promising tool is presented.

Read more … Green Bonds for Climate Resilience – State of Play and Roadmap to Scale

- Details

"Mitigation efforts require measures to address the underlying problem by slowing or stopping the rise in fossil fuel emissions, which could irreversibly and catastrophically raise the Earth’s temperature. Adaptation is needed to help people and governments withstand and minimize the ravages of climate change that are already here."

- Details

"While small- and medium-sized enterprises (SMEs) account for the vast majority of all formal jobs in developing countries, they often struggle to obtain the financing they need to grow. Indeed, access to finance remains one of the top five obstacles SMEs face in the regions where the European Bank for Reconstruction and Development (EBRD) invests. This raises the question of whether improving SME access to finance can help create additional employment. This Impact Brief draws on data from the recent EBRD, European Investment Bank and World Bank Group (EBRD-EIB-WBG) Enterprise Surveys and from clients of the EBRD’s Advice for Small Businesses (ASB) programme to estimate the impact of access to finance, and related advisory services, on employment.

Read more … Small business and job creation: Evidence from the EBRD regions

- Details

"The Agricultural Outlook 2021-2030 is a collaborative effort of the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization (FAO) of the United Nations. It brings together the commodity, policy and country expertise of both organisations as well as input from collaborating member countries to provide an annual assessment of the prospects for the coming decade of national, regional and global agricultural commodity markets.

- Details

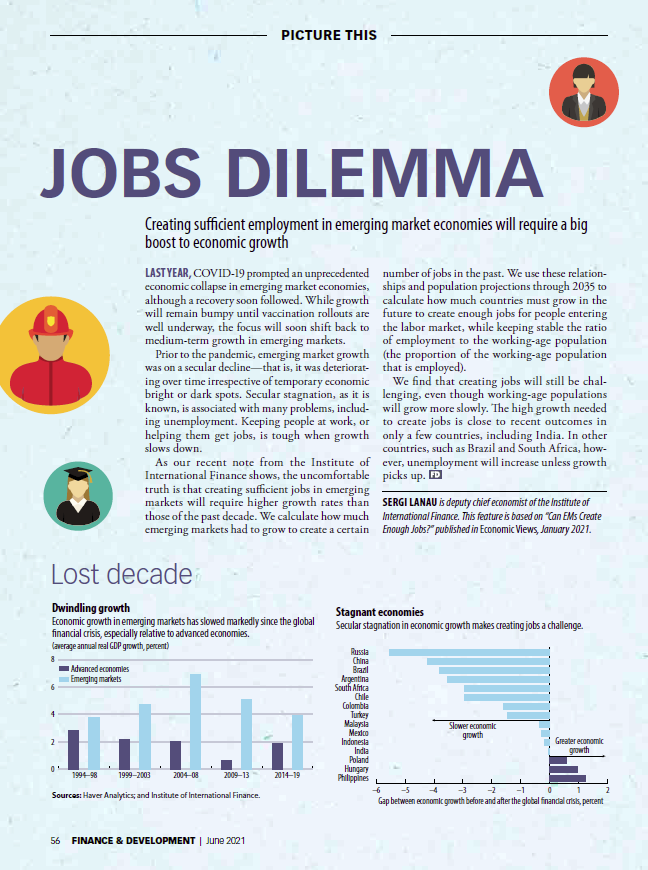

The new article in the IMF's Finance&Development magazine discusses the topic of employment and key preconditions to continue creation of jobs. according to the authors, "creating sufficient jobs in emerging markets will require higher growth rates than those of the past decade". The article contains few graphs that demonstrate the state of employment and jobs in various economies across the world.

- Details

This report presents findings from a survey on green finance conducted among 1 000 households in the Kyrgyz Republic (Kyrgyzstan) in 2019. Although green finance is an emerging trend, knowledge about the appetite for green financial products and services in Kyrgyzstan is almost inexistent. The OECD prepared the household survey to close this gap in evidence. The research identified needs and demand from existing and potential clients of Kyrgyz financial institutions for financial instruments, including those that promote sustainable development.

Read more … Accessing and Using Green Finance in the Kyrgyz Republic

- Details

Artificial intelligence technologies are permeating financial services sectors around the world. The application of these technologies in emerging markets allows financial service providers to further automate their business processes and to leverage new and big data sources to overcome obstacles, including the high cost of serving rural and low-income customers and establishing customer identity and creditworthiness,

Read more … Artificial Intelligence Innovation in Financial Services

- Details

"From Sub-Saharan Africa to the Indian Subcontinent, asset finance and leasing companies are doing invaluable, innovative work to finance critical assets for low-income and informal borrowers. But unlike banks and microfinance institutions, many of these companies do not have deep experience in organizing a credit operation, mitigating risk throughout a credit transaction or managing a portfolio of loans or leases. This has important implications for the ability of asset finance companies (AFCs) to achieve financial sustainability: poor credit risk management will prevent them from turning receivables into cash, inhibiting their potential scale."

Read more … Getting Repaid in Asset Finance: A Guide to Managing Credit Risk

- Details

"Economic prospects have diverged further across countries since the April 2021 World Economic Outlook (WEO) forecast. Vaccine access has emerged as the principal fault line along which the global recovery splits into two blocs: those that can look forward to further normalization of activity later this year (almost all advanced economies) and those that will still face resurgent infections and rising COVID death tolls. The recovery, however, is not assured even in countries where infections are currently very low so long as the virus circulates elsewhere.

- Details

In this EBRD working paper authors discuss "the relationship between quarterly estimates of economic activity and people's mobility during the Covid-19 crisis in a sample of 53 economies."

"Social distancing aimed at containing the spread of the Covid-19 has constrained both demand and supply across economies resulting in the greatest disruption to global economic activity since the Second World War. The drop in people’s movements relative to the normal state of the economy has been a good predictor of economic activity since the early months of the crisis.

Read more … Mobility and economic activity around the world during the Covid-19 crisis

- Details

The EBRD Annual Review 2020 "describes the impact of the EBRD’s investments, projects and policy work amid the Covid-19 crisis, and outlines our achievements in key sectors and initiatives." Investments made by the EBRD in 2020 totaled "a record €11 billion through 411 projects, responding to the effects of the pandemic and preparing for recovery."

- Details

This joint ADB and World Bank publication analyses climate change risks in the Kyrgyz Republic and intends to guide policy dialogue to mitigate climate change risks in the country.

Among key messages, the publication puts emphasis on significant air temperature rise, which is projected to be above the global average and changes in both maximum and minimum extremes. Another significant area of risk concern is water resources. Potential loss of glaciers may result in the irregularity of water flow, potential floods and droughts.