- Details

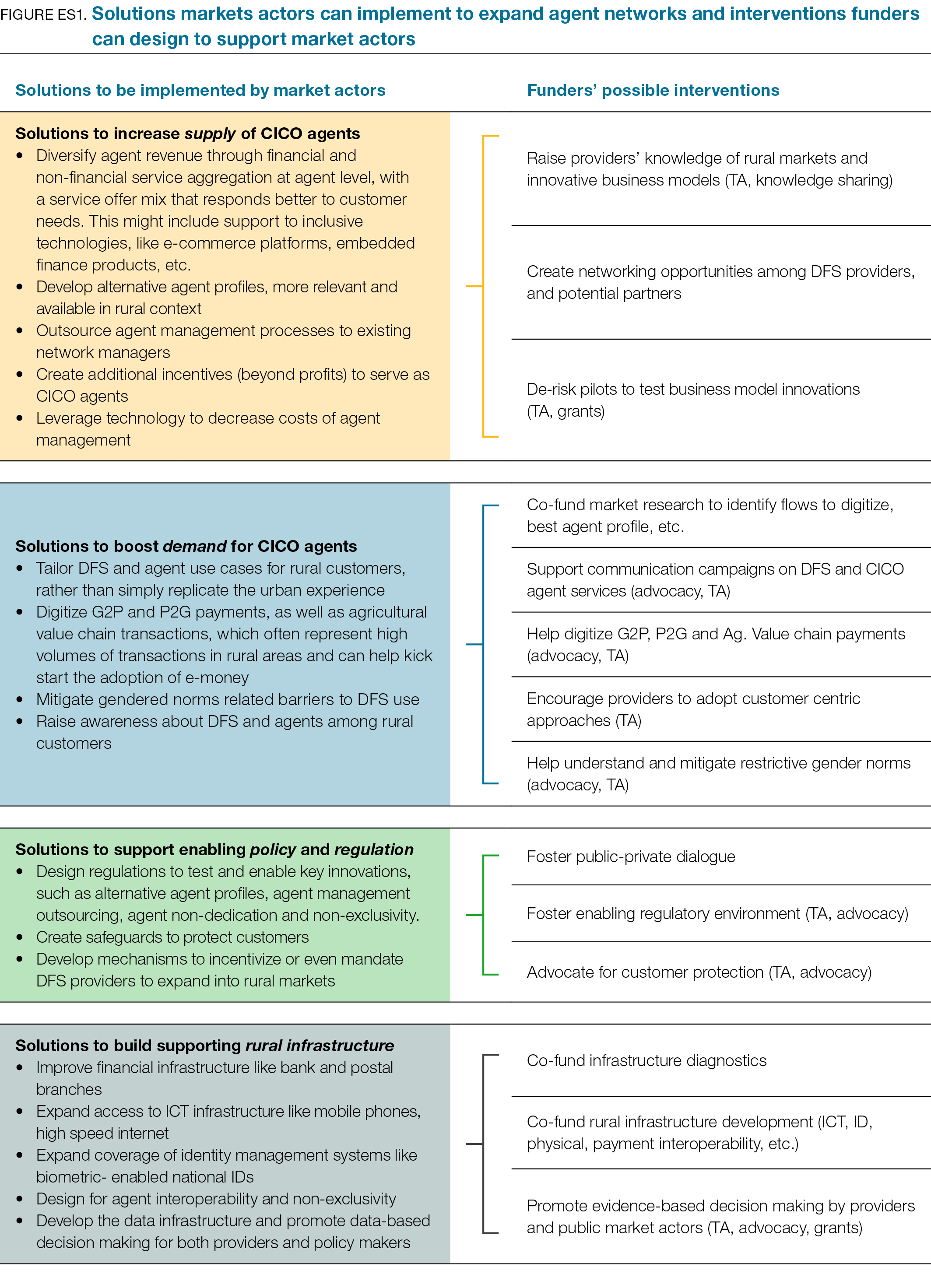

"Rural development is central to realizing the 2030 Sustainable Development Goals (SDGs) agenda because nearly 80 percent of the world’s poor live in rural areas (UNDESA 2021). Moreover, rural populations have less access to education, health, electricity, sanitation, and other services, leading to marked rural-urban disparities, discontent, and discord.

It is widely accepted that financial services for the poor and excluded is a key enabler in advancing several SDGs. However, increasing access to, and usage of, financial services in rural areas is not easy. These areas tend to be poor, remote, sparsely populated, and poorly connected by weak infrastructure. This makes rural markets more expensive to serve for financial service providers and less attractive compared to urban markets. Digital financial services (DFS) can help lower costs for providers, which is essential for reaching poor customers at scale."

Read more … Developing Rural Agent Networks: Emerging Guidance for Funders

- Details

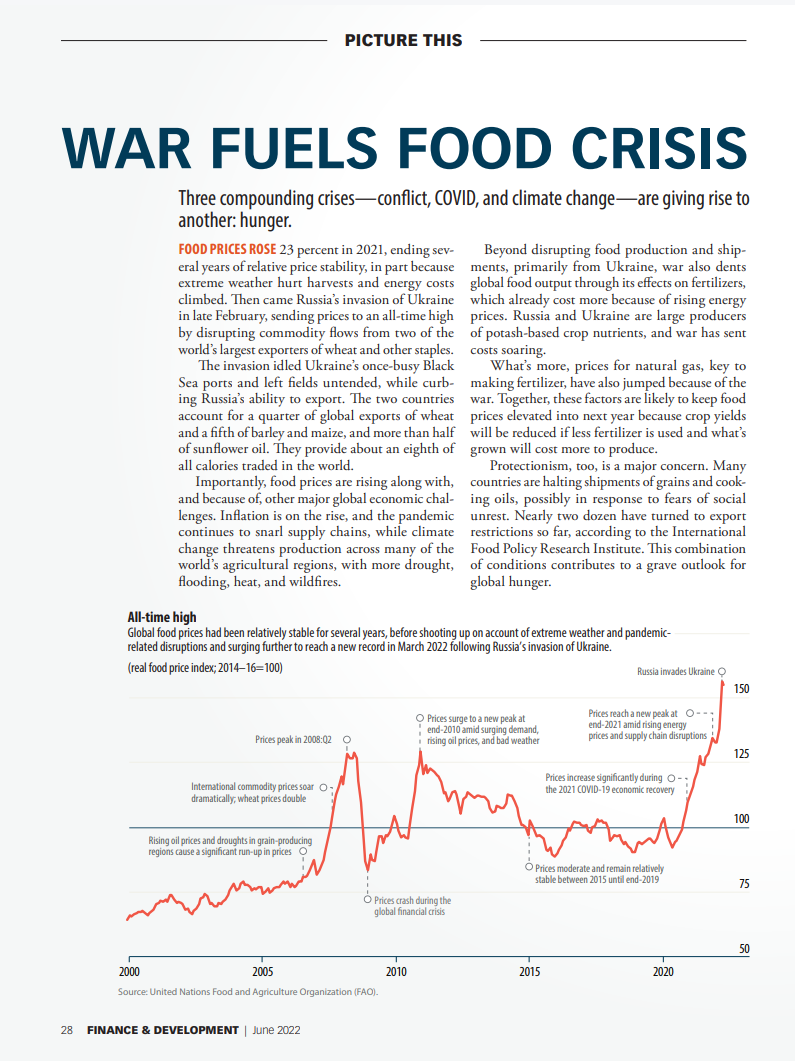

"Three compounding crises—conflict, COVID, and climate change—are giving rise to another: hunger.

Food prices rose 23 percent in 2021, ending several years of relative price stability, in part because extreme weather hurt harvests and energy costs climbed. Then came Russia’s invasion of Ukraine in late February, sending prices to an all-time high by disrupting commodity flows from two of the world’s largest exporters of wheat and other staples.

The invasion idled Ukraine’s once-busy Black Sea ports and left fields untended, while curbing Russia’s ability to export. The two countries account for a quarter of global exports of wheat and a fifth of barley and maize, and more than half of sunflower oil. They provide about an eighth of all calories traded in the world.

Importantly, food prices are rising along with, and because of, other major global economic challenges. Inflation is on the rise, and the pandemic continues to snarl supply chains, while climate change threatens production across many of the world’s agricultural regions, with more drought, flooding, heat, and wildfires."

- Details

"Given its significance for low-income populations and overall economic development, the international development community has long focused on the MSE sector. Yet much of what we know about MSEs remains theoretical; important knowledge gaps still exist. Despite decades of research, little is known about the unique characteristics of MSE owners, the trajectories of their businesses, and the role financial services play in supporting MSE owners and employees. Moreover, while research on microenterprises is extensive, it often relies on data such as the World Bank Country Indicators and Enterprise Surveys that exclude from their sample very small enterprises with fewer than five employees and informal enterprises, where much of the world’s poor population is concentrated. Consequently, insights on how MSEs sustain and expand livelihoods are based on the experience of larger, more formal MSEs while small, informal, and the poorest MSEs often remain excluded."

Read more … No Small Business. Gaps in Understanding Micro and Small Enterprises

- Details

Rural agent networks are critical to “last mile” financial inclusion. This reading deck for Financial Services Providers (FSPs) shows: (i) how rural Cash-in/Cash-Out (CICO) agent network expansion leads to increased customer value and sustained market growth; (ii) the barriers FSPs face to expand rural CICO networks; and (iii) successful new practices carried out in different markets that address barriers and result in improved rural CICO reach and quality.

The material is prepared by CGAP in English language. Click here to access the material.

Source: Blackburn, Christopher and Hernandez, Emilio. 2022. “Agent Networks at the Last Mile: Implications for Financial Service Providers.” Reading Deck. Washington, D.C.: CGAP. https://www.cgap.org/research/reading-deck/agent-networks-last-mileimplications-financial-service-providers

Illustration: Boston Consulting Group, IDEO and Rie Speer, Lorena Velasco via Communication for Development Ltd.

- Details

Banking-as-a-Service (BaaS) is an entirely new business model that enables non-banks to offer banking services under their own brand and seamlessly embedded into their digital offering. By enabling the embedding of financial services into almost any digital context, BaaS may augur a profound evolution of the financial sector of which we are only seeing the early stages.

Read more … Banking-as-a-Service: How it Can Catalyze Financial Inclusion

- Details

"Money has transformed human society, enabling commerce and trade even between widely dispersed geographic locations. It allows the transfer of wealth and resources across space and over time. But for much of human history, it has also been the object of rapacity and depredation.

- Details

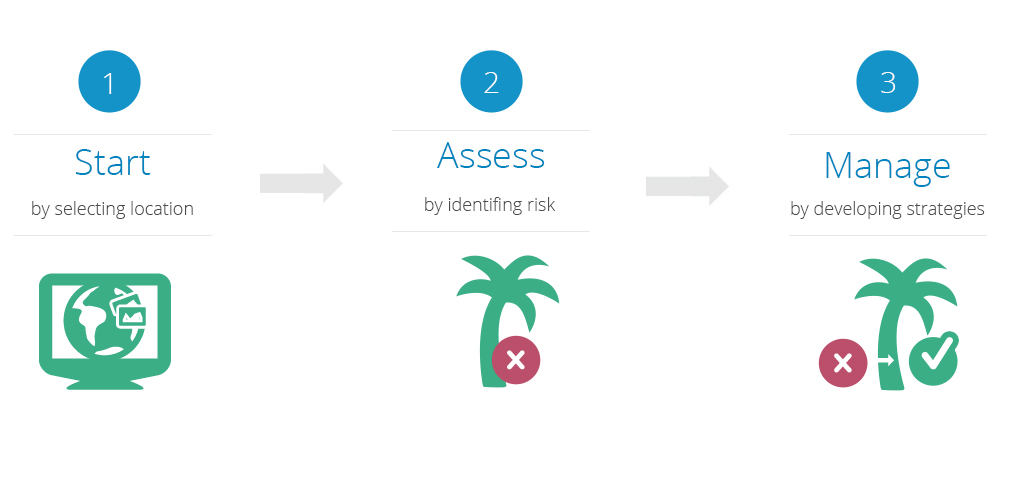

The Global Map of Environmental & Social Risk in Agro-commodity Production (GMAP) enables users to conduct rapid environmental and social due diligence associated with trade and short-term finance, and to make responsible and strategic sourcing, financing, and risk management decisions.

Use the tool to access detailed risk analysis reports and explore risk management guidance.

Read more … GMAP: Global Map of Supply Chain Risks in Agro-Commodity Production

- Details

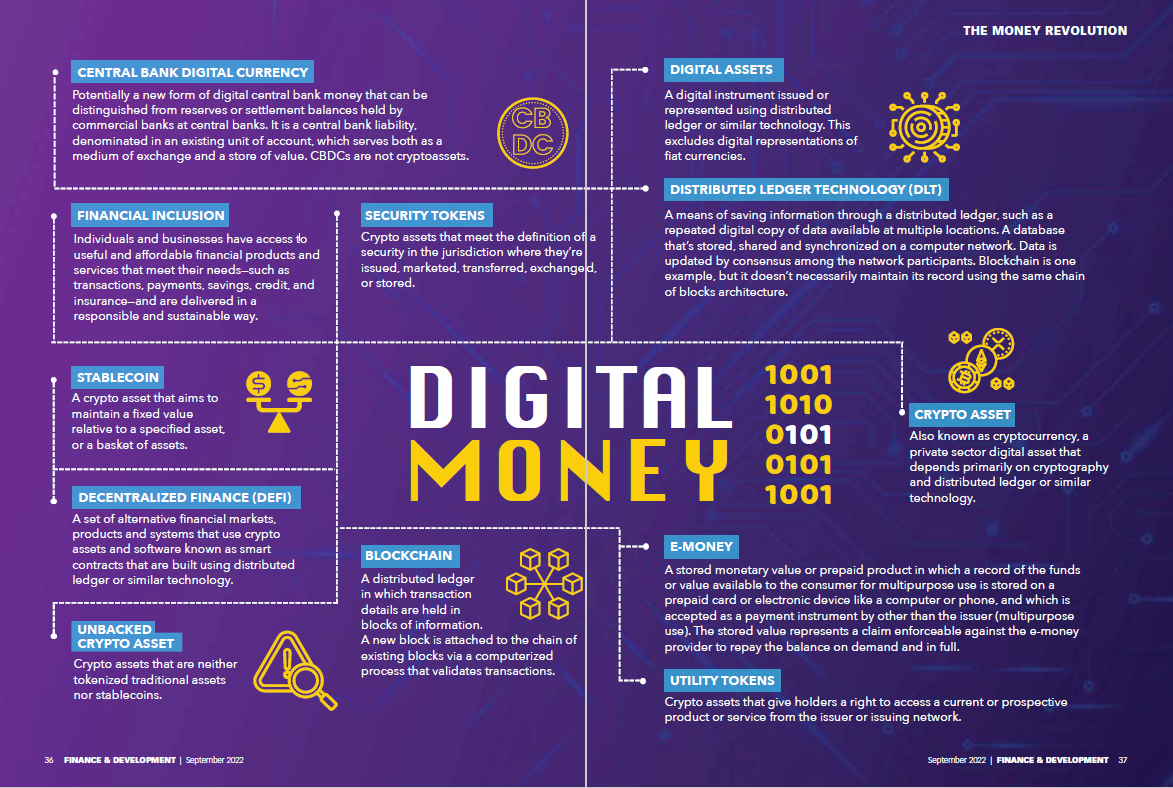

A brief guide to blockchain and crypto lingo.

- Details

The report covers the 49 regional members of ADB. It discusses trends in development progress and the challenges to achieving inclusive and sustainable economic growth across Asia and the Pacific. This 53rd edition looks at how most economies in the region have bounced back to varying degrees from the COVID-19 pandemic. A gradual recovery of cyclical industries, the release of pent-up consumer demand, and increased confidence levels have contributed to developing Asia’s economy.

- Details

The region’s economy is expected to grow 4.3% this year, compared with ADB’s projection in April of a 5.2% expansion, while the growth forecast for next year is lowered to 4.9% from 5.3%. The downward revisions have been driven by increased monetary tightening by central banks, fallout from the protracted Russian invasion of Ukraine, and recurrent COVID-19 lockdowns in the People’s Republic of China. Inflation in developing Asia this year is likely to reach 4.5%, up from ADB’s earlier projection of 3.7%. The forecast for 2023 is 4.0%, up from 3.1%. While inflation in the region remains lower than elsewhere, supply disruptions continue to push up food and fuel prices.

Read more … Asian Development Outlook (ADO) 2022 Update: Entrepreneurship in the Digital Age

- Details

"The world is paying a high price for Russia’s war of aggression against Ukraine. The high humanitarian cost continues to grow and the global economic outlook has darkened further.

This Interim Report focuses on the effects of the war on the world economy and the energy crisis. With the impacts of the COVID-19 pandemic still lingering, the war is dragging down growth more than anticipated. Inflation has intensified and become widespread across countries and consumer items. The risk of energy disruptions has risen. The Interim Report is an update on the assessment in June 2022 issue of the OECD Economic Outlook (Number 111)."

Read more … OECD Economic Outlook: Interim Report Paying the Price of War. September 2022

- Details

"A persistently large trade finance gap is an ongoing global challenge, particularly for small and medium-sized enterprises, which continue to face significant barriers to access financing. Since 2012, ADB has conducted a Trade Finance Gaps, Growth, and Jobs Survey. Reflecting on the survey results, the report provides insights on trade finance trends, analysis, and lessons and identifies what needs to happen to ensure access to trade finance is more inclusive. The report discusses the rapid digitalization in trade and trade finance markets and advocates for increased international cooperation to enable the full benefits of digitization to be realized."

- Impacts of COVID-19 on Households’ Business, Employment and School Education: Evidence from Household Survey in CAREC Countries

- Digital Divide Decoded: Can E-Commerce and Remote Workforces Enhance Enterprise Resilience in the COVID-19 Era?

- Measuring the Environmental Performance of Agriculture Across OECD Countries

- Banking in Layers