- Details

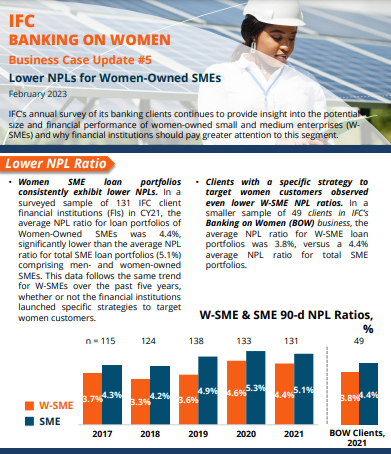

"IFC’s annual survey of its banking clients continues to provide insight into the potential size and financial performance of women-owned small and medium enterprises (WSMEs) and why financial institutions should pay greater attention to this segment". Survey results show that women SME loan portfolios consistently exhibit lower NPLs, average loan sizes to Women-SMEs were smaller than average loan sizes to total SMEs, and average size of deposits from W-SMEs was comparable to the average size of total SME deposits.

- Details

"The paper estimates how the time needed to export goods, the monetary cost of doing so, and uncertain time frames impact exports from Kazakhstan, the Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan. It finds that the uncertainty and the high monetary costs traders face hold back exports from the five countries, along with remoteness from ports and global markets."

- Details

"Social norms – the informal rules that influence how people behave and expect others to behave – can play a significant role in driving financial decisions, including how, where, and what people save for. The effect that social norms have on the financial inclusion of specific target populations is an emerging field of research whose importance is becoming increasingly recognized, but which has not been systematically analyzed or incorporated into financial inclusion programming. This study aims to address this knowledge gap, by providing deep, actionable insights into savings and financial planning behaviors."

- Details

"CGAP has set to demonstrate how business intelligence can be improved through interventions requiring minimum or no investment in technology through a set of pilots. This Technical Note presents an overview of the approach and initial observations on what it reveals for MFIs implementing new digital products and channels. It explains the importance of business intelligence focused on customer behavior, which customer behavior is relevant to measure, and how to build a business intelligence practice that supports this competency."

Read more … A Bedrock of Successful Digitization in Microfinance

- Details

"This paper presents the findings of a comprehensive literature review to identify evidence on what works to support women entrepreneurs in developing countries. It covers both the evidence of constraints women entrepreneurs are facing and evidence of intervention effectiveness in We-Fi’s four focus areas: access to finance, access to skills and networks, access to markets, and an enabling environment."

Read more … Supporting women entrepreneurs in developing countries: what works?

- Details

"An increasing number of National Financial Inclusion Strategies are now highlighting the need to promote women’s financial inclusion. However, this new analysis from WBL and CGAP finds that they could do more to promote access to credit for women entrepreneurs, and to enhance the national-level collection and analysis of sex-disaggregated financial data."

- Details

"This working paper analyzes the impact of infrastructure and trade facilitation on imports and exports in five Central Asian countries and outlines how improving hard and soft infrastructure would help boost regional trade and integration."

Read more … Trade Facilitation, Infrastructure, and International Trade in Central Asian Countries

- Details

"Global growth is projected to fall from an estimated 3.4 percent in 2022 to 2.9 percent in 2023, then rise to 3.1 percent in 2024. The forecast for 2023 is 0.2 percentage point higher than predicted in the October 2022 World Economic Outlook (WEO) but below the historical (2000–19) average of 3.8 percent. The rise in central bank rates to fight inflation and Russia’s war in Ukraine continue to weigh on economic activity."

Read more … IMF's World Economic Outlook Update, January 2023

- Details

"Analyzing topics including global value chains, investment, the movement of people, and regional cooperation initiatives, it outlines the economic and environmental challenges the region currently faces. It explores how trade and investment policies can support climate action and highlights why a joined-up approach is essential to help deepen the digital economy, strengthen supply chains and foster greener businesses, markets, and trade."

- Details

"This paper documents a substantial change in regional trade patterns precipitated by the war on Ukraine and the subsequent introduction of trade sanctions on Russia. It provides evidence suggestive of intermediated trade via neighbouring economies being used to circumvent the sanctions."

Read more … The Eurasian roundabout: Trade flows into Russia through the Caucasus and Central Asia

- Details

"Global growth is projected to decelerate sharply, reflecting synchronous policy tightening aimed at containing very high inflation, worsening financial conditions, and continued disruptions from Russia’s invasion of Ukraine. Investment growth in emerging market and developing economies (EMDEs) is expected to remain below its average rate of the past two decades. Further adverse shocks could push the global economy into recession."

Read more … World Bank’s Global Economic Prospects, January 2023

- Details

In this DAMU podcast, Mr Yerkin Uderbay hosts Mr Jenisbek Dosymkhanov, President of Toyota Financial Services Kazakhstan (MFI) to talk about the main focus of microfinance institutions in Kazakhstan and the impact of the pandemic on the financial services market.

Read more … DAMU Podcast: Microfinance institutions in Kazakhstan

- Fintech and SME Finance: Expanding Responsible Access

- Will Central Bank Digital Currencies be a Game-Changer for Financial Inclusion?

- Strengthening Food Safety Systems in the Central Asia Regional Economic Cooperation Member Countries: Current Status, Framework, and Forward Strategies

- Public–Private Partnership Monitor: Kazakhstan