- Details

"Years after the global financial crisis of 2008-09 balance sheets of banks in many advanced economies and emerging markets remained clogged by non-performing loans (NPLs) – broadly understood as loans that are at least 90 days in arrears. This has brought the issue of NPL resolution to the forefront of policy debate, with countries from Italy to India putting forward packages aiming to reduce the ratios of NPLs to total loans (NPL ratios). Such packages may include establishment of Asset Management Companies specialising in dealing with non-performing assets, provision of public sector funds for bank recapitalisation with the view to facilitate management and write-off of NPLs, changes to loans classification and provisioning rules or amendments to the tax treatment of NPLs."

Read more … Cross-border spillovers from reducing non-performing loans

- Details

The Working Group II contribution to the IPCC Sixth Assessment Report assesses the impacts of climate change, looking at ecosystems, biodiversity, and human communities at global and regional levels. It also reviews vulnerabilities and the capacities and limits of the natural world and human societies to adapt to climate change.

Read more … Climate Change 2022: Impacts, Adaptation and Vulnerability

- Details

Public goods are those that are available to all (“nonexcludable”) and that can be enjoyed over and over again by anyone without diminishing the benefits they deliver to others (“nonrival”). The scope of public goods can be local, national, or global. Public fireworks are a local public good, as anyone within eyeshot can enjoy the show. National defense is a national public good, as its benefits are enjoyed by citizens of the state.

- Details

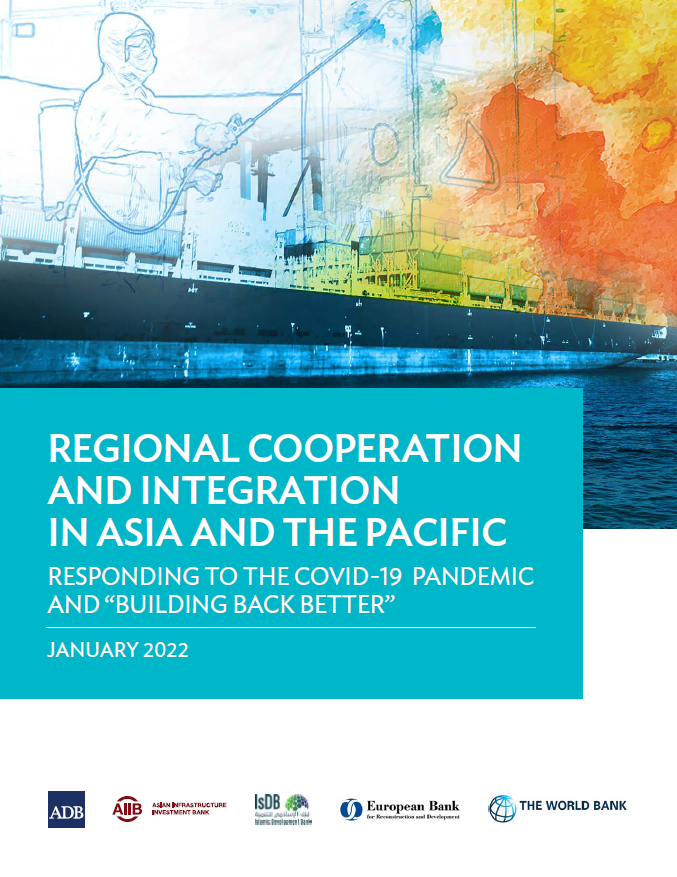

This report explores how regional cooperation and integration (RCI) can be enhanced in Asia and the Pacific to help the region build back resiliently and sustainably from the coronavirus disease (COVID-19) pandemic.

- Details

This EBRD Assessment Report provides a comprehensive cross-jurisdictional analysis of business reorganisation tools and stakeholders' perceptions on business reorganisation in 38 emerging economies that are part of the EBRD regions, while exploring recent insolvency trends and practices in more advanced markets such as France, Germany, England and Wales, and the United States.

Read more … EBRD Insolvency Assessment on Reorganisation Procedures

- Details

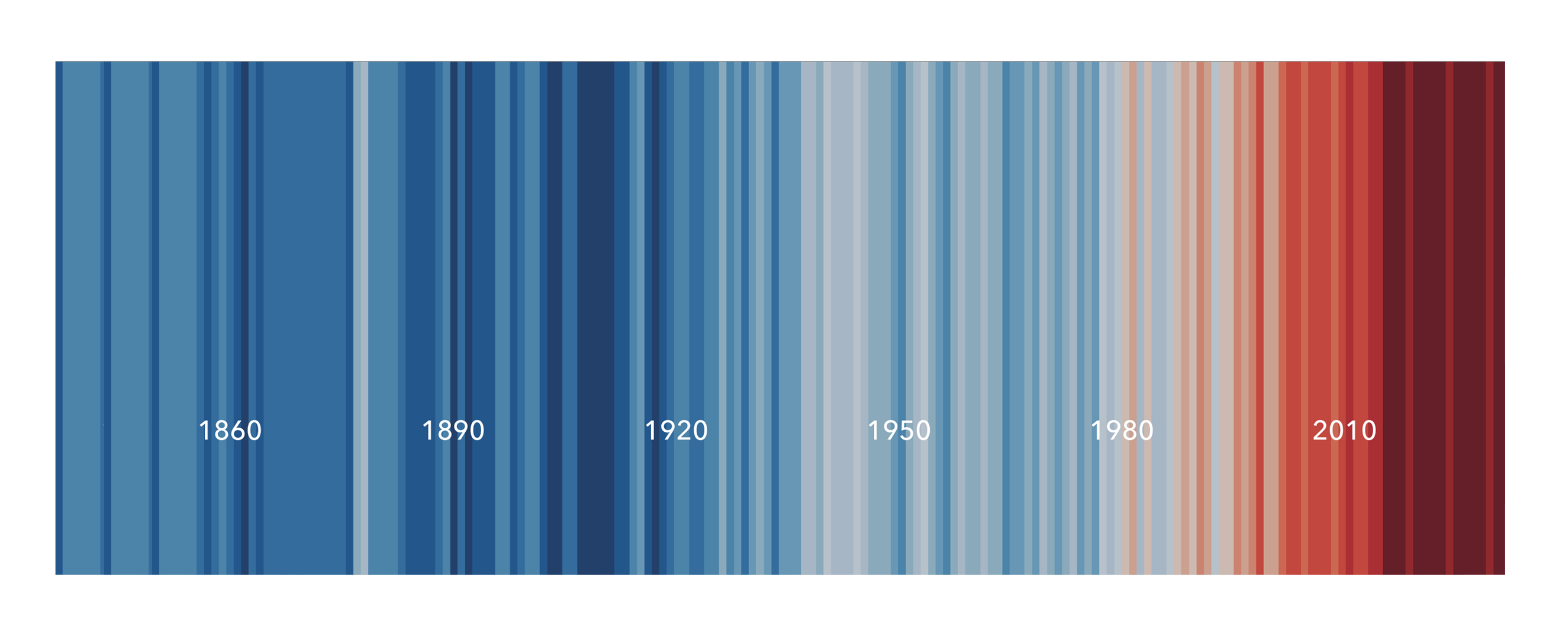

Following a raft of net zero target announcements in 2020 and 2021, scrutiny is mounting about the plans to get there. Some countries have detailed outlines of how they will reduce their emissions to net zero, but many still do not. Thanks to countries with detailed plans we have an idea of the task at hand to decarbonize at the country level, but it is hard to imagine what it will take on a global basis. This is especially true given that the current global pledges won’t get us to net zero in time to limit the temperature rise to 1.5°C.

- Details

"This reading deck describes three regulatory approaches used by policy-makers to regulate digital banks. It has a focus on harnessing the potential of digital banks to bring welcome competition and innovation to the banking sector and advance financial inclusion. It will help policy makers, especially in emerging markets and developing economies, to learn from other countries’ experiences as they decide how to regulate digital banks within their own countries."

Read more … Digital Banks: How Can They Be Regulated to Deepen Financial Inclusion?

- Details

This paper introduces a new index of financial inclusion for 153 advanced, emerging, and developing economies using a comprehensive set of new indicators, grouped into four different dimensions: financial access, usage, financial development, and fintech infrastructure. The fintech infrastructure dimension in particular captures electronic and digital payments and their enabling infrastructure.

Read more … Understanding Financial Inclusion: What Matters and How It Matters

- Details

"We are facing a global climate emergency that demands immediate action and long-term solutions, with financial institutions uniquely positioned to help support a net zero carbon future and a more sustainable world.

The urgency has never been greater: polar ice is melting and sea levels are rising, as are global temperatures. The National Aeronautics and Space Administration reports that last year tied with 2016 as the warmest on record since recordkeeping began in 1880, and that 19 of the warmest years have occurred since 2000."

- Details

This publication provides updated economic growth forecasts for developing Asia. It downgrades forecasts by 0.1% to 7.0% for 2021 and 5.3% for 2022.

The main risk to the outlook remains a resurgence in cases of coronavirus disease (COVID-19), especially given the emergence of a fast-spreading variant. Other risks include a protracted correction in the housing market that could induce an unexpectedly sharp slowdown in the People's Republic of China, rising inflation, and persistent global supply disruption.

Read more … Asian Development Outlook (ADO) 2021 Supplement: Recovery Continues

- Details

"The volume highlights the need for decisive and comprehensive policy action to help manage NPLs swiftly. It explores the legal and economic conditions conducive to NPL resolution, the role of asset management companies, the potential of technological solutions, and the importance of regional financial cooperation. It provides insights to help policy makers chart a course through the financial and economic fallout of the coronavirus disease (COVID-19) pandemic to recovery and sustained financial stability in Asia, Europe, and beyond. The publication is a collaborative project of the Asian Development Bank and the European Central Bank."

Read more … Nonperforming Loans in Asia and Europe—Causes, Impacts, and Resolution Strategies